- ETH was up by greater than 7% within the final 24 hours.

- Metrics and indicators appeared bullish on the token.

Ethereum’s [ETH] huge worth decline appeared to have come to an finish because the king of altcoin’s worth elevated within the final 24 hours.

In actual fact, as per AMBCrypto’s evaluation, issues would possibly flip bullish for the king of altcoins, which could enable ETH to recapture its misplaced worth.

Ethereum is buckling up

The crypto market witnessed a crash on the twelfth of April, which had a significant influence on ETH’s worth.

The downtrend pushed the king of altcoins’ worth beneath $3k, which raised alarms and prompted panic amongst buyers.

Nevertheless, the previous couple of hours witnessed a change in market pattern as most cryptos day by day charts turned inexperienced.

Sjuul, founding father of AltCryptoGems and a well-liked crypto analyst, not too long ago posted a tweet revealing that if ETH manages to go above $3,050, a bull run would possibly start.

The excellent news was that ETH managed to maneuver above that stage. In response to CoinMarketCap, ETH was up by greater than 7% within the final 24 hours.

At press time, it was buying and selling at $3,257.33 with a market capitalization of over $391 billion.

To see whether or not that is the start of a full-fledged restoration, AMBCrypto checked Ethereum’s on-chain metrics.

Our evaluation of CryptoQuant’s data revealed that its trade reserve was dropping, signifying a drop in promoting stress.

Upon additional evaluation, we discovered fairly a couple of different bullish metrics. For instance, the token’s lively addresses elevated by 12%. In the meantime, its transaction depend additionally surged by almost 10% in comparison with yesterday.

Moreover, ETH’s Funding Fee was inexperienced. This meant that long-position merchants had been dominant and had been prepared to pay short-position merchants.

What are the subsequent doable targets?

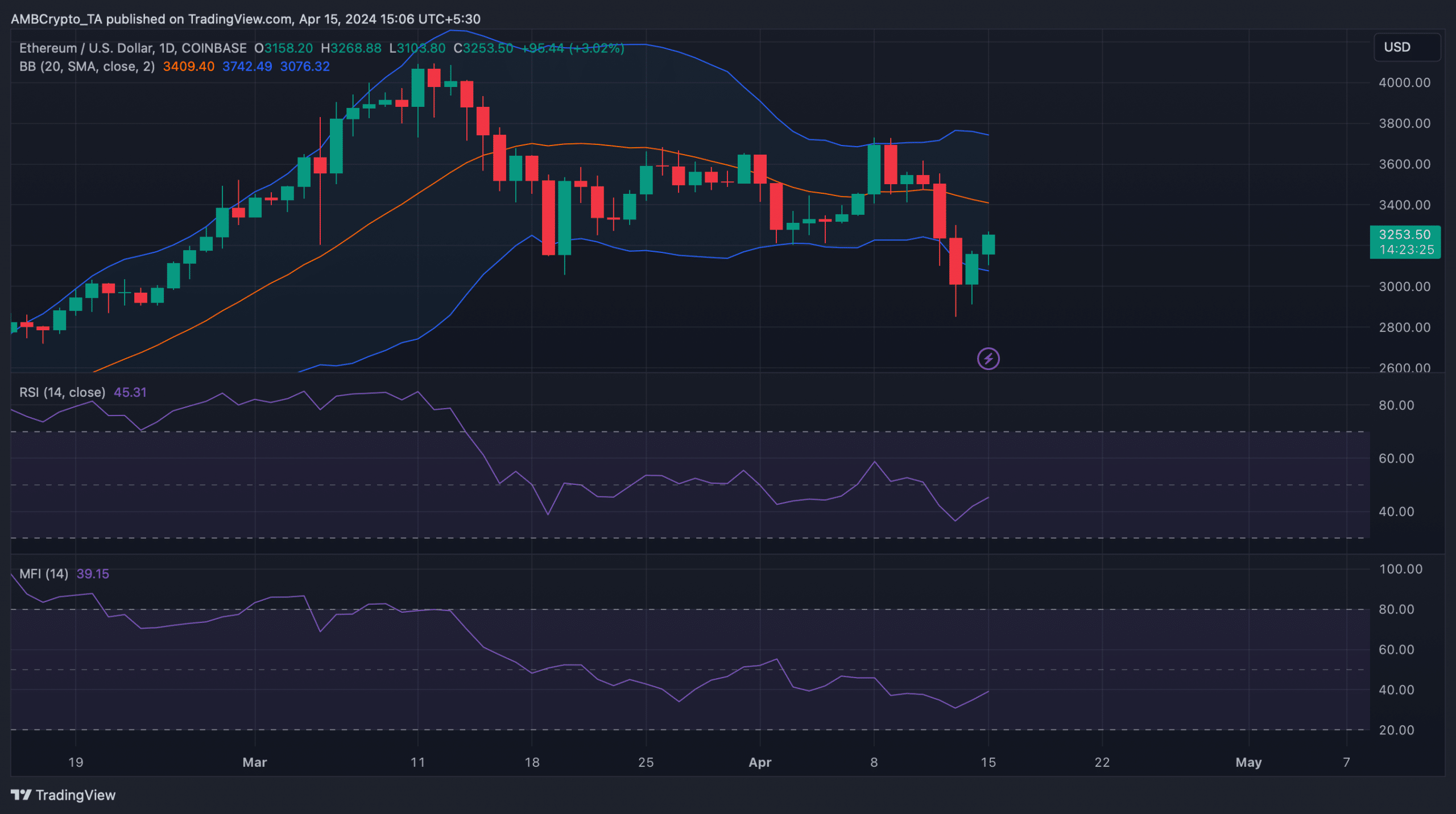

AMBCrypto then analyzed Ethereum’s day by day chart to see the opportunity of the token persevering with its worth uptick. ETH’s Relative Power Index (RSI) registered a pointy uptick on the fifteenth of April.

The Cash Movement Index (MFI) additionally adopted the same pattern, hinting at a continued worth improve. ETH’s worth rebounded from the decrease restrict of the Bollinger Bands, additional suggesting that the bull rally would possibly proceed.

Learn Ethereum’s [ETH] Price Prediction 2024-25

Our take a look at Hyblock Capital’s knowledge identified fairly a couple of ranges that ETH would possibly attain this week if the bull rally really sustains. The primary goal for ETH may be $3.34k, as liquidation would rise at that stage.

If a profitable breakout occurs above that, then ETH would possibly as nicely contact $3.6k and even $3.8k within the following days.