Key Notes

- Bitcoin stalled under $120K whereas Ethereum surged to contemporary all-time highs.

- Weak whale demand and ETF outflows restricted BTC upside.

- Spinoff market knowledge exhibits a $3 billion cluster of brief positions at $117,800.

Bitcoin’s worth stalled at round $117,000 on Saturday, Aug 23, with intraday beneficial properties capped at simply 3%. In contrast, Ethereum (ETH) surged greater than 10% to achieve a contemporary all-time excessive of $4,900. This transfer adopted dovish feedback from Federal Reserve Chair Jerome Powell on the Jackson Gap symposium, signaling decrease rates of interest.

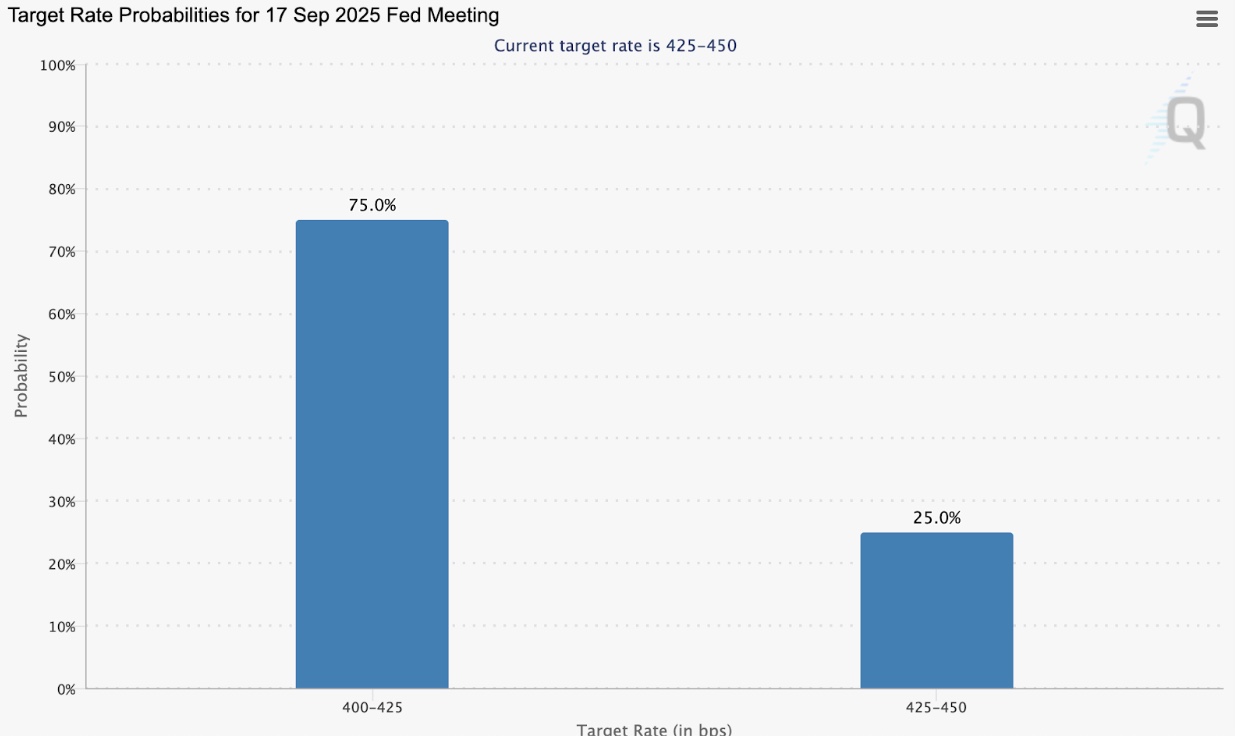

Fed Watch Instrument Reveals 75% probability of charge lower after Fed Chair Speech on Friday | Supply: CME Group

Powell famous that draw back dangers to employment have risen, opening the door for a attainable charge lower in September. In response, CME Group’s Fed Watch tool exhibits analysts now pricing in 75% of a charge easing within the subsequent FOMC slated for September 17, 2025.

Altcoins reacted strongly with ETH, Ripple (XRP), Solana (SOL), and Cardano (ADA) all posting double-digit beneficial properties up to now 24 hours, consolidating above key resistance ranges at $4,750, $3, $200, and $0.90, respectively, on the time of publication.

Bitcoin, nevertheless, did not hold tempo, rapidly retreating to $115,600, after a rejection from its intraday peak of $117,370. Market metrics spotlight three primary causes behind BTC’s underwhelming efficiency in comparison with its rivals.

1. Bitcoin Sees Weak Demand Amongst Coinbase Whale Merchants

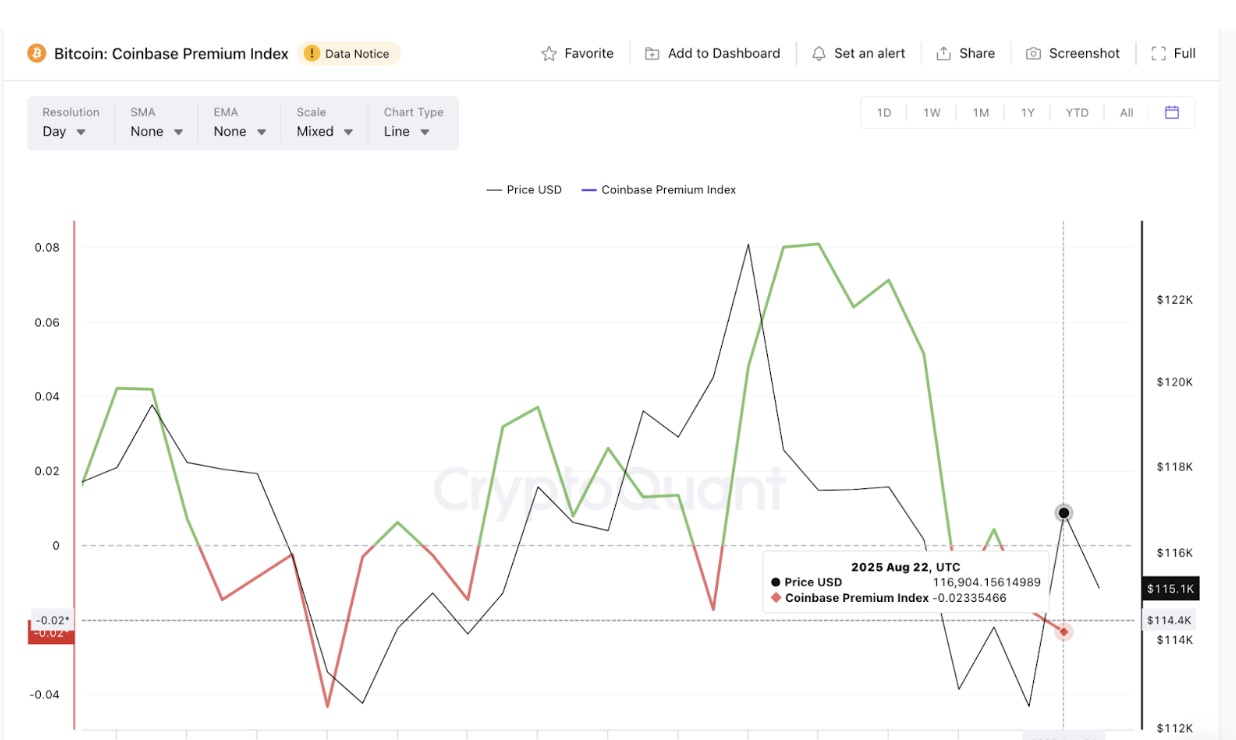

One main issue has been weak institutional demand. Cryptoquant’s Coinbase Premium Index, which measures the distinction between Bitcoin costs on Coinbase Professional, dominated by US-based company buyers and retail-dominated Binance, fell to 0.002%, its lowest since Aug. 1.

Bitcoin Premium Index falls to 21-day low on August 22 | Supply: CryptoQuant

When this metric traits adverse or near-zero, it alerts that company buyers are exhibiting little urge for food, leaving retail merchants to drive market exercise. The 21-day low studying on Fridays urged that whereas retail participation was sturdy, whale patrons within the U.S. remained hesitant.

This cautious stance amongst establishments has weighed closely on Bitcoin’s potential to push greater towards its layer-1 rivals.

2. Bitcoin ETFs Didn’t Register a Single Day of Influx this Week

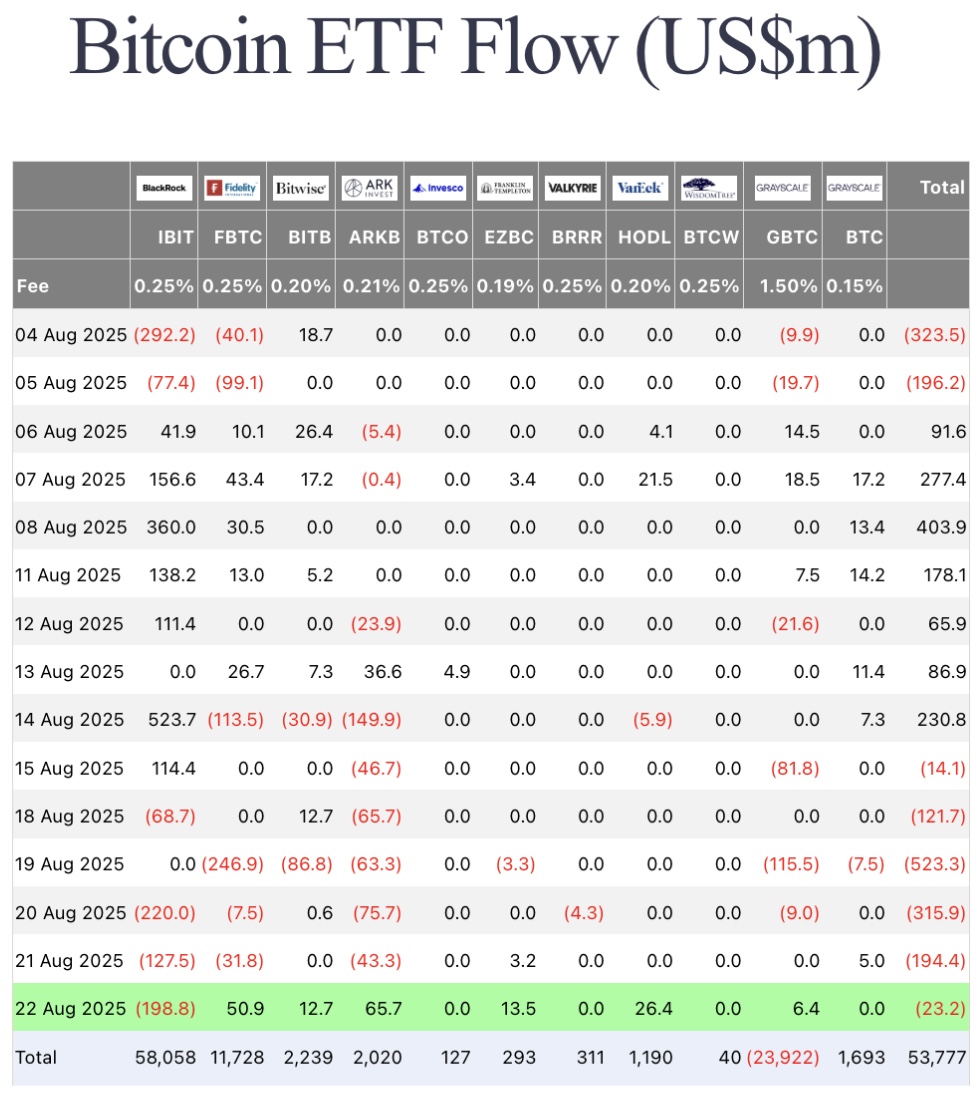

ETF flows this week additional emphasised investor preferences, sidelining Bitcoin. In accordance with Farside Buyers, Bitcoin funds recorded $23 million in outflows on Friday.

This meant that the Bitcoin ETF did not register a single day of internet inflows this week, shedding $1.2 billion as withdrawals exceeded deposits in six consecutive buying and selling days courting again to Aug. 15.

Bitcoin ETF Flows August 2025 | Supply: Farside Buyers

In distinction, Ethereum ETFs pulled in $337 million in internet inflows on Friday after taking in $287 million on Thursday.

This divergence highlights how investor capital rotated towards Ethereum and different altcoins following Powell’s remarks, leaving Bitcoin sidelined within the rally. With out ETF inflows to help upward stress, BTC’s upside trajectory was inevitably capped.

3. BTC Bulls Face $3B Resistance Cluster at $117,800

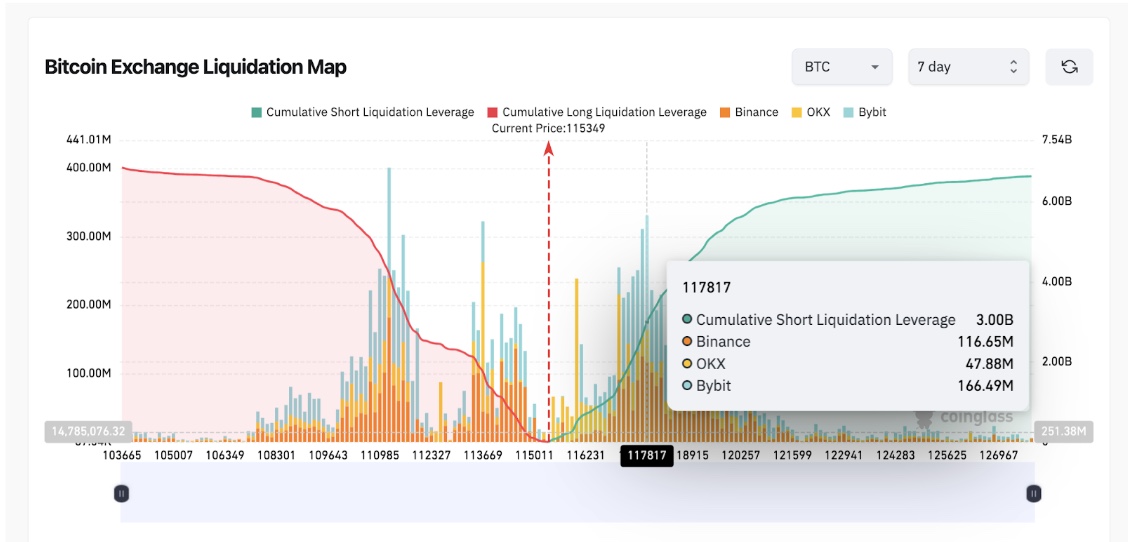

Spinoff market knowledge provides additional insights into Bitcoin’s laggard worth motion under $120,000 on Friday. Coinglass liquidation maps present the distribution of leveraged positions throughout key worth ranges. At first look, sentiment leans bullish, with complete lengthy leverage of $6.86 billion narrowly exceeding shorts at $6.64 billion.

Bitcoin Liquidation Map as of August 23, 2025 | Supply: Coinglass

Nevertheless, a deeper look reveals over $3 billion price of shorts clustered at $117,800, almost 50% of all lively draw back bets. Such concentrated brief leverage incentivizes strategic sell-offs, as merchants try to stop a breakout past that key worth stage. Bitcoin’s rejection from the intraday excessive of $117,377 aligns intently with this resistance wall.

Bitcoin Value Forecast

Given the $117,800 resistance cluster, Bitcoin is unlikely to maintain a clear break above $120,000 with out contemporary inflows. Except bullish liquidity overwhelms brief incentives, near-term worth motion might consolidate between $113,500 help and $118,000 resistance.

A decisive shut above $118,000 might set off a brief squeeze, setting the stage for a push towards $123,000. Conversely, failure to defend $113,500 might open a retracement path again towards $110,000.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm data by yourself and seek the advice of with an expert earlier than making any choices based mostly on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting varied Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at present learning for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.