This information offers a complete overview of the method for changing Bitcoin (BTC) right into a wrapped or tokenized kind (cbBTC, wBTC and others) for use as collateral for borrowing stablecoins like USDT and USDC. It explores a number of distinct pathways, detailing the related platforms, advantages, and inherent dangers of every strategy. The knowledge offered is predicated on analysis performed in September 2025 and is meant for informational functions solely.

Be aware: A few of the methods listed under are for intermediate and superior customers. In case you are undecided learn how to strategy this, take skilled crypto recommendation.

Understanding Wrapped Bitcoin

Wrapped Bitcoin (wBTC) and its variants, resembling Coinbase’s cbBTC, are tokens on different blockchains (primarily Ethereum) that signify Bitcoin. Every wrapped token is backed 1:1 by an equal quantity of BTC held in custody. This course of permits Bitcoin, which is native to its personal blockchain, to be utilized throughout the decentralized finance (DeFi) ecosystem, enabling actions like lending, borrowing, and buying and selling on platforms that assist these tokens.

Choice 1: Coinbase and Aave Protocol – BTC to cbBTC

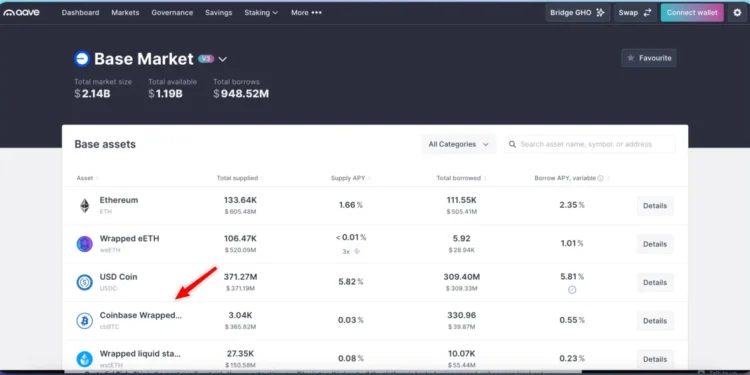

This route includes utilizing Coinbase or Bybit to transform BTC to cbBTC after which supplying it as collateral on the Aave protocol, a number one decentralized lending platform.

Route:

1. Convert BTC to cbBTC: Inside your Coinbase account, you possibly can wrap your BTC into cbBTC. That is usually carried out by sending BTC out of your principal Coinbase account to a Base or Ethereum deal with, the place it's robotically transformed to cbBTC [1].

2. Convert BTC to cbBTC: It's also possible to use Bybit crypto exchange to transform BTC to cbBTC. Bybit will even allow you to withdraw cbBTC on totally different chains, making it simpler so that you can take it to totally different blockchain.

2. Provide cbBTC to Aave: Join a suitable web3 pockets (e.g., MetaMask, Coinbase Pockets, Ledger, ) to the Aave utility. Switch the cbBTC out of your Coinbase account to this pockets.

3. Borrow USDT/USDC: On the Aave platform, provide your cbBTC to the lending pool. You may then borrow USDT or USDC in opposition to your provided collateral, as much as the required collateralization ratio.

Advantages:

• Belief and Safety: Coinbase is a well-established and controlled entity, offering a level of belief within the custody of the underlying BTC that backs cbBTC.

• Deep Liquidity: Aave is without doubt one of the largest and most liquid DeFi lending protocols, providing substantial swimming pools for borrowing and lending.

• Ecosystem Integration: cbBTC is designed for the Base ecosystem, which can supply decrease transaction charges and quicker speeds in comparison with the Ethereum mainnet.

| Platform | colleteral asset | Borrowable Stablecoins | Provide APY | Borrow APY (USDC) | Borrow APY (USDT) |

| AAVE | cbBTC | USDT/USDC | <0.01% | 5.82% | 6.85% |

| Kamino Finance (Solana) | cbBTC | USDT/USDC | 3.99% (Rewards) | – | – |

Be aware: The above knowledge adjustments quick. Test official web site to get the newest knowledge

Dangers:

• Centralization: The first danger is the centralized nature of cbBTC. The underlying Bitcoin is held in custody by Coinbase, making a single level of failure. If Coinbase had been to face regulatory points or insolvency, the worth and redeemability of cbBTC could possibly be compromised. Nevertheless, Coinbase is a NASDAQ listed web site and the belief on their merchandise together with cbBTC and BASE blockchain is rising.

• Sensible Contract Vulnerabilities: Aave, like all DeFi protocols, is topic to good contract danger. A bug or exploit within the Aave protocol may result in a lack of funds.

• Liquidation Danger: If the worth of BTC (and due to this fact cbBTC) drops considerably, your collateral could also be liquidated to cowl your mortgage. That is an automatic course of in DeFi protocols.Choice 2: Utilizing Wrapped Bitcoin (WBTC) for Stablecoins loans on DeFi Platforms

This selection makes use of Wrapped Bitcoin (WBTC), probably the most extensively adopted type of tokenized Bitcoin, on established DeFi lending platforms like Aave or Compound.

Route:

1. Convert BTC to WBTC: You may convert BTC to WBTC by means of varied centralized exchanges (e.g., Kraken) or decentralized providers that act as retailers within the WBTC minting course of.

2. Provide WBTC to a Lending Platform: Just like the cbBTC route, you'd switch your WBTC to a web3 pockets and provide it as collateral on a platform like Aave or Compound.

3. Borrow USDT/USDC: Borrow stablecoins in opposition to your WBTC collateral.| Platform | Collateral Asset | Borrowable Stablecoins | Provide APY | Borrow APY (USDC) | Borrow APY (USDT) |

| Aave Protocol | WBTC | USDC, USDT, and many others. | <0.01% | 5.82% | 8.65% |

| Compound Finance | WBTC | USDC, USDT, and many others. | Varies | Varies | Varies |

Advantages:

• Widespread Adoption: WBTC is probably the most acknowledged and built-in type of wrapped Bitcoin, supported by an enormous array of DeFi functions and having fun with the best liquidity.

• Decentralized Governance (Partial): Whereas nonetheless reliant on custodians, the WBTC DAO (Decentralized Autonomous Group) provides a layer of neighborhood governance to the method.

• Confirmed Monitor File: WBTC has been in existence longer than many different wrapped Bitcoin variants and has a extra established historical past.Dangers:

• Custodian Danger: WBTC depends on a consortium of custodians to carry the underlying BTC. Whereas that is extra decentralized than a single custodian like Coinbase, it nonetheless presents counterparty danger.

• Sensible Contract and Liquidation Dangers: These are the identical as with Choice 1 and are inherent to utilizing DeFi lending protocols.

• Wrapping/Unwrapping Charges: The method of minting and burning WBTC can contain charges that might not be current within the extra streamlined Coinbase cbBTC course of.Choice 3: Fluid Protocol for Built-in Bitcoin Lending

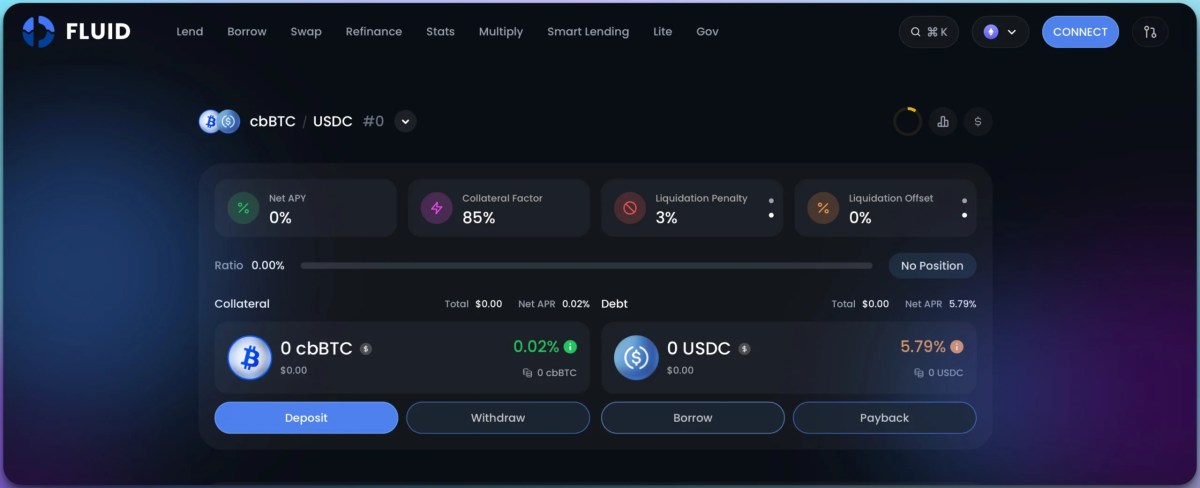

Fluid is a more moderen lending protocol that provides a extra built-in expertise, with particular vaults for lending and borrowing varied property, including cbBTC and WBTC.

Route:

1. Purchase cbBTC or WBTC: Observe the conversion steps outlined in Choice 1 or 2.

2. Use Fluid Protocol Vaults: Join your pockets to the Fluid utility and choose a vault that matches your required collateral and debt asset (e.g., cbBTC/USDC, WBTC/USDT).

3. Create a Place: Provide your wrapped Bitcoin and borrow stablecoins immediately throughout the chosen vault.Advantages:

• Probably Higher Charges: As a more moderen protocol, Fluid could supply extra aggressive rates of interest or incentives to draw customers and liquidity.

• Specialised Vaults: The vault construction permits for extra particular danger administration and probably extra environment friendly use of capital.

• Rising Ecosystem: Partaking with newer protocols can present alternatives to learn from their progress and future token incentives.Dangers:

• Newer Protocol Danger: Fluid has a shorter monitor document than Aave or Compound, which might indicate greater good contract danger and fewer certainty about its long-term stability.

• Decrease Liquidity: Whereas rising, Fluid’s liquidity swimming pools are smaller than these of the key protocols, which may result in greater slippage or issue coming into/exiting giant positions.

• Complexity: The number of vaults and choices could also be extra complicated for customers who're new to DeFi.Choice 4: Centralized Bitcoin Lending Platforms

For individuals who choose an easier, non-DeFi strategy, centralized lending platforms supply a simple solution to borrow in opposition to your native Bitcoin with out the necessity for wrapping. I've talked about one such platform called Nexo before, and shared my sincere overview on what I believe. I do use Nexo for myself, however preserve it small as their is counterparty danger with centralized lending platforms.

Route:

1. Create an Account: Join an account on a platform like Nexo or YouHodler.

2. Deposit BTC: Switch your native BTC on to your account on the platform.

3. Borrow Stablecoins: Request a mortgage in USDT or USDC, utilizing your deposited BTC as collateral.Advantages:

• Simplicity: That is probably the most simple choice, with a person expertise much like a standard monetary service. There are not any web3 wallets, gasoline charges, or complicated protocol interactions.

• Buyer Assist: Centralized platforms usually supply devoted buyer assist.

• Insurance coverage: Many centralized platforms present insurance coverage on custodial property, providing a level of safety in opposition to hacks.Dangers:

• Custodial Danger: That is probably the most important danger. You might be entrusting your Bitcoin to a 3rd get together. If the platform is hacked, mismanaged, or turns into bancrupt, you might lose your funds solely.

• Lack of Transparency: The inner workings, reserves, and lending actions of centralized platforms are sometimes opaque in comparison with the general public, on-chain nature of DeFi protocols.

• Phrases and Situations: The platform has full management over the phrases of the mortgage and might change them. They will additionally freeze your account or property in the event that they deem it crucial.Abstract and Suggestions: Get USDT, USDC Curiosity Loans with Bitcoin Collateral

Choosing the proper Bitcoing lending choice to borrow steady coin depends upon your particular person danger tolerance, technical experience, and priorities. Here's a abstract to assist information your choice:

| Characteristic | DeFi (Aave, Compound, Fluid) | Centralized (Nexo, YouHodler) |

| Management over Funds | Excessive (Non-custodial, you maintain your keys) | Low (Custodial, platform holds your property) |

| Transparency | Excessive (All transactions are on-chain and public) | Low (Operations are largely opaque) |

| Complexity | Excessive (Requires web3 pockets, understanding of gasoline charges, and many others.) | Low (Easy, web2-style person interface) |

| Danger Profile | Smart contract bugs, liquidation, wrapped asset danger | Custodial danger (platform failure/hack), lack of transparency |

| Potential Returns | May be greater on account of yield farming and token incentives | Typically fastened and could also be decrease than DeFi potential |

For person who prioritizes simplicity:

• Choice 4 (Centralized Lending) is probably the most appropriate. It avoids the complexities and good contract dangers of DeFi. A few of them like Nexo don't have any lock-in characteristic, although it's possible you'll incurr withdrawal charges and the chance profile as said above. For the person snug with DeFi who values belief within the custodian:

• Choice 1 (Coinbase/Aave/Kamino) affords a great steadiness, combining the strong and battle-tested Aave protocol with the perceived safety of Coinbase because the custodian for cbBTC.For the DeFi-native person in search of most decentralization and adoption:

• Choice 2 (WBTC on Aave/Compound) is the usual selection. WBTC’s wider adoption and extra decentralized (although nonetheless custodial) mannequin make it a cornerstone of the DeFi ecosystem.Remaining phrases:

DeFi world is quick rising, and my suggestion could be monitor your favourite protocol for greatest yeild regularly and don't shrink back from shifting funds from one to protocol (as shifting price is fraction) and returns are excessive. Although don't take undesirable dangers through the use of much less established defi platform for additional yield. It's also possible to use an AI instrument like Manus or one thing much like repeatedly monitor the well being of those deficiencies platrorms and discover out which platform is providing greatest yeild.

Earlier than continuing with any of those choices, it's essential to conduct your personal thorough analysis, perceive the precise phrases and circumstances of every platform, and by no means make investments greater than you're keen to lose.

Assist us enhance. Was this beneficial

A Guide to Using Bitcoin for Stablecoin Loans – Navigating Bitcoin-Backed Lending was revealed on CoinSutra – Bitcoin Community