One other bearish day within the broader cryptocurrency market has hampered Ethereum’s upward motion, because the altcoin’s value stays under the $4,500 stage. Within the midst of the continued bearish efficiency, a good portion of Ethereum has been noticed leaving main centralized exchanges at a fast price.

Huge Cash Ethereum Buyers Fleeing Binance

Over the previous few days, Ethereum, the second-largest digital asset, has been scuffling with heightened volatility, which started after reaching a brand new all-time excessive. As costs fluctuate, Darkfost, an creator and market professional, pointed out a rising shift in investor sentiment and action on Binance, the world’s main crypto alternate.

The on-chain professional revealed that ETH reserves on Binance proceed to shrink, pushed by persistent whale outflows. Giant ETH holders have been steadily withdrawing their property from the crypto alternate, an indication of rising belief and curiosity within the altcoin.

Along with lowering alternate liquidity, this sample helps Ethereum’s bullish sentiments as a result of declining provide on important platforms has all the time coincided with rising value momentum. Such a growth usually suggests a long-term holding strategy, as these giant traders transfer their cash to chilly storage.

In keeping with the professional, whales are nonetheless energetic and hold accumulating Ethereum because the bullish development develops. A number of notable whale withdrawals on Binance have been found in the course of the early hours of Thursday, with a view to deploy it on Aave for yield.

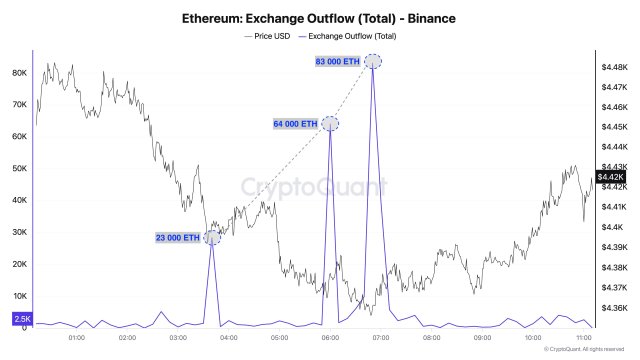

Actually, inside a couple of minutes, Binance noticed three important outflows. Knowledge shared by the on-chain professional reveals that the primary transaction consists of roughly 23,000 ETH, the second, which was bigger, contained 64,000 ETH, whereas the final and largest switch contained 83,000 ETH. In whole, these transactions are valued at roughly $750 million.

Following the substantial whale outflows, Ethereum reserves have now fallen to 4.2 million ETH. This growth implies there may be nonetheless a high demand for ETH, and Binance is unavoidably one of the vital standard platforms for large-scale transactions. General, the sturdy help for ETH from whales is a extremely encouraging indicator and is probably going one of many elements contributing to its recent outperformance of Bitcoin.

ETH Whales Are On The Transfer

It’s value noting that Ethereum whale exercise extends past centralized exchanges. Glassnode, a number one on-chain knowledge analytics agency, has outlined a notable disparity in motion amongst whale holders. In August, the biggest holders of ETH made opposing actions.

Mega whales, significantly wallet addresses holding no less than 10,000 ETH, drove the rally with internet inflows reaching a peak of +2.2 million ETH during the last 30 days. Nonetheless, these key traders have now halted their accumulation.

Moreover, giant whales holding 1,000 ETH to 10,000 ETH have been steadily accumulating following weeks of distribution. Inside a 30-day interval, these traders have amassed greater than 411,000 ETH. The huge motion highlights giant holders’ curiosity and conviction in ETH’s long-term prospects.

Featured picture from iStock, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.