XRP has been range-bound in latest days, consolidating after efficiently holding sturdy above the crucial $2.10 assist stage. As one of many standout performers this cycle, XRP skilled an enormous surge following the US election, capturing investor consideration. Nevertheless, latest value motion has launched uncertainty, leaving some buyers involved about the potential of additional draw back.

Associated Studying

Regardless of these fears, on-chain knowledge suggests a special narrative. Insights from Santiment reveal that whales have amassed one other 40 million XRP prior to now 24 hours. This important accumulation signifies that Sensible Cash could also be positioning itself for an upcoming rally. Traditionally, such whale exercise has preceded main value actions, offering a bullish sign for long-term holders.

XRP’s ability to maintain the $2.10 support level amid market fluctuations demonstrates resilience, however the subsequent decisive transfer will rely on whether or not bulls can capitalize on this accumulation part. If shopping for momentum continues and XRP breaks out of its present vary, a push towards new highs may comply with.

XRP Continues To Sign Energy

XRP continues to show resilience, buying and selling above key assist ranges and attracting buyers who acknowledge its long-term potential. Regardless of a big 30% retrace from latest highs, XRP has held its floor, sustaining crucial assist zones that bolster a bullish outlook. This stability is driving confidence amongst market contributors, with many seeing the altcoin as a prime contender for future development.

High analyst Ali Martinez lately highlighted compelling data from Santiment, displaying that whales added one other 40 million XRP to their holdings within the final 24 hours. This follows a broader development of constant whale accumulation, a phenomenon typically thought to be an indicator of good cash positioning for a big market transfer. Such exercise means that institutional and high-net-worth buyers anticipate XRP to outperform within the coming months.

The sustained curiosity in XRP stems from its capability to stay sturdy regardless of latest corrections and broader market uncertainty. Holding above key assist ranges not solely displays technical energy but in addition underscores investor confidence in its potential for a big rally.

Associated Studying

As whale accumulation continues and sentiment shifts, XRP is well-positioned to capitalize on constructive momentum. A breakout above resistance ranges may mark the start of a strong rally, reinforcing its management amongst altcoins within the present cycle.

Technical Evaluation: Key Ranges To Watch

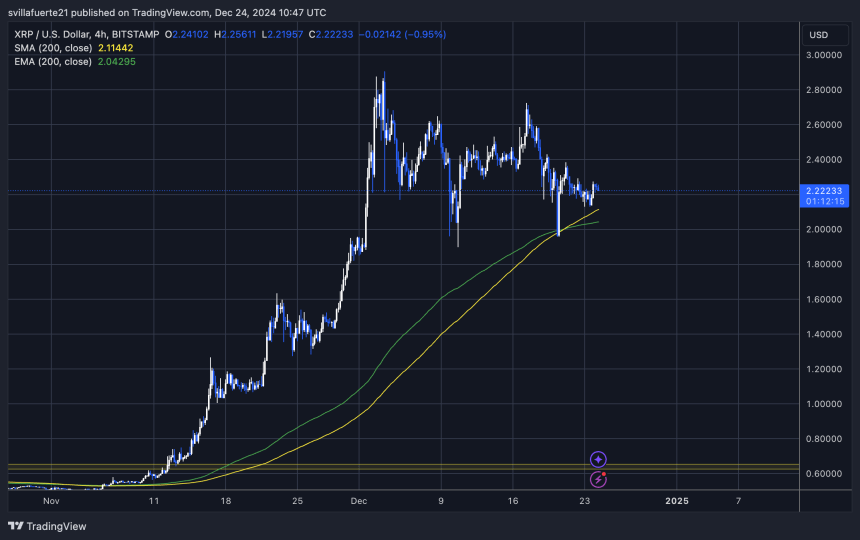

XRP is presently buying and selling at $2.22 after efficiently testing the 4-hour shifting common (MA) and exponential shifting common (EMA) round $1.96 just a few days in the past. This bounce off crucial assist ranges highlights XRP’s short-term energy, reinforcing its bullish momentum. The MA and EMA are broadly thought to be key indicators for assessing the well being of an asset, and XRP’s capability to carry above them indicators sturdy demand at decrease ranges.

Sustaining assist above $2.13 within the coming days is crucial to maintain this momentum. If XRP continues to commerce above this stage, it will solidify investor confidence and pave the way in which for a possible check of the $2.40 resistance mark. Breaking above $2.40 would doubtless set off further shopping for curiosity, doubtlessly driving XRP towards new highs because the broader market sentiment improves.

Associated Studying

On the flip facet, dropping the $2.13 assist may introduce some short-term weak point, resulting in a retest of decrease ranges close to the MA and EMA. Nevertheless, so long as XRP maintains its general construction above these shifting averages, the bullish narrative stays intact, and the altcoin may proceed to draw good cash positioning for the subsequent rally.

Featured picture from Dall-E, chart from TradingView