- XRP is holding agency in opposition to a deeper pullback, bolstered by robust whale assist.

- This resilience means that the present correction is a part of a “wholesome” retracement.

Ripple [XRP] finds itself at a vital crossroads as 2024 attracts to an in depth. With the altcoin market set to journey Bitcoin’s momentum and break new psychological boundaries in 2025, now may be the time to take motion should you’re “lengthy” on XRP and need to see it outpace its rivals – identical to the whales are doing.

Since December kicked off, massive ““unknown wallets” holding vital XRP quantities have both been unloading their positions or aggressively including extra.

This back-and-forth has already made a noticeable impression on XRP’s worth – leaving it in a state of uncertainty because it braces for its subsequent huge transfer – whether or not up or down.

XRP has a robust assist base

Ten days in the past, XRP got here almost near breaching the essential psychological threshold of $3, fueled by a formidable 19% single-day surge. Nonetheless, as of now, XRP is buying and selling at $2.30.

This dip is a part of a broader development, as many cryptocurrencies are within the pink, and traders are weighing their choices – ought to they trim their holdings or make the most of the decrease costs to purchase extra?

Ripple is not any exception. Its 1-day worth chart reveals bulls working onerous to fend off a deeper pullback, whereas bears stay steadfast. For HODLers, the continued assist from whales presents a much-needed sense of safety.

This assist creates a robust base for XRP to rebound when the market shifts bullish as soon as once more.

And when will that occur? It’s seemingly tied to the efficiency of Bitcoin, the coin with a trillion-dollar market cap, or the upcoming FOMC assembly, the place traders are betting on a 25 foundation factors fee reduce.

Both method, this robust basis may be precisely what XRP must set its sights on the $3 milestone within the quick time period. The truth that huge wallets are accumulating XRP provides weight to this development, however will or not it’s sufficient to push XRP over the sting?

The current correction is probably going tied to exterior elements

Among the many top 10 altcoins, two have been hit hardest by the present market volatility: XRP and Cardano [ADA].

What’s fascinating is the strikingly related worth sample they share. Each cash capitalized on the “Trump pump,” breaking by means of psychological boundaries with triple-digit month-to-month good points.

However with such speedy progress comes elevated threat, and each cash at the moment are extra weak to sharp corrections because the market adjusts.

In actual fact, XRP and ADA have skilled a few of the steepest drops within the final 24 hours – every slipping by greater than 3%.

This means the story is much from over, and a strong rebound remains to be very a lot on the playing cards – regardless of some bumps within the derivatives market, notably with Open Curiosity (OI) displaying some volatility.

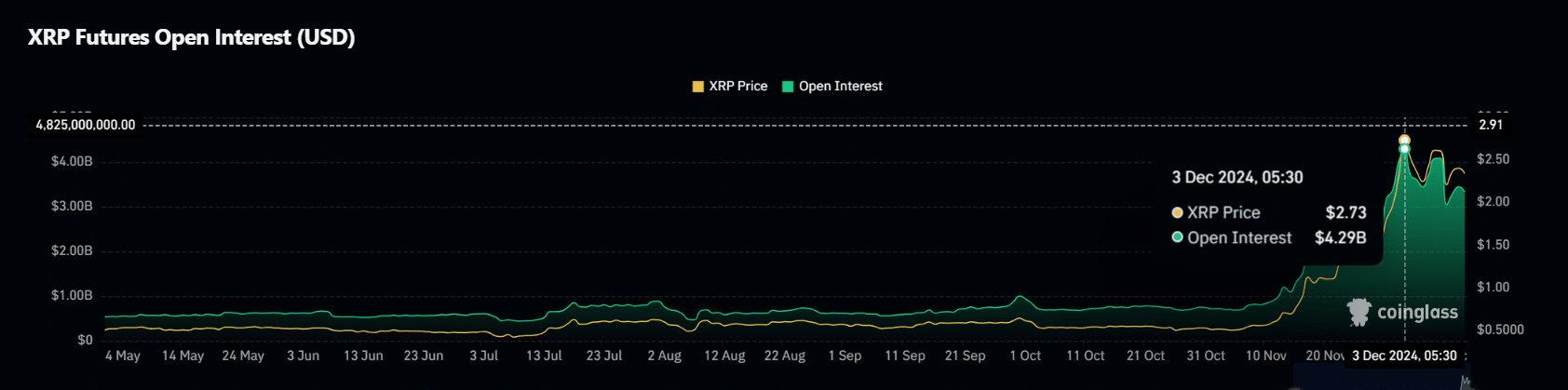

OI surged to an all-time excessive of $4.29 billion simply ten days in the past, matching XRP’s peak close to $2.90 for the day.

Many traders went “lengthy,” betting on a $3 breakout. Nonetheless, with that breakout failing to materialize, the OI has since dropped to $3.33 billion, resulting in round $6 million in lengthy liquidations – a 1% improve from the day gone by.

Learn XRP’s Price Prediction 2024–2025

However right here’s the place issues get attention-grabbing: a resurgence of quick positions might spark a serious squeeze, particularly with whale assist and bullish on-chain exercise behind XRP.

That mentioned, your persistence will seemingly face checks except Bitcoin breaks by means of key resistance ranges or a broader macroeconomic development takes form.

Till then, with robust assist in place, consolidation looks like the extra possible path for XRP.