- Quantity spikes verify stronger promoting stress throughout value declines.

- The dying cross and Fibonacci ranges level to extra declines in retailer.

Bitcoin’s [BTC] value continued its downward trajectory, buying and selling at $82,499 as of press time, after breaking beneath essential help ranges.

The cryptocurrency is now dealing with growing bearish stress, with technical indicators suggesting a protracted correction.

Including to the technical considerations, well-known analyst Ali Charts tweeted that Bitcoin has witnessed a crossover between the 50-day and 100-day transferring averages on the each day chart.

This implies continued shifts in momentum that merchants ought to watch carefully.

Demise cross confirms bearish development

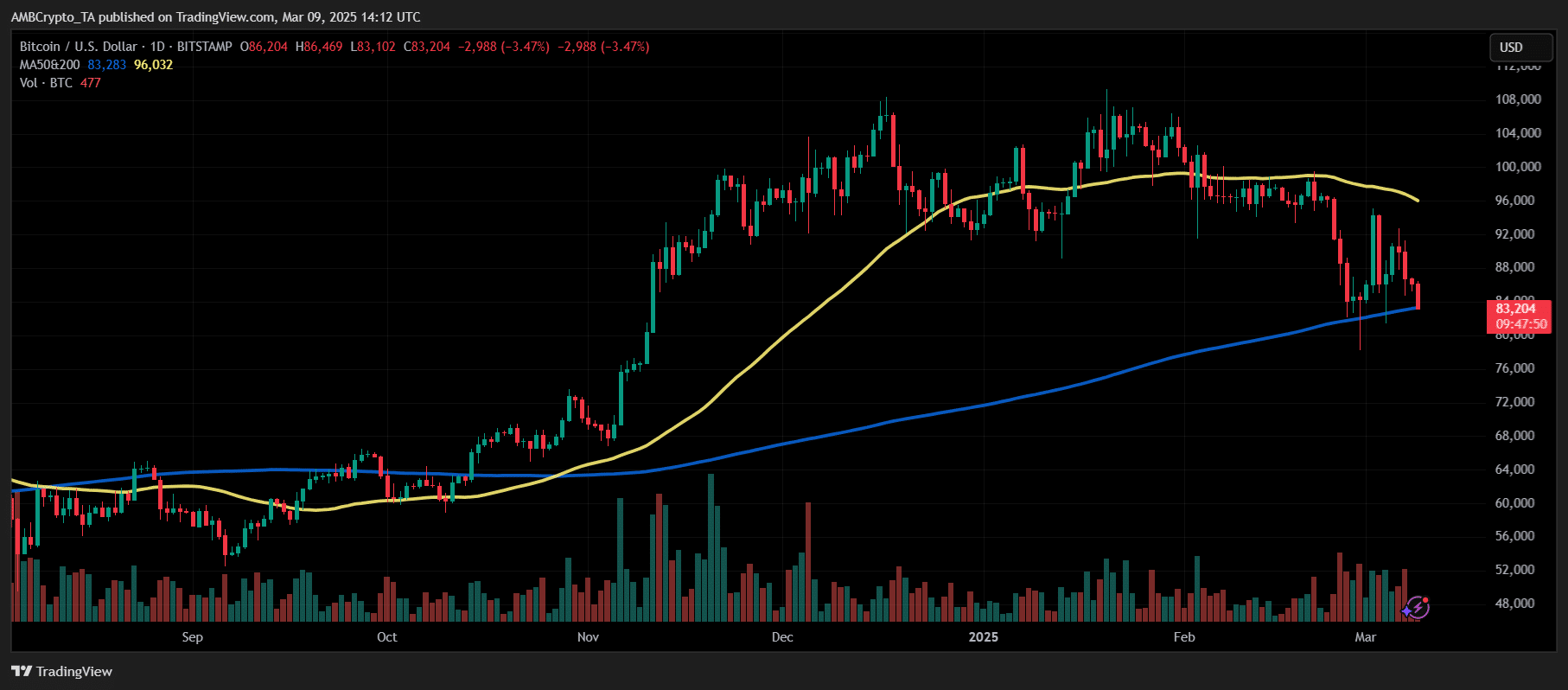

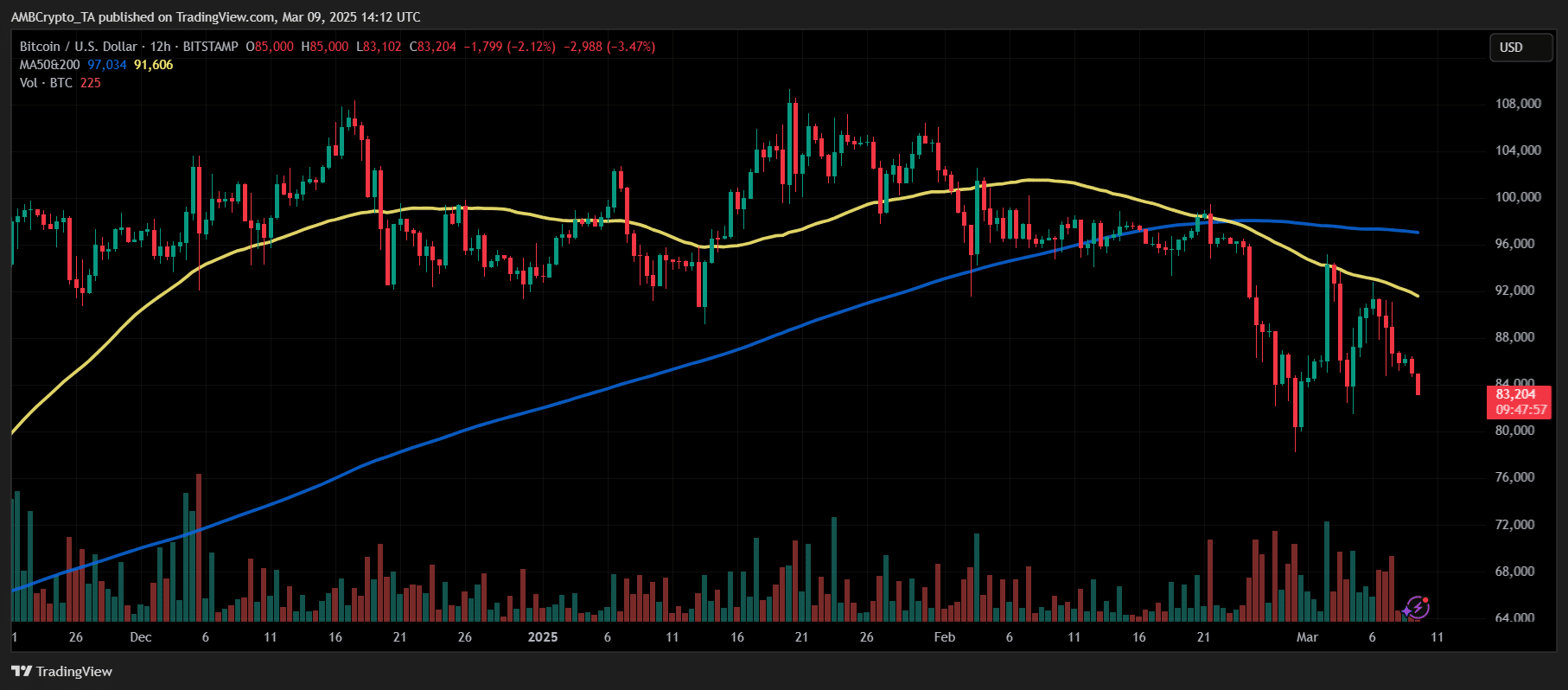

A Demise Cross—a widely known bearish sign—was confirmed in February when Bitcoin’s 50-period transferring common (MA) fell beneath the 200-period MA on each the each day and 12-hour timeframes.

Traditionally, this crossover has preceded prolonged intervals of downward value motion.

Bitcoin’s 50-period MA was $97,041 at press time, whereas the 200-period MA was at $91,631. It strengthened robust resistance ranges above the worth.

BTC has but to point out indicators of reversing the development, remaining beneath these key ranges.

Fibonacci ranges counsel additional declines

Bitcoin beforehand didn’t maintain a transfer above the 50% Fibonacci retracement stage at $85,723. It was now testing the 23.6% retracement stage at $82,902, a key short-term help.

A decisive break beneath this zone might result in a deeper correction towards $80,380, which marks the 0% Fibonacci retracement from latest highs.

BTC’s most up-to-date rejection close to $88,181, aligning with the 61.8% Fibonacci stage, means that bullish makes an attempt have been weak, additional validating the downward stress.

RSI nears oversold territory

The Relative Energy Index (RSI) was 40.70 at press time, displaying weak momentum however not but coming into oversold circumstances (<30).

Earlier RSI lows at 33.79 and 16.73 point out that Bitcoin has traditionally skilled deeper corrections earlier than important rebounds.

A drop beneath 30 RSI would counsel oversold circumstances, doubtlessly signaling a short-term reversal.

Quantity tendencies reinforce promoting stress

Quantity evaluation exhibits that promoting exercise spikes throughout downward strikes, confirming a market pushed by bearish sentiment.

Nonetheless, if Bitcoin experiences a quantity decline throughout additional value drops, it could point out vendor exhaustion, doubtlessly establishing for a aid bounce.

Bitcoin examined $82,902 on the time of writing, the 23.6% Fibonacci retracement stage, which serves as speedy help. Holding above this stage is essential to stop additional draw back.

A breakdown beneath $82,902 might push Bitcoin towards $80,380, the 0% Fibonacci retracement stage, marking a crucial help zone.

Key help and resistance ranges to observe

On the upside, Bitcoin faces robust resistance at $85,723, the 50% Fibonacci stage. A decisive break above this resistance might shift momentum and permit Bitcoin to check $88,181, the 61.8% Fibonacci retracement stage.

Nonetheless, if Bitcoin fails to reclaim $85,723, bearish stress might persist, growing the chance of additional declines. Merchants ought to watch value motion carefully at these ranges for affirmation of development continuation or reversal.

With the Demise Cross nonetheless in play and the 50/100-day transferring common crossover famous by Ali Charts, BTC stays in a medium-term downtrend except important shopping for stress emerges.

Merchants ought to monitor RSI ranges and quantity tendencies at key helps to gauge potential reversal indicators.