- Bitcoin’s vacation rally brings it near $100K, fueling hypothesis and heightened volatility.

- Leverage and market sentiment is essential as BTC navigates liquidation zones and key worth ranges.

Bitcoin [BTC] delivered a vacation shock this Christmas, surging to a outstanding $99.8K and reigniting dealer optimism for a possible breakout above $100K.

Because it edges nearer to this essential psychological and technical degree, market individuals are bracing for heightened volatility.

Above $100K lies a pivotal liquidation zone for brief positions, the place a breach might ignite a fast rally towards $110K.

Nonetheless, the trail is fraught with dangers, because the $90K degree beneath represents a precarious assist that, if examined, might set off important liquidations of lengthy positions.

Bitcoin’s means to navigate these ranges will outline its trajectory because it closes the yr with unprecedented momentum.

BTC’s efficiency — A vacation miracle!

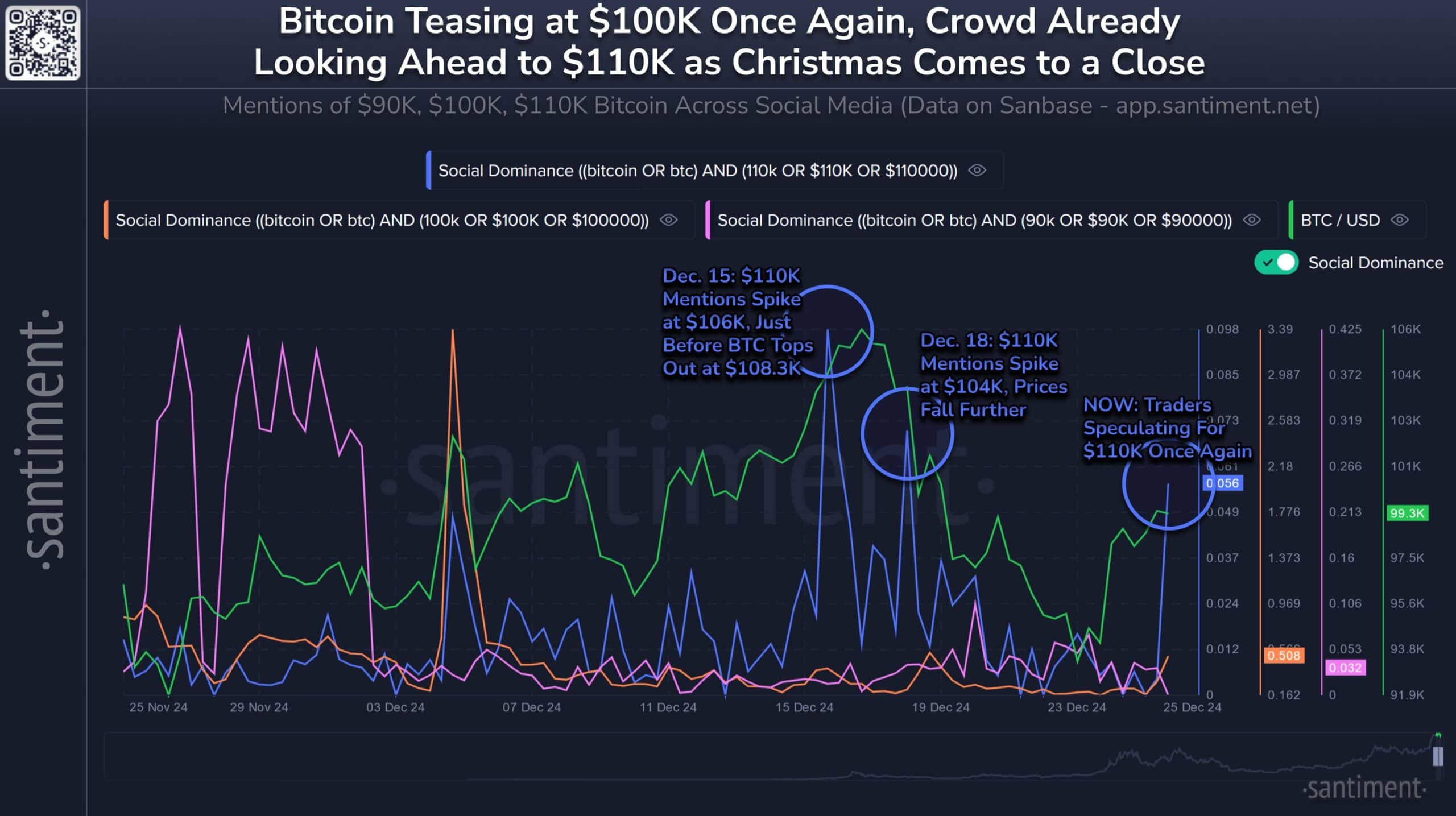

Bitcoin’s surge to $99.8K on Christmas marked a pivotal second within the last quarter of 2024, with each social sentiment and worth dynamics aligning to push the cryptocurrency nearer to the psychological $100K threshold.

On the twenty fifth of December, mentions of $100K surged alongside Bitcoin’s worth, displaying the psychological significance of this degree.

Merchants’ focus has additionally shifted to $110K, with a notable enhance in mentions of this goal, mirroring patterns noticed earlier in December throughout Bitcoin’s rallies to $106K and $104K.

Historic information means that social-driven worth euphoria has performed a pivotal position in Bitcoin’s efficiency this month.

As an illustration, on the fifteenth of December, mentions of $110K spiked considerably simply as Bitcoin peaked at $108.3K.

Equally, one other surge in social chatter on the 18th of December coincided with Bitcoin’s try to stabilize at $104K earlier than retreating additional.

These developments exhibit that speculative sentiment typically results in short-term tops, notably at key worth milestones.

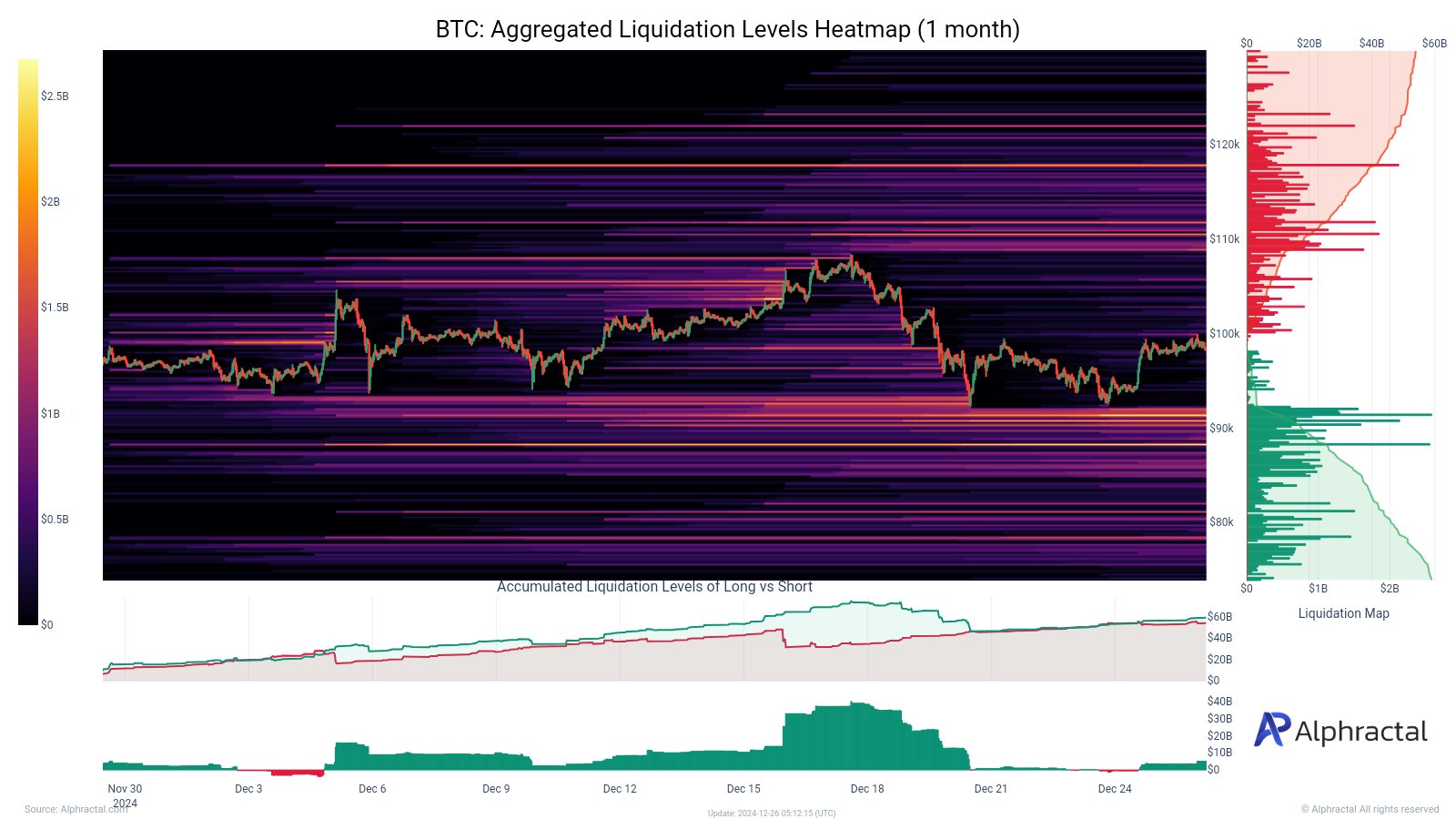

As Bitcoin closes in on the $100K mark, its volatility stays underpinned by liquidation pressures.

On the upside, breaching $100K might set off cascading liquidations of quick positions, propelling Bitcoin towards $110K.

Nonetheless, the $90K assist degree beneath stays a essential zone to observe, as lengthy liquidations right here might gas a pointy reversal.

The market’s present conduct indicators cautious optimism.

Merchants are speculating closely about Bitcoin’s means to take care of its upward momentum, however its current historical past of pullbacks following sentiment-driven peaks suggests the trail to $110K would require greater than social hype.

Sustained demand and robust technical assist can be key to breaking via and holding larger ranges.

Bitcoin: Key liquidation zones

Bitcoin’s current transfer towards $100K highlights two essential zones that would outline its near-term trajectory.

The $110K degree stands out as the first liquidation zone for brief positions, representing a possible inflection level the place a break above might gas a pointy rally.

On the flip facet, the $90K area has emerged as an important assist degree for lengthy positions. A dip beneath this vary might cascade into important liquidations, exacerbating downward strain.

Merchants ought to stay vigilant, because the interaction between these zones will doubtless dictate Bitcoin’s worth motion within the coming weeks, particularly amidst heightened volatility.