- Bitcoin MVRV ratio urged potential market shifts, with an important help degree to observe at 1.75.

- Retail and whale exercise confirmed blended indicators, with energetic addresses rising however giant transactions barely declining.

Bitcoin [BTC] just lately surged above $66,000, marking a quick rally that excited traders and analysts a couple of potential bullish development for October, known as “Uptober.”

Nevertheless, this value bounce was short-lived, as Bitcoin encountered a big correction shortly thereafter.

Over the previous week, the main cryptocurrency has seen a downward trajectory, declining by 6.6% and buying and selling under $62,000 on the time of writing, with a further dip of 0.4% within the final 24 hours.

Amid this fluctuation, a CryptoQuant analyst identified has shed light on a vital development occurring within the background. In line with the analyst, this rising sample might probably have notable implications for Bitcoin’s future market habits.

MVRV ratio suggests a serious transfer for BTC

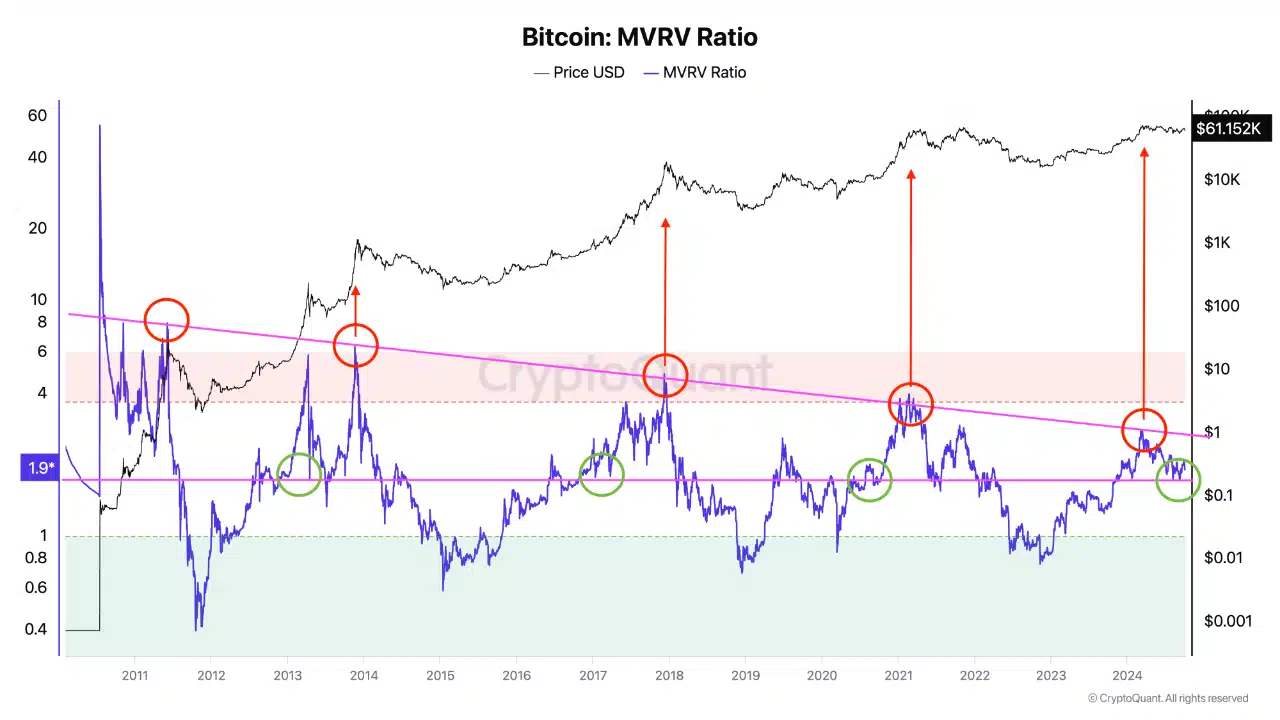

The CryptoQuant analyst’s focus was on Bitcoin’s Market Worth to Realized Worth (MVRV) ratio. It is a key metric that assesses whether or not BTC is presently overvalued or undervalued by evaluating its market worth to the worth at which all cash final moved.

The MVRV ratio has been helpful traditionally in figuring out significant market highs and lows throughout Bitcoin’s halving cycles.

The MVRV ratio, as defined by the analyst, has been in a downward development, with an important help degree recognized at 1.75.

Presently, the ratio stands at 1.9. This raises a pivotal query: if the MVRV ratio breaks out of this historic downtrend and reverses path, might it rise to a spread between 4 and 6?

Such a spread has traditionally indicated a market peak for Bitcoin, as noticed in prior cycles. The analyst’s concentrate on the MVRV metric highlights its significance in offering a gauge for potential market sentiment and future value actions.

Different metrics present blended traits

Given this potential shift in market situations, it’s price exploring different indicators that might supply perception into Bitcoin’s future trajectory.

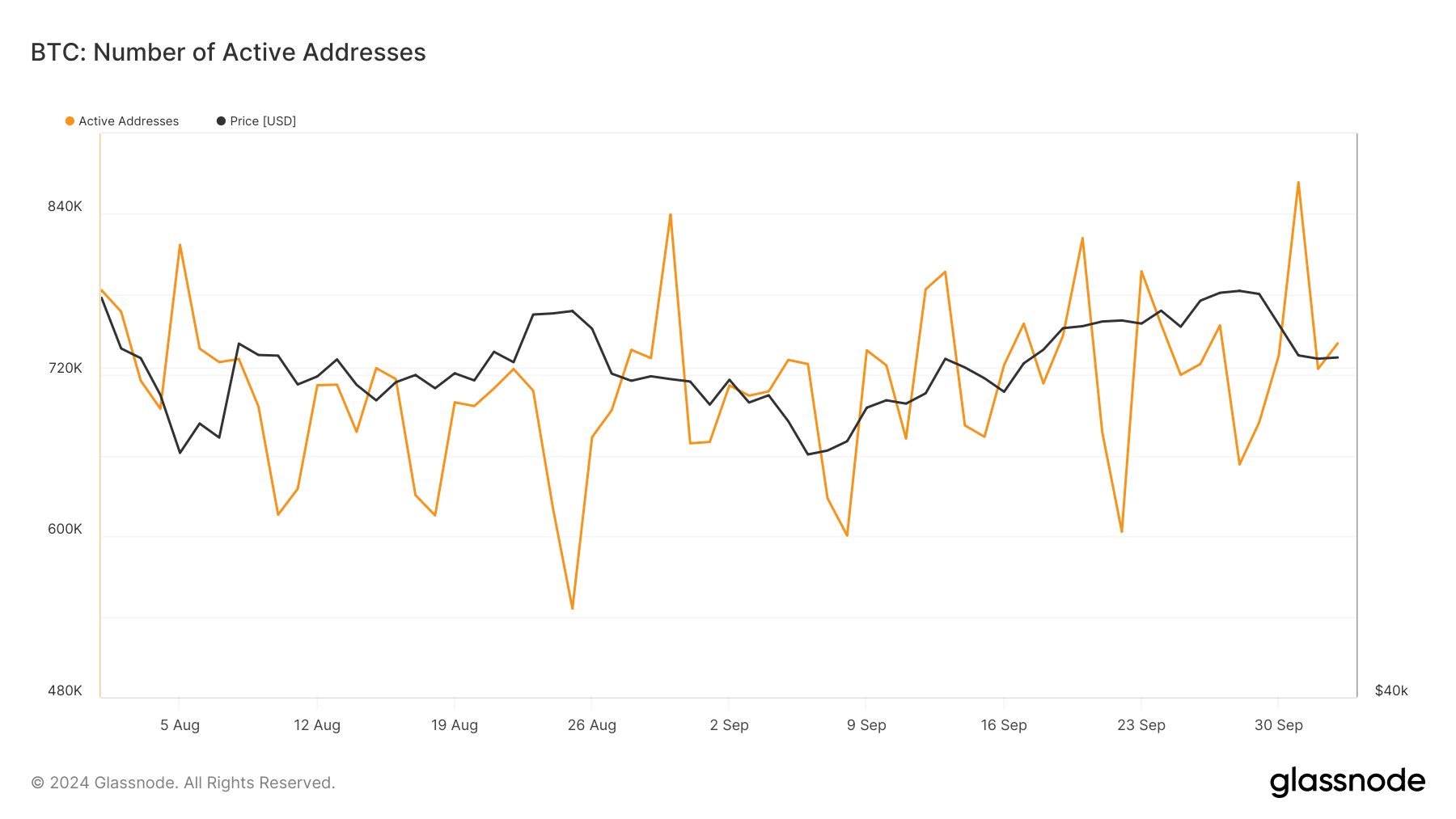

For example, one key metric to observe is Retail Investor Exercise, which is commonly mirrored within the variety of energetic addresses. In line with data from Glassnode, this metric has been on a gradual rise month-over-month.

After reaching 832,000 addresses in August and barely declining to 822,000 in September, Bitcoin’s energetic addresses have continued to develop, presently standing at over 863,000.

This rising development suggests renewed retail curiosity and involvement within the Bitcoin market, even amid latest value volatility.

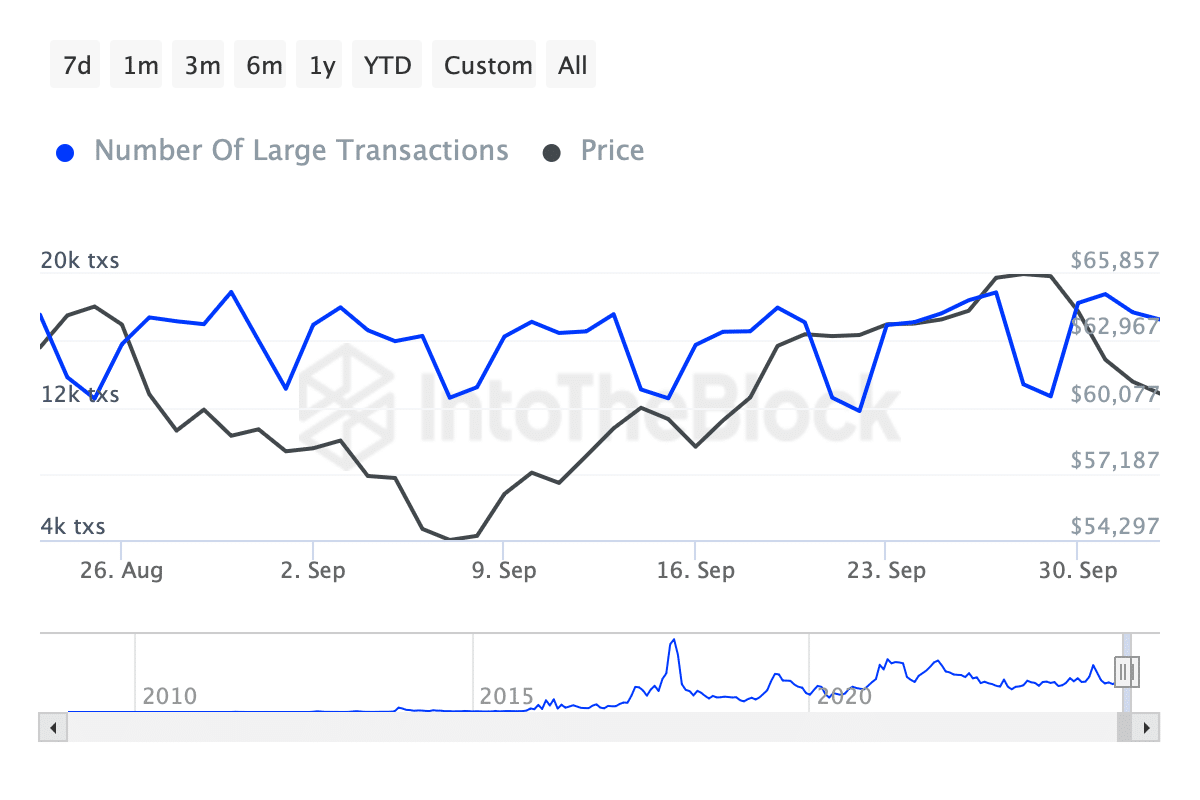

Whereas retail curiosity offers one facet of the image, understanding the exercise of bigger traders, usually termed “whales,” is equally essential. An necessary indicator on this regard is the amount of transactions exceeding $100,000, as tracked by information from IntoTheBlock.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

This metric noticed a noticeable uptick between August and September, rising from under 14,000 transactions to over 18,000.

Nevertheless, since that surge, there was a gradual tapering, with whale transactions just lately lowering to round 17,700.