In keeping with a brand new technical evaluation, Bitcoin (BTC) and the broader crypto market may very well be mirroring historical post-halving cycle patterns. Whereas the market has beforehand rallied by means of July and August, historic fractals level to a possible crash in September, adopted by a push right into a cycle peak later within the yr.

Associated Studying

September Proves Dangerous For Bitcoin And Crypto Market

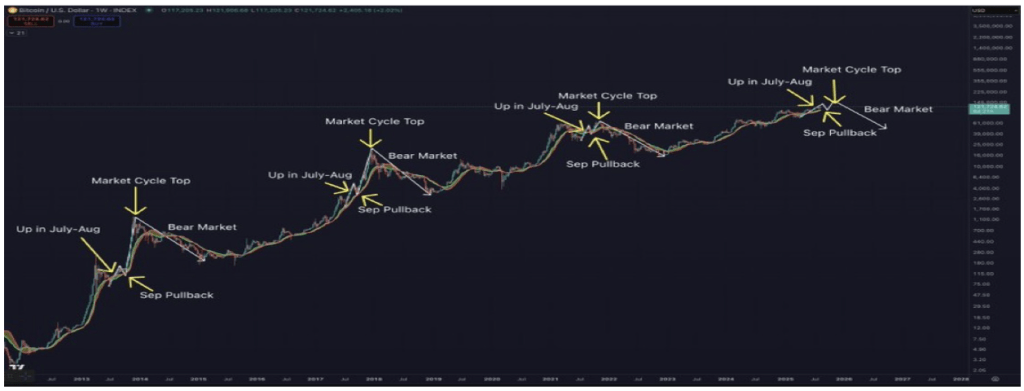

A latest X social media post by crypto analyst Benjamin Cowen has highlighted a recurring sample in Bitcoin’s price action that might have important implications for the market over the approaching months. His evaluation reveals that Bitcoin has persistently adopted a post-halving cycle that displays distinct seasonal price movements, notably round July, August, and September.

The chart shared by Cowen illustrates that in earlier cycles, Bitcoin has typically rallied in July and August, fueling optimism and powerful market sentiment. Nonetheless, every time this has been adopted by a September crash, resulting in a reset earlier than the ultimate push towards the cycle prime, which often arrives within the last quarter of the year.

In keeping with the evaluation, this repeating construction isn’t distinctive to a single cycle however has appeared throughout a number of previous cycles, giving weight to the skilled’s argument that historical past may very well be repeating. In 2013, 2017, and 2021, Bitcoin’s value conduct adopted this sample nearly identically, exhibiting power in mid-summer and weak point in September.

After a last rally to a peak, every of those cycles was ultimately adopted by an extended bear market phase, throughout which valuations corrected sharply from their highs. Based mostly on Cowen’s report, the present cycle seems to be unfolding the identical manner, as Bitcoin already displayed power in July and August this yr, sparking concerns {that a} September pullback may very well be approaching.

BTC Cycles Recommend Market Nonetheless Has Room To Develop

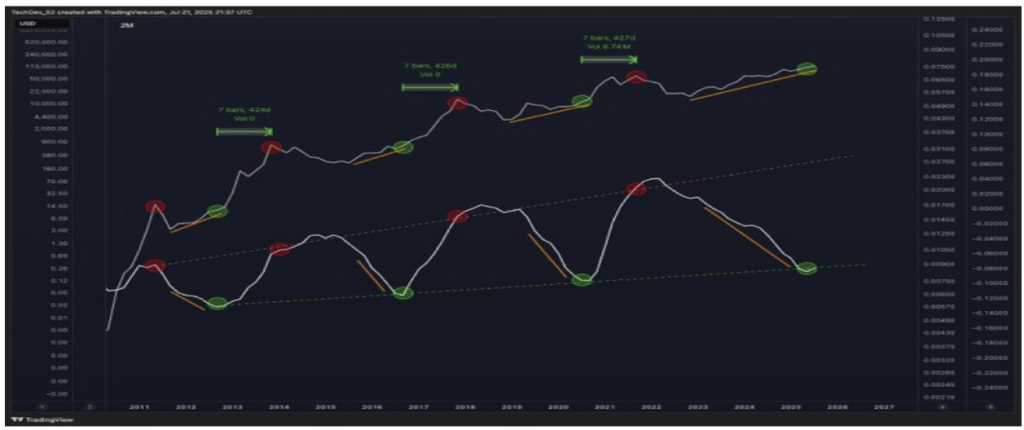

A brand new technical evaluation by crypto market skilled TechDev additionally reveals a recurring sample in Bitcoin’s long-term value cycles, arguing that, opposite to widespread perception, the present market should be far from its peak. The evaluation, supported by a historic chart of BTC’s efficiency, reveals that each market prime has persistently occurred round 14 months after a selected cyclical sign.

The chart outlines a number of Bitcoin cycles relationship again to 2011, with tops and bottoms clearly marked with inexperienced and purple indicators. Every upward run is adopted by a major correction after which a restoration accumulation part. The information additionally revealed that every cycle prime typically aligned with a measured timeframe of roughly 420 days.

Associated Studying

Based mostly on this mannequin, present projections present that Bitcoin still has room to run. The newest inexperienced marker on the chart indicators that the market may already be transitioning out of its corrective part. If historic patterns maintain, this might imply the market is getting into a protracted development window slightly than nearing exhaustion.

Featured picture from Unsplash, chart from TradingView