Following its blistering efficiency within the first week of October, the Bitcoin value motion has been just about tame all month. The truth is, the premier cryptocurrency has witnessed moments of bearish motion in what’s broadly thought to be the traditionally bullish month of “Uptober.”

With the substantial downward strain in current weeks, the Bitcoin value seems set to shut the month within the crimson. Nonetheless, a current analysis reveals that the market chief is perhaps gearing up for its subsequent main value transfer within the coming week.

Why BTC Might Make A Main Transfer Subsequent Week

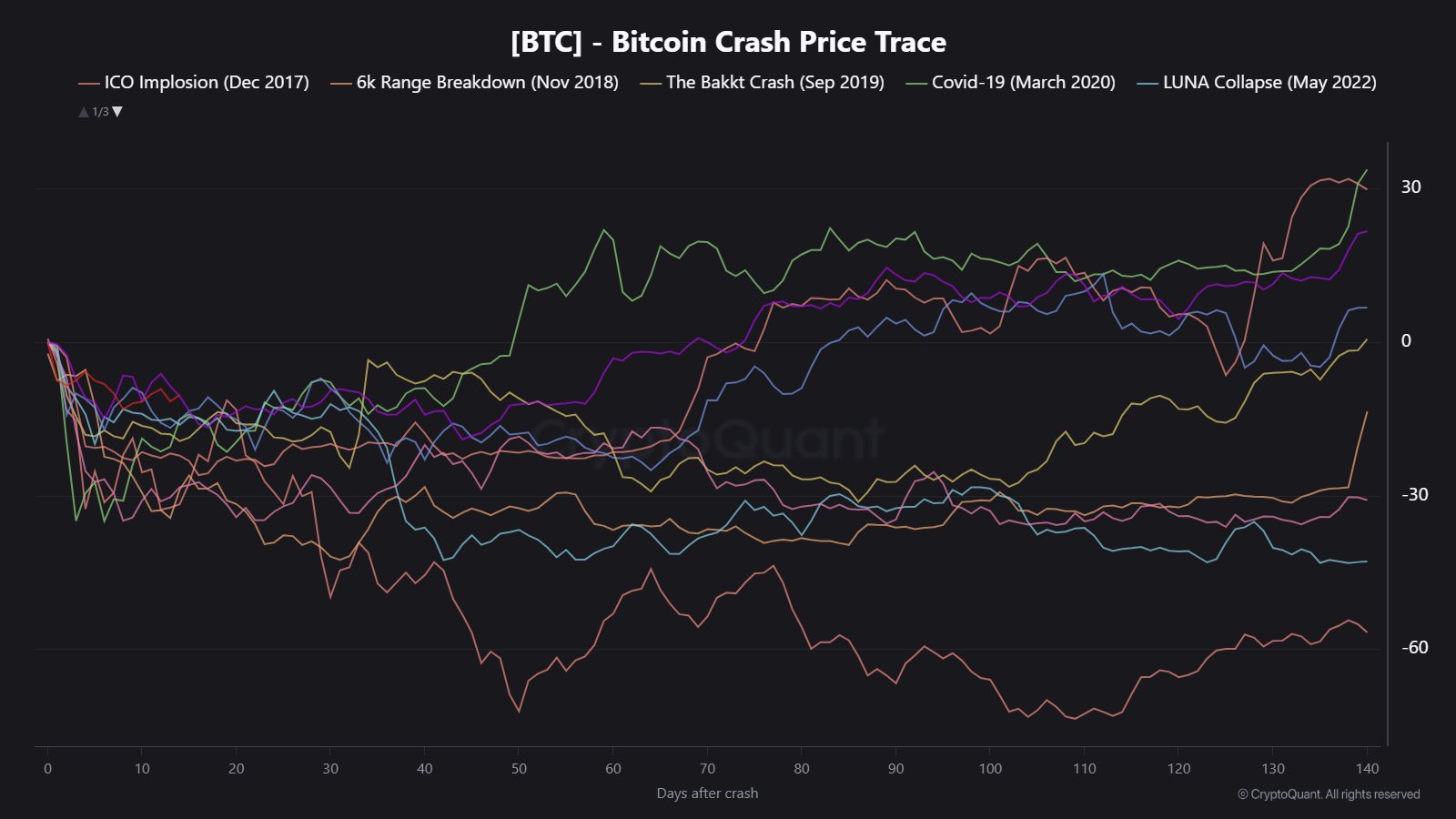

In a recent video on YouTube, crypto analyst Maartunn shared an thrilling speculation across the Bitcoin value, saying that the coin may make its subsequent large transfer within the coming week. This analysis is predicated on the Bitcoin Crash Value Hint, which displays BTC’s conduct after a significant value downturn.

In response to Maartunn’s evaluation, the Bitcoin value tends to enter a interval of consolidation or sideways motion after a pointy crash for about two to 4 weeks, earlier than making its subsequent main transfer. This has been the case for the flagship cryptocurrency because it fell greater than 16% on October 10.

Maartunn famous that the market chief is presently 14 days into this consolidation part, which means that the subsequent transfer may come anytime from now.

Supply: @JA_Maartunn on X

The analyst went additional to supply clues within the knowledge, highlighting that market volatility is shrinking for the premier cryptocurrency. Maartunn believes that this decline in volatility alerts that traders are ready on the sidelines for the subsequent important value transfer.

As of this writing, Bitcoin is valued at round $111,690, reflecting a mere 0.6% bounce up to now 24 hours.

Stage To Watch For The Subsequent Transfer

Maartunn went additional by revealing $112,500 as a crucial stage to look at in case the Bitcoin value makes its subsequent main transfer. This value stage is the short-term holders’ (STHs) realized value, which regularly acts as a dynamic support and resistance level.

Usually, with BTC’s worth beneath this STH realized value, it signifies that probably the most reactive set of Bitcoin traders is within the crimson. These short-term traders are doubtless going to dump their belongings at breakeven value—when the Bitcoin value returns to their price foundation.

In the end, this sell-off would put downward strain on Bitcoin’s value, making the STH realized value (presently at $112,500) a big resistance stage.

The value of BTC on the every day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.