Key Notes

- Ethereum worth rebounded above $4,000 after touching a 50-day low at $3,927.

- Beaconchain information exhibits 2,589 ETH staked in 24 hours, absorbing $11 million from market provide.

- T Rex’s $32 million BitMine ETF inflows mirror robust institutional demand for ETH regardless of weak sentiment.

Ethereum worth rebounded above $4,000 on Saturday, Sept 25, after briefly plunging beneath the important degree on Friday for the primary time in 50 days. Regardless of skinny weekend liquidity, Ethereum has managed a 2.2% intraday worth rally, supported by seen on-chain flows.

Coinmarketcap information exhibits ETH rebounded from intraday lows of $3,927 to succeed in $4,021 by Saturday night, amid 49% decline in buying and selling volumes to $29 billion. On-chain metrics present an elevated exercise on Ethereum staking contracts as market volatility intensified on Friday.

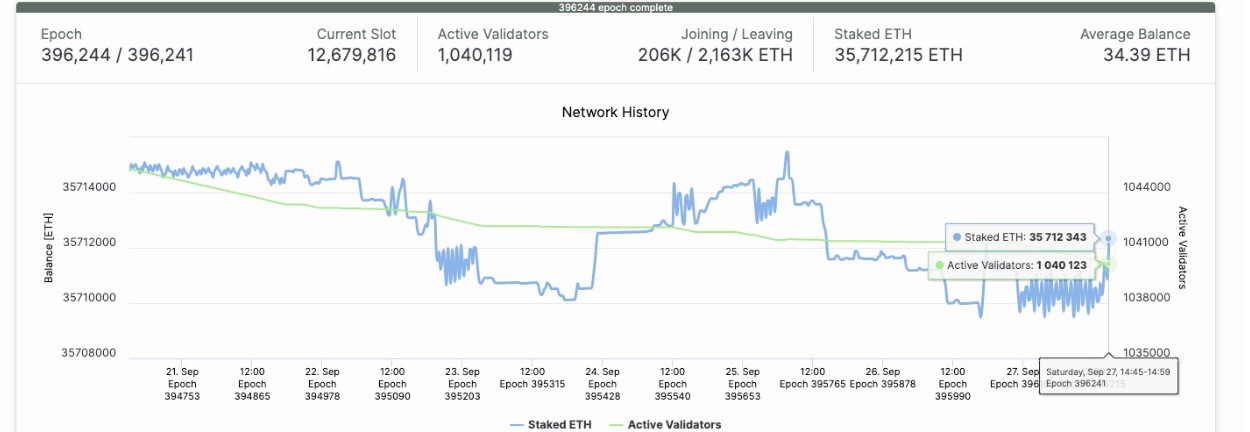

Ethereum staking deposits elevated by 2,589 ETH (~$11 million) on Saturday, Sept 27 | Supply: Beacoincha.in

Official information from Beaconcha.in signifies that Ethereum staking deposits elevated by 2,589 ETH over the past 24 hours, reaching 35,712,343 ETH on the time of this report. Valued at present costs, the most recent staking contracts have absorbed practically $11 million from the Ethereum market provide, nullifying the affect of the rapid liquidations, which noticed the BTC worth stay within the purple, pinned beneath $110,000 on the time of publication.

T Rex’s $32 Million BitMine ETF Reaffirms Company Demand for ETH

Ethereum noticed one other wave of whale inflows as T Rex launched its 2x BitMine ETF (BMNU), which secured $32 million in inflows on its first buying and selling day.

The by-product gives 2x leveraged publicity to BitMine’s (BMNR) inventory worth, providing company buyers secondary publicity to the second-largest cryptocurrency by market capitalization..

Bloomberg’s Chief ETF Analyst, Eric Balchunas, highlighted that BMNU’s $32 million in inflows ranked because the third-largest first-day takings amongst all US-listed ETFs accredited in 2025.

Big Day One quantity quantity for T Rex’s 2x BitMine ETF $BMNU with $32m, making it the third greatest first day of any of the 650-ish ETFs launched this 12 months after XRP ETF and Dan Ives ETF pic.twitter.com/bWzULsA7Yj

— Eric Balchunas (@EricBalchunas) September 26, 2025

The optimistic first-day exhibiting displays robust institutional demand regardless of weakened market sentiment since ETH worth retraced from the all-time excessive of $4,953 in August 2025.

Ethereum Value Forecast: Can ETH Stay Above $4,000?

Ethereum’s rebound above $4,000 has been supported by staking inflows and ETF demand. Whereas this displays appreciable buy-pressure stopping additional declines however technical indicators stay blended.

From a technical perspective, a rising wedge sample fashioned earlier in September stays a key bearish overhang on Ethereum’s near-term worth outlook.

Ethereum (ETH) Technical Value Evaluation | Supply: TradingView

The wedge breakdown tasks a draw back goal close to $3,200, suggesting Ethereum faces dangers of deeper retracement if promoting stress intensifies.

Increasing Bollinger Bands point out rising volatility, however ETH nonetheless trades closest to the decrease band round $3,916, confirming draw back dangers. Nonetheless, an in depth above $4,000 may show decisive for speculative merchants aiming for an additional try on the 20-day transferring common close to $4,373.

The Relative Energy Index (RSI) at 38 signifies oversold situations, which may incentivize speculative merchants seeking to enter at a neighborhood low.

If ETH consolidates above $4,000 and breaks $4,373 resistance, bulls may face one other main provide cluster at $4,500. Conversely, failure to carry $3,916 dangers accelerating a drop towards $3,500, with the rising wedge goal at $3,200 nonetheless in play.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm data by yourself and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting numerous Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at the moment learning for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.