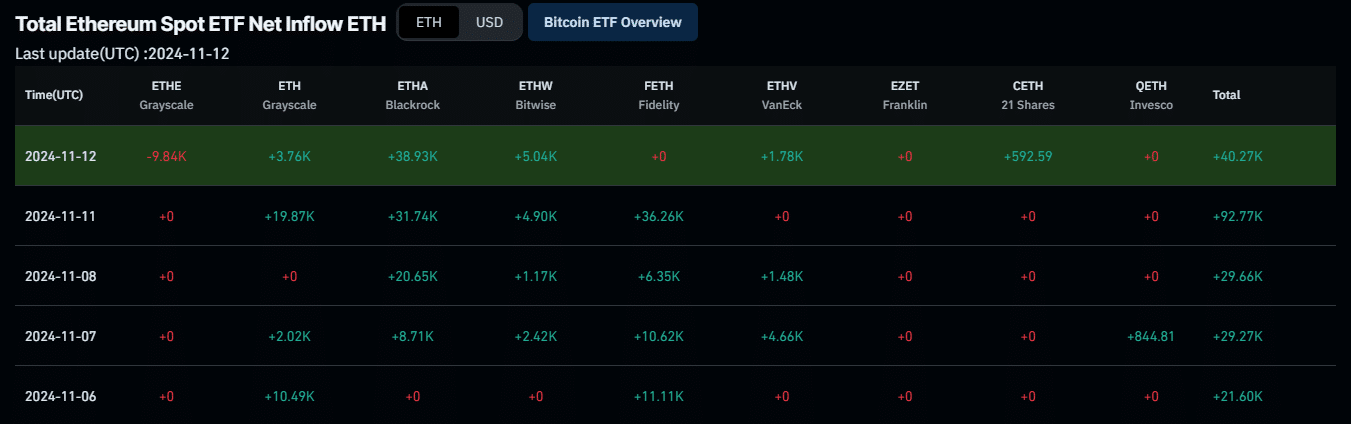

- Spot Ethereum ETFs have skilled 5 consecutive days of optimistic netflows.

- The short-term decline is partly pushed by spinoff merchants taking quick place.

Over the previous week, Ethereum [ETH] has surged by 22.5%, reaching $3,444.25 — a stage not seen since July 24 of this yr. Nevertheless, it has since dropped by 6.37%.

Based on AMBCrypto’s evaluation, this steered that the continuing decline is non permanent and unlikely to influence Ethereum’s longer-term outlook.

5-day shopping for streak provides to ETH bullish outlook

Ethereum’s bullish outlook was gaining momentum, supported by a five-day shopping for streak from conventional buyers, who’re more and more committing to ETH.

These buyers have been persistently buying spot ETH ETFs from a number of main platforms.

As of this writing, Coinglass reported a optimistic Netflow in spot ETH ETFs, with a complete of 213,570 ETH acquired throughout this era.

This sustained acquisition, regardless of latest value fluctuations, signaled that conventional buyers have been sustaining sturdy long-term confidence in Ethereum, getting ready for the subsequent section of upward motion.

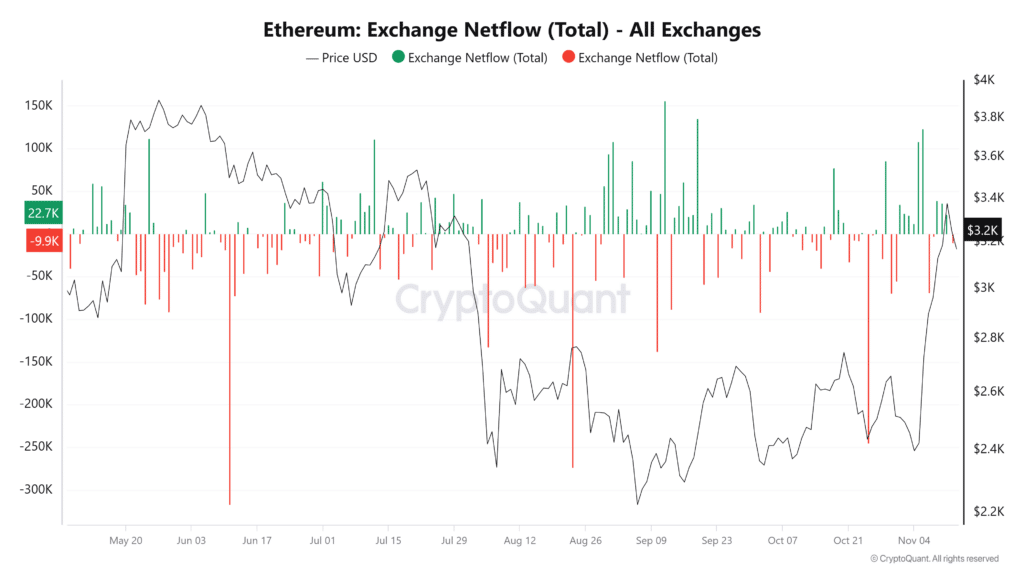

Alongside this transfer by institutional buyers, AMBCrypto has noticed the same development amongst some spot merchants.

Whereas conventional buyers remained energetic, there was a shift amongst some merchants, with Trade Netflow displaying a destructive flip — a 9,957.59 ETH outflow up to now 24 hours, in line with Cryptoquant.

Spinoff merchants flip bearish on ETH

Spinoff merchants have turned bearish on ETH, with vital lengthy liquidations recorded up to now 24 hours.

A protracted liquidation happens when the value strikes in opposition to the place of lengthy merchants, who had wager on an upward development however can now not keep their positions.

Based on Coinglass, $98.73 million price of lengthy trades have been forcefully closed because the market traits downward.

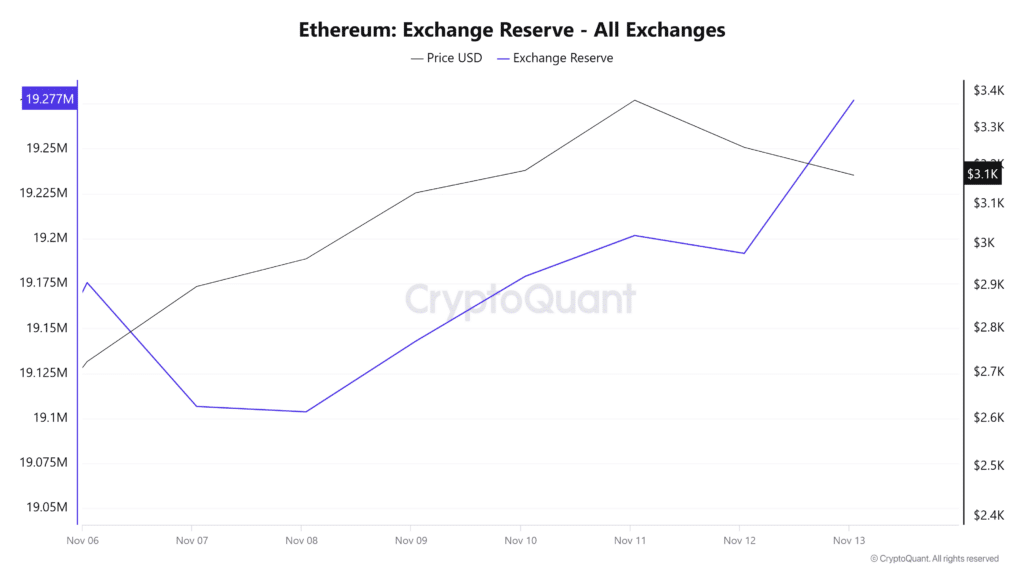

In parallel, Ethereum’s rising Trade Reserve steered an inflow of ETH into alternate wallets, indicating that some merchants are getting ready to promote.

Given these elements, ETH’s value is more likely to expertise additional declines. Nevertheless, the important thing query stays: how low will it go?

AMBCrypto has performed additional evaluation to undertaking potential value ranges for ETH’s downturn.

A minor dip earlier than resuming bullish rally

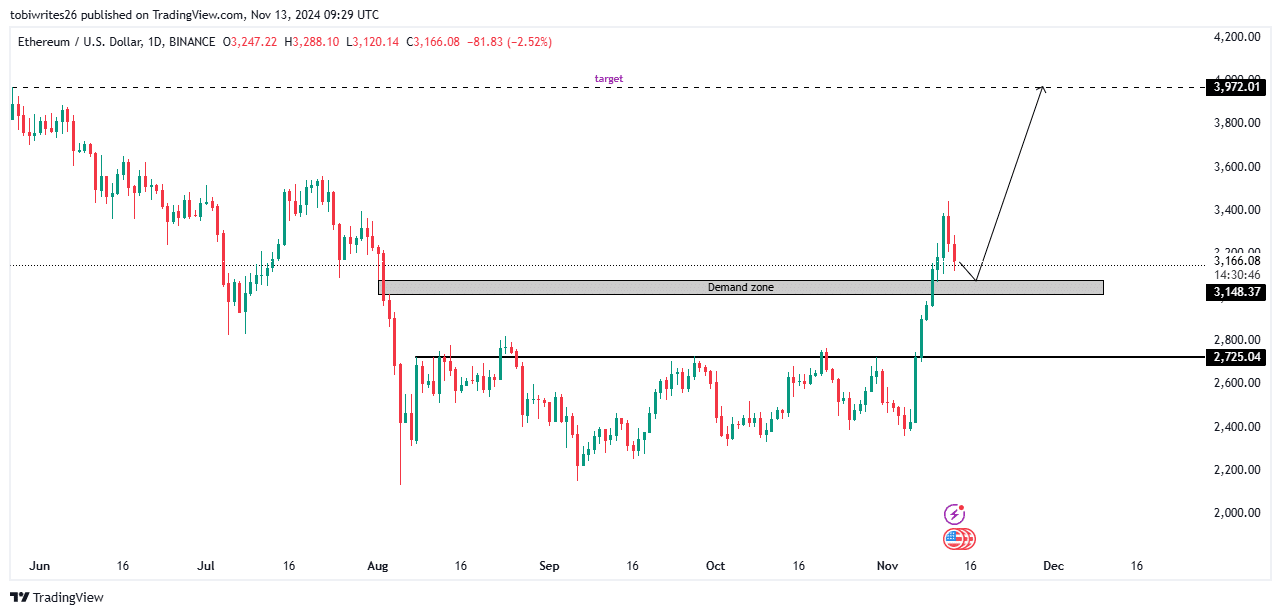

ETH continued to take care of a powerful total bullish construction, although a slight decline is anticipated earlier than its rally resumes.

Based on the day by day ETH chart, the important thing demand zone the place it should fall lies between $3,079.89 and $3,015.91.

This zone is anticipated to supply the shopping for strain essential to get ETH again on monitor for its bullish motion.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

As soon as ETH reaches this stage, it’s anticipated to make a major upward transfer towards $3,972.01.

Nevertheless, if bearish sentiment persists, ETH may see an extra drop, doubtlessly falling to $2,725.04 — a stage that would function a catalyst for a renewed bullish surge.