A cluster of long-idle Bitcoin moved again into circulation Wednesday, elevating recent questions on promoting strain as costs slide from latest highs.

Associated Studying

Sleeping Cash Stir After Years

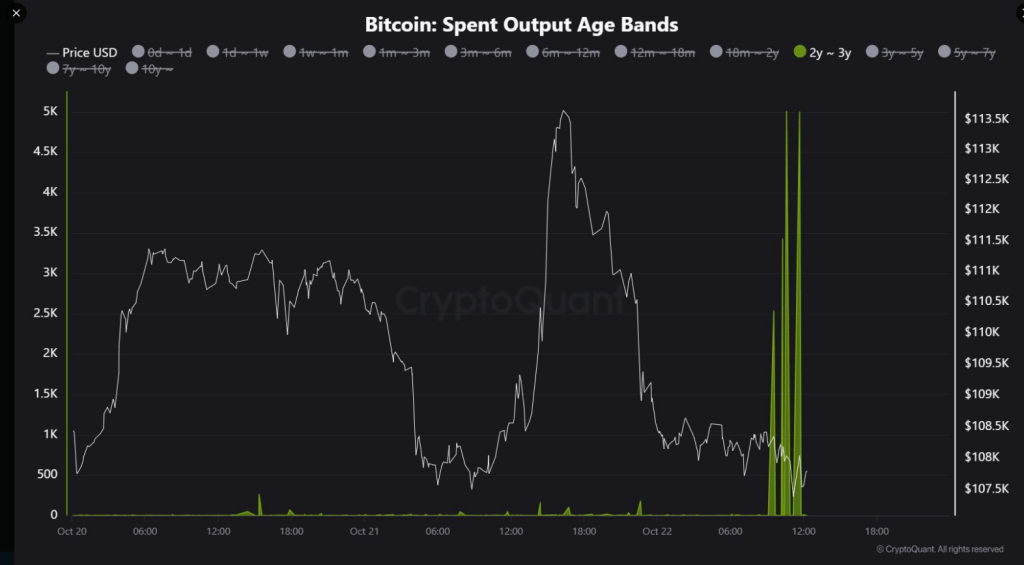

Based on CryptoQuant analyst JA Maartun, precisely 15,965 BTC that had been idle for about three years have been shifted earlier within the day. The cash moved whereas Bitcoin traded beneath $110,000, and at roughly $108,000 a coin the batch is value about $1.724 billion.

CryptoQuant’s on-chain data present these addresses had little to no exercise since late 2022 and early 2023, and the funds have been despatched to undisclosed locations.

Market watchers flagged the timing. Outdated cash waking up throughout a pullback can sign profit-taking, or just inner reshuffles between personal accounts and buying and selling venues.

Stories have disclosed that such strikes typically replicate tax planning, trade custody adjustments, or giant holders adjusting positions — however the precise motive right here is just not public.

15,965 BTC aged 2–3 years simply moved on-chain ⏱️

This cohort has been dormant since late 2022–2023—till now. pic.twitter.com/vw2z0fjHvv

— Maartunn (@JA_Maartun) October 22, 2025

New Whales Underwater

Information from market trackers level to strain on newer giant holders who purchased close to latest highs. These so-called new whales carry a median value of $113,000 per BTC, leaving many positions underwater whereas costs commerce beneath that stage. The unrealized losses tied to those wallets are approaching $7 billion, in keeping with the identical datasets.

On the identical time, accumulation by different massive wallets continues. Analysts reported that about 26,500 BTC have flowed into accumulation addresses in latest days, an indication that some giant gamers are including quietly in the course of the dip.

This mixture of promoting and shopping for creates a tug-of-war in value motion. Brief-term dynamics are fragile. Help round $107,000–$108,000 is one stage merchants are watching intently. If that zone holds, a bounce is feasible; if it fails, additional draw back towards $100,000 may observe.

Worth Targets Spark Debate

The massive actions have intensified debate over how excessive Bitcoin would possibly go subsequent. Based on public feedback, the CEO of Galaxy Digital stated reaching $250,000 by year-end would require “a heck of numerous crazy stuff.”

Different market figures maintain extra bullish targets in play: Fundstrat’s Tom Lee and BitMEX’s Arthur Hayes have every voiced conviction in $200,000–$250,000 outcomes, pointing to potential coverage strikes and inflows as drivers.

Institutional numbers are a part of the backdrop. Galaxy Digital reported a file quarter with $29 billion in income, a determine that supporters cite as proof of rising institutional involvement available in the market. That development is a part of why some traders stay assured at the same time as short-term charts wobble.

Associated Studying

Open Curiosity Falls, Threat Eases

In the meantime, on-chain analytics supplier Glassnode reveals open curiosity has dropped by about 30%, lowering among the extra speculative strain that may amplify strikes.

Decrease open curiosity typically cools violent swings and makes value developments simpler to learn, not less than till recent catalysts arrive.

Featured picture from Pexels, chart from TradingView