- Bitwise CIO predicts $15 billion influx into Ethereum ETFs inside 18 months.

- Ethereum ETFs anticipated to draw important institutional funding, bolstering ETH’s market place.

Anticipation for the launch of Ethereum [ETH] ETFs has reached a fever pitch, with many consultants speculating about potential launch dates. Business analysts are more and more assured that ETFs may debut as quickly as mid-July.

Latest developments counsel that a number of candidates will submit their amended S-1 varieties by eighth July, as reported by Bloomberg.

Nate Geraci, president of The ETF Retailer, indicated that ultimate approvals might be anticipated by twelfth July, doubtlessly setting the stage for a launch throughout the week of fifteenth July.

Ethereum ETFs to see $15 billion inflows?

Bitwise’s CIO, Matt Hougan, has expressed confidence in Ethereum’s enchantment to institutional buyers, a sentiment not universally shared till now.

In a video with analyst Scott Melker, the CIO reveals that the observations from European and Canadian markets, the place Ethereum constantly attracts substantial funding, reinforce his optimistic outlook for related success within the U.S. market.

Hougan’s evaluation extends past mere hypothesis, delving into strategic conversations with leaders from main monetary establishments.

One such dialogue with a $100+ billion advisory agency revealed a readiness to diversify into Ethereum upon the launch of an official ETF, highlighting the broader monetary neighborhood’s rising consolation with cryptocurrency as a authentic asset class.

Moreover, Hougan challenges the prevailing narrative of excessive correlation between cryptocurrencies and conventional monetary markets.

He argues that, apart from transient intervals of alignment as a consequence of extraordinary financial measures like these lately seen, cryptocurrencies typically function independently of conventional markets.

This independence is essential for buyers searching for diversification and risk-adjusted returns.

Ethereum’s battle: Market downturn and surging liquidations

Amid the broader market downturn, Ethereum’s efficiency mirrors the decline seen in Bitcoin, with ETH dropping roughly 6.2% within the final 24 hours to a present buying and selling value of $3,139.

This important lower has led to appreciable losses for a lot of merchants.

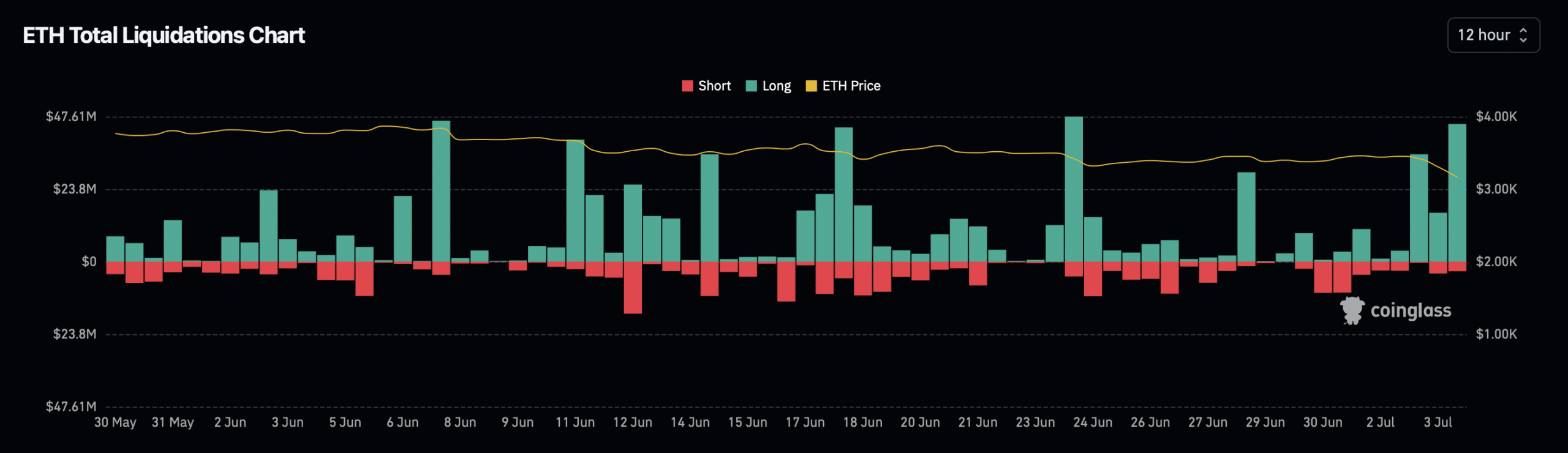

Data from Coinglass reveals that over the previous 24 hours, 113,506 merchants have been liquidated, contributing to whole liquidations of $317.34 million.

Of this, Ethereum-related liquidations account for about $76.51 million, predominantly in lengthy positions, amounting to $70.16 million in comparison with $6.35 million in shorts.

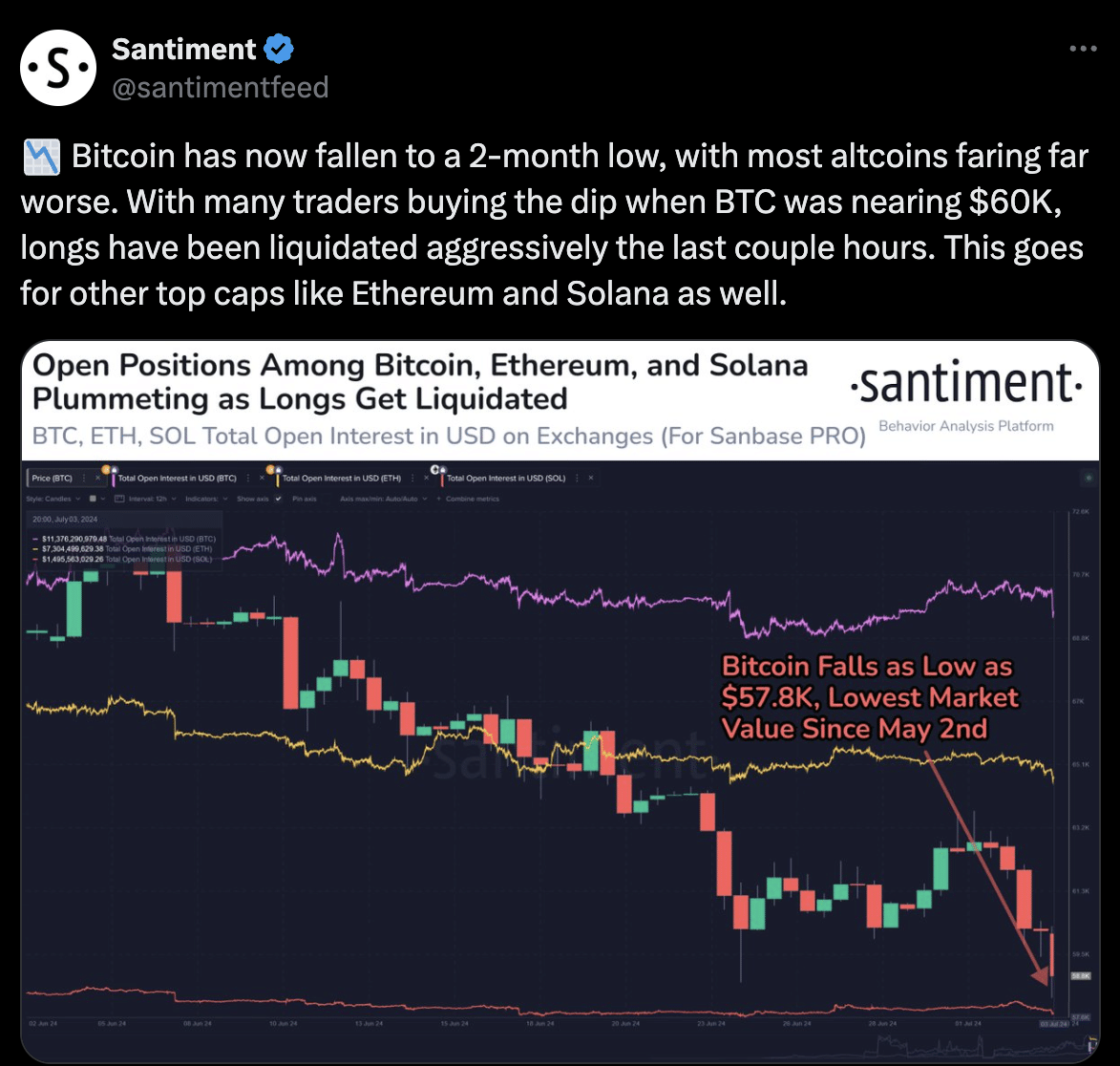

Additional exacerbating the scenario, market intelligence platform Santiment has reported a downturn in Ethereum’s open curiosity.

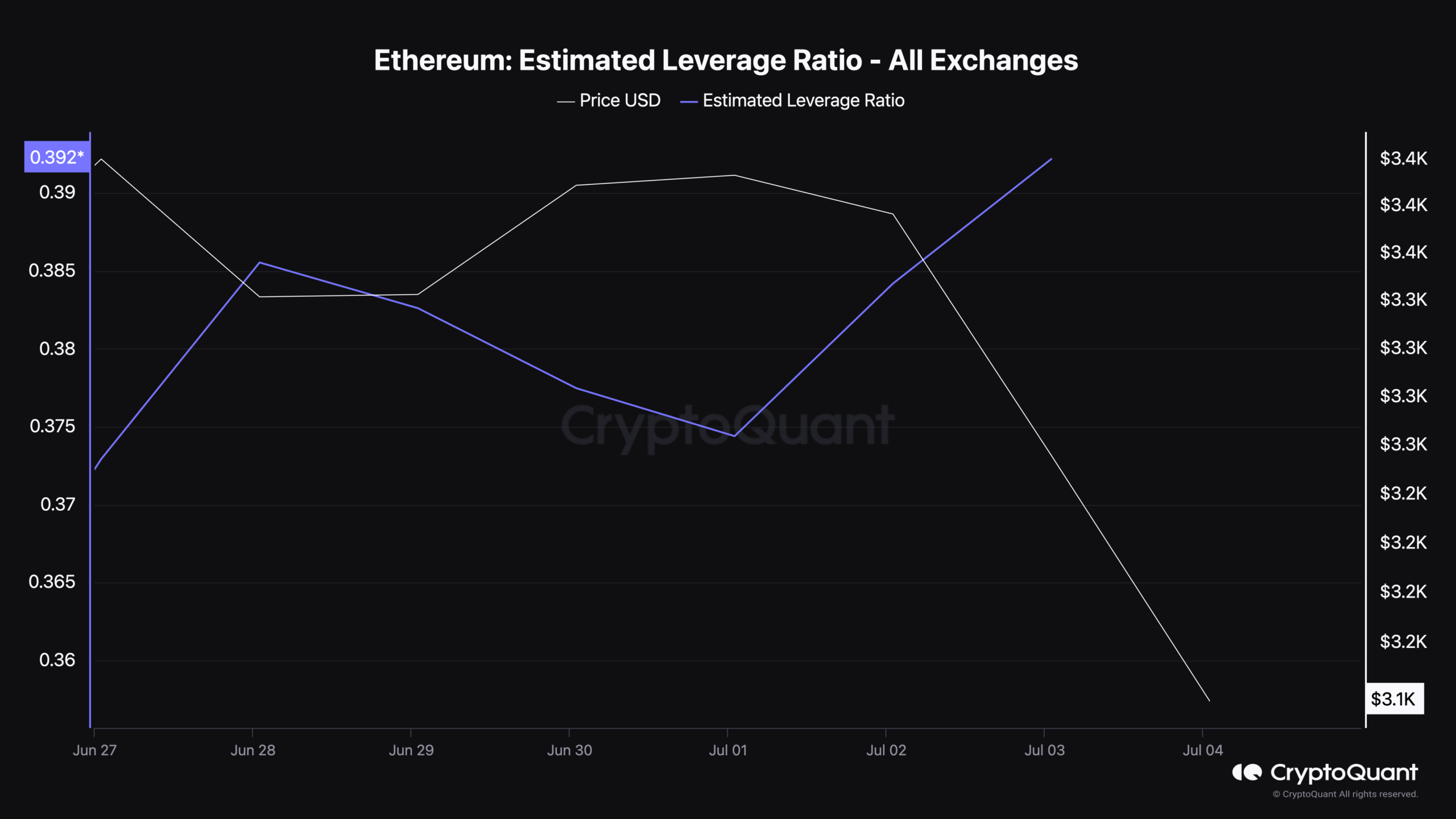

Moreover, data from CryptoQuant highlights that Ethereum’s Estimated Leverage Ratio throughout all exchanges has risen to a notable 0.392. This means a rise in leveraged positions relative to the asset’s market cap which may counsel heightened danger of volatility or additional liquidations.

Learn Ethereum’s [ETH] Price Prediction 2024-25

Regardless of these challenges, not all indicators for Ethereum are bearish.

AMBCrypto has reported a current uptick in Ethereum’s decentralized application (dApp) volume, suggesting some areas of the Ethereum ecosystem proceed to see sturdy exercise.