Since hitting a brand new all-time excessive virtually a month in the past, Bitcoin has executed little to guarantee traders of intent to discover new value territories. Amid announcement of recent US commerce tariffs and rising geopolitical tensions between Israel and Iran, the premier cryptocurrency has come beneath bearish influences to commerce as little as 101,000.

At press time, Bitcoin is hovering close to $104,000 following a 2.03% % decline up to now day. Nevertheless, standard analytics firm Glassnode has highlighted an important value vary value monitoring particularly within the introduction of an extra value decline.

Associated Studying: Bitcoin Sees Modest Gains, But Demand Weakness Limits Breakout Potential

$95,500–$97,000: Bitcoin’s Line In The Sand

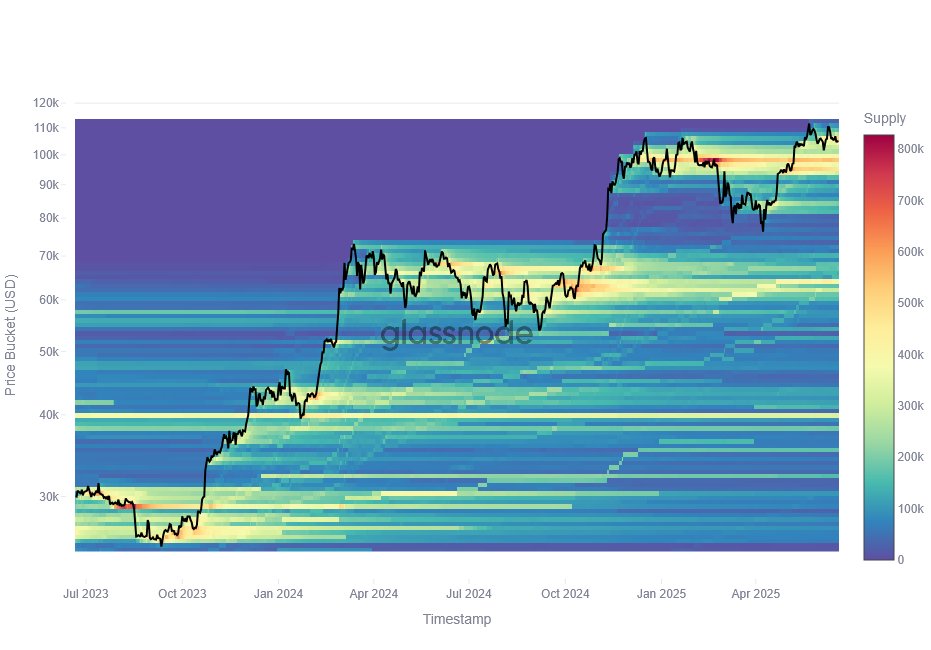

In a recent X post, Glassnode shares an perception into the Bitcoin market based mostly on knowledge from Price Foundation Distribution (CBD) heatmap. The CBD is a standard on-chain metric that tracks the value ranges at which tokens had been final bought or offered. When a considerable quantity of cash are traded inside a particular value vary, it types a provide cluster able to performing as a assist or resistance degree.

Based on Glassnode’s report, the Bitcoin’s CBD heatmap exhibits the primary dense provide cluster beneath the present market value lies at $95,500 – $97,000 value zone. Curiously, this vary rests just under the short-term holders (STH) price foundation suggesting a confluence of technical and on-chain metric to current a high-stake battleground.

Subsequently, Glassnode analysts clarify that holding the market value above this threshold reinforces bullish momentum and boosts Bitcoin probabilities of re-entering a value discovery mode. Nevertheless, a breakdown beneath the $95,500 value degree might set off panic promoting supporting bearish projections for the mid-term to short-term.

Curiously, outstanding market analysts together with nameless X professional with username Mr. Wall Avenue has backed the latter situation stating Bitcoin is due for an extra value drops. Mr. Wall Avenue strictly warns Bitcoin wouldn’t maintain above the $100,000 psychological assist zone forecasting a value fall to across the $93,000 – $95,000 which Glassnode predicts ought to induce widescale market liquidations.

Bitcoin Market Overview

On the time of writing, Bitcoin is buying and selling at $103,753 with a cumulative 1.27% decline up to now week. Throughout this era, the flagship cryptocurrency remained largely beneath $106,000 barring a weak value breakout between June 16 and June 17.

On a month-to-month scale, Bitcoin has now recorded a 6.10% loss, signaling a gradual shift in momentum with bearish forces regaining management of the market. In the meantime, with a market cap of $2.05 trillion, the “digital gold” continues to rank as the biggest cryptocurrency with a reported market dominance of 64.3%.