- Bitcoin’s STH provide is dealing with rising stress as macro uncertainty fuels market volatility

- If BTC breaks beneath $72k, capitulation dangers might escalate

On 09 April, U.S. President Donald Trump introduced a 90-day pause on tariffs, triggering an 8.27% single-day surge in Bitcoin [BTC] – Its longest inexperienced candlestick in almost a month. Then, on 10 April, U.S. core CPI inflation fell beneath 3.0% for the primary time since March 2021. In response, Bitcoin surged by 3.36% to $82,532 at press time.

With these back-to-back macro boosts, the market gave the impression to be gaining momentum. Nevertheless, an actual take a look at would possibly lie forward.

Quick-Time period Holders (STHs) have been feeling the stress, as their realized value stood at $93k at press time – Far above BTC’s degree.

So, if the Federal Reserve delays charge cuts, will STHs maintain agency? Or will mounting resistance drive them to capitulate?

Bitcoin’s STH provide alerts capitulation threat

Bitcoin’s short-term holder (STH) provide is approaching an important inflection level.

On 10 February, STH-held BTC peaked at a four-year excessive of 400k. Nevertheless, it has since declined to 360k, signaling web distribution.

This coincided with the world’s largest cryptocurrency breaching three key assist ranges – An indication of the sustained sell-side stress from this cohort.

On-chain data from Glassnode revealed that the majority of those holdings had been accrued round $93k. With BTC buying and selling beneath this realized value, roughly 360k BTC stays in an unrealized loss state, heightening the danger of capitulation.

Extra critically, the STH realized value sat at $131k and $72k, defining the essential liquidity zones.

If Bitcoin retraces to the decrease band at $72k, revenue margins for these holders would erode by 22%, inserting further stress on short-term conviction. Traditionally, a breach of the decrease band has catalyzed compelled liquidations.

Ought to Bitcoin maintain a transfer beneath $72k, cascading promote stress might materialize, amplifying drawdowns.

Conversely, reclaiming $93k would flip STH’s positioning again into revenue, doubtlessly mitigating supply-side threat and reviving bullish momentum.

Macro volatility shaking short-term confidence

From a macro-structural standpoint, Bitcoin’s value motion continues to consolidate beneath the pivotal $85k resistance degree. Repeated rejections at this threshold point out a liquidity zone that, if breached, might set off a cascade of brief liquidations.

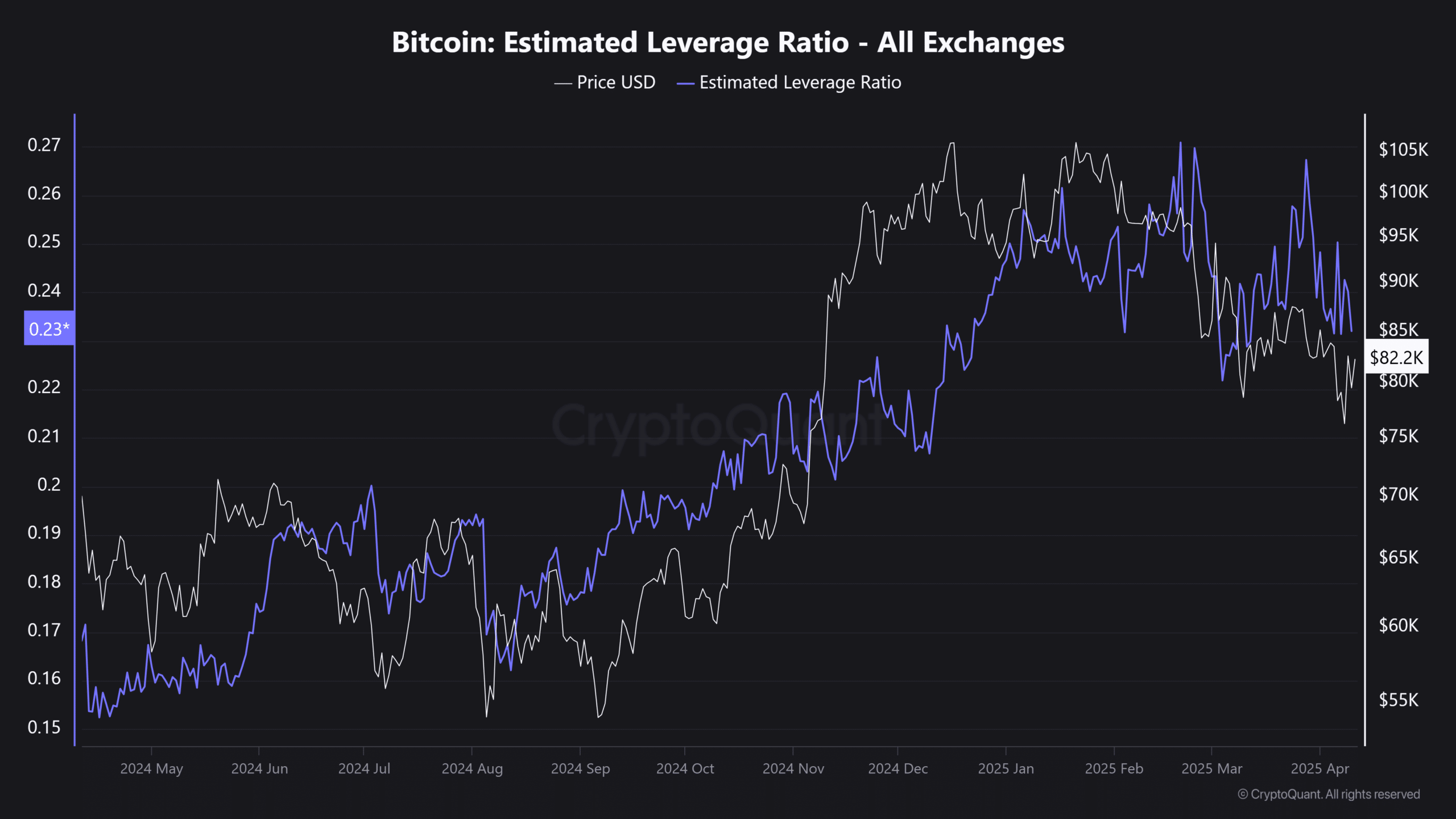

Concurrently, Bitcoin’s Estimated Leverage Ratio (ELR) slipped beneath its early March baseline – Signaling a sustained deleveraging part. Futures merchants stay risk-averse, with a noticeable discount in high-leverage positioning.

Regardless of these challenges, nevertheless, Bitcoin has demonstrated some resilience.

Following the tariff-related market turbulence, BTC’s market cap noticed solely a $90 billion drawdown – A comparatively modest flush-out in comparison with different threat belongings.

Nevertheless, with the Federal Reserve much less prone to reduce rates of interest quickly, macro uncertainty might push short-term holders to exit. Lots of them purchased round $93k. And, if the worth doesn’t recuperate quickly, they could promote to keep away from deeper losses.

With concern nonetheless excessive, speculative demand low, and key resistance ranges overhead, a dip to $72k stays an actual chance earlier than Bitcoin can try a sustained breakout.