- Bitcoin ETF cumulative inflows attain $21 billion, with BTC round $2,500 shy of $70,000.

- IBIT emerges because the market chief.

Bitcoin’s [BTC] current value journey has been nothing in need of spectacular. The coin has continued to make headlines be it for crossing vital value thresholds or hitting milestones in exchange-traded funds (ETFs) inflows.

This week, BTC surged previous the vital $68,000 mark, inching ever nearer to the $70,000 valuation.

Nevertheless, at press time the worth had dipped to $67,442. Whereas this marked a 2.25% drop over the previous day, the month-to-month positive factors remained sturdy at 6.86%.

Now, the king coin stays round 3.65% away from reaching $70,000, and with the document inflows in Bitcoin ETFs, attaining this goal wouldn’t be too far-fetched.

In accordance with data from SoSo Worth, on twenty first of October, the entire internet inflows stood at $294.29 million, contributing to a cumulative complete influx of $21.23 billion.

Furthermore, the entire internet belongings stood at $65.34 billion, representing 4.88% of the cryptocurrency’s complete market capitalization.

BlackRock’s IBIT dominates the Bitcoin ETF market

Value noting {that a} main contributor to those inflows was BlackRock’s iShares Bitcoin Belief (IBIT). Regardless of the worth dip, IBIT recorded inflows of $329 million on twenty first October.

Furthermore, it outperformed all spot Bitcoin ETF merchandise, surpassing $23 billion in complete internet inflows.

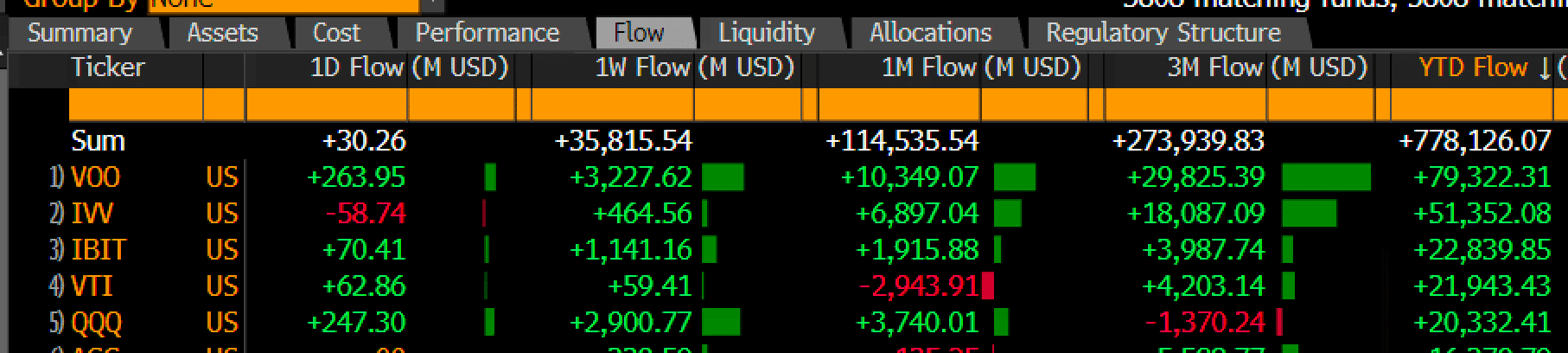

Eric Balchunas, senior ETF analyst at Bloomberg, noted on X that IBIT had an distinctive week. The ETF attracted $1.1 billion in new money. Moreover, it surpassed Vanguard’s VTI for third place in YTD flows.

As per the analyst, what made this achievement much more outstanding was that IBIT is a comparatively new launch, competing with ETFs which have been established for over 20 years and handle tons of of billions of {dollars}.

BlackRock’s IBIT now boasts $26 billion in AUM, putting it within the high 2% of all ETFs globally.

Bitcoin ETFs vs gold ETFs

These outstanding inflows elevate questions on whether or not Bitcoin ETFs are pulling traders away from conventional safe-haven belongings.

Balchunas weighed in on this competitors between Bitcoin and gold. In an interview with Bloomberg Surveillance, he remarked,

“Bitcoin and the ETFs that launched could have stolen the thunder that will have in any other case gone to gold this yr.”

The analyst estimated that gold may have seen inflows of as much as $10 billion, with out the emergence of Bitcoin ETFs.

A lot of this shift, he recommended, is a results of Bitcoin’s rising recognition and its growing function as a competitor to gold within the asset market.

Establishments stack as retail curiosity fades

BTC ETFs’ market place is a testomony to rising institutional curiosity. In the meantime, retail engagement has slowed. In accordance with current information from Google Tendencies, searches for “Bitcoin” and “Bitcoin ETF” have seen a marked decline.

Curiosity in “Bitcoin ETF” has remained subdued for the reason that launch of spot ETFs in January 2024, with a score of simply 2 final week.

Learn Bitcoin’s [BTC] Price Prediction 2024 – 2025

Equally, searches for “Bitcoin” have dropped considerably from March, with a rating of 33 final week. This stark distinction highlighted the shift in market dynamics.