The latest Bitcoin on-chain data reveals a notable improvement amongst mid-tier buyers often called Dolphins (wallets holding between 100 and 1,000 BTC). These entities, that are seen because the stability between retail merchants and institutional whales, have quietly turn into essentially the most dominant cohort in 2025.

Their accumulation development, which began earlier this 12 months, has now reached ranges not seen in Bitcoin’s historical past, and on-chain information reveals the sheer quantity of confidence within the long-term trajectory of the world’s largest cryptocurrency.

Dolphins Take Management Of The Market

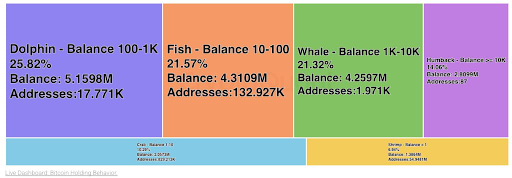

In keeping with Santiment’s on-chain information, Bitcoin Dolphins now maintain round 5.16 million BTC, representing about 26% of the entire circulating provide. This share is bigger than that of each smaller retail holders (Shrimps and Crabs) and large-scale buyers (Whales and Humpbacks). The regular rise of their holdings since early 2025 factors to deliberate and sustained accumulation in periods of market consolidation.

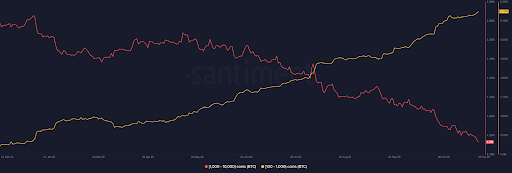

The chart beneath clearly illustrates this habits, exhibiting a easy upward development in Dolphin balances from late April by October 2025. Every transient pause within the curve is highlighted accumulation throughout minor corrections, which means that these holders have been benefiting from worth pullbacks to strengthen their positions. This gradual however constant buildup signifies rising conviction quite than speculative buying and selling exercise.

Total Holdings Of Bitcoin Dolphin Addresses. Source: Santiment

Total Holdings Of Bitcoin Dolphin Addresses. Source: Santiment

The numbers present that Dolphins have collected greater than 681,000 BTC to date this 12 months. This improve highlights how this group has turn into an important by way of Bitcoin’s provide dynamics. Whales and Humpbacks have proven much less aggressive habits, whereas Dolphins look like absorbing a big portion of the accessible cash.

This growing development amongst Dolphin wallets is rather more attention-grabbing when checked out as compared with whale addresses, that’s, addresses holding between 1,000 BTC and 10,000 BTC. Knowledge from Santiment reveals that addresses that fall into this cohort have seen their collective holdings falling since April, falling from 4.58 million BTC in April to 4.2 million BTC on the time of writing, as proven within the picture beneath.

Bitcoin Balance By Addresses. Source: Santiment

Affect On Bitcoin’s Worth Construction

The rise of Dolphins is a positive shift in Bitcoin’s possession construction. In contrast to Whales, whose actions can cause short-term price swings, Dolphins signify a bigger group of strategic buyers with a longer-term outlook.

Presently, there are about 17,771 addresses inside this class, every holding between 100 BTC and 1,000 BTC, and collectively they account for 25.82% of Bitcoin’s circulating provide. Their collective management of greater than 1 / 4 of all Bitcoin suggests a gradual decentralization of provide away from a number of dominant holders.

Then again, there are 1,971 addresses holding between 1,000 BTC and 10,000 BTC, translating to about 21.32% of the entire circulating provide. This information displays a more healthy market stability between institutional and enormous retail participation.

Bitcoin Balance By Addresses. Source: @nehalzzzz1 on X

On the time of writing, Bitcoin is buying and selling at $113,345.

Featured picture created with Dall.E, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our group of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.