The worth of Bitcoin (BTC) has not been significantly spectacular over the weekend, which has been a considerably constant theme of the cryptocurrency market to this point within the 12 months 2025. The premier cryptocurrency continues to hover across the $108,000 mark, exhibiting indicators of indecision amongst the traders.

With the coin’s indecisive worth motion, the dialog has been about when the Bitcoin worth will return to its all-time excessive. Apparently, the newest on-chain information exhibits that traders have gotten more and more assured within the long-term promise of the flagship cryptocurrency.

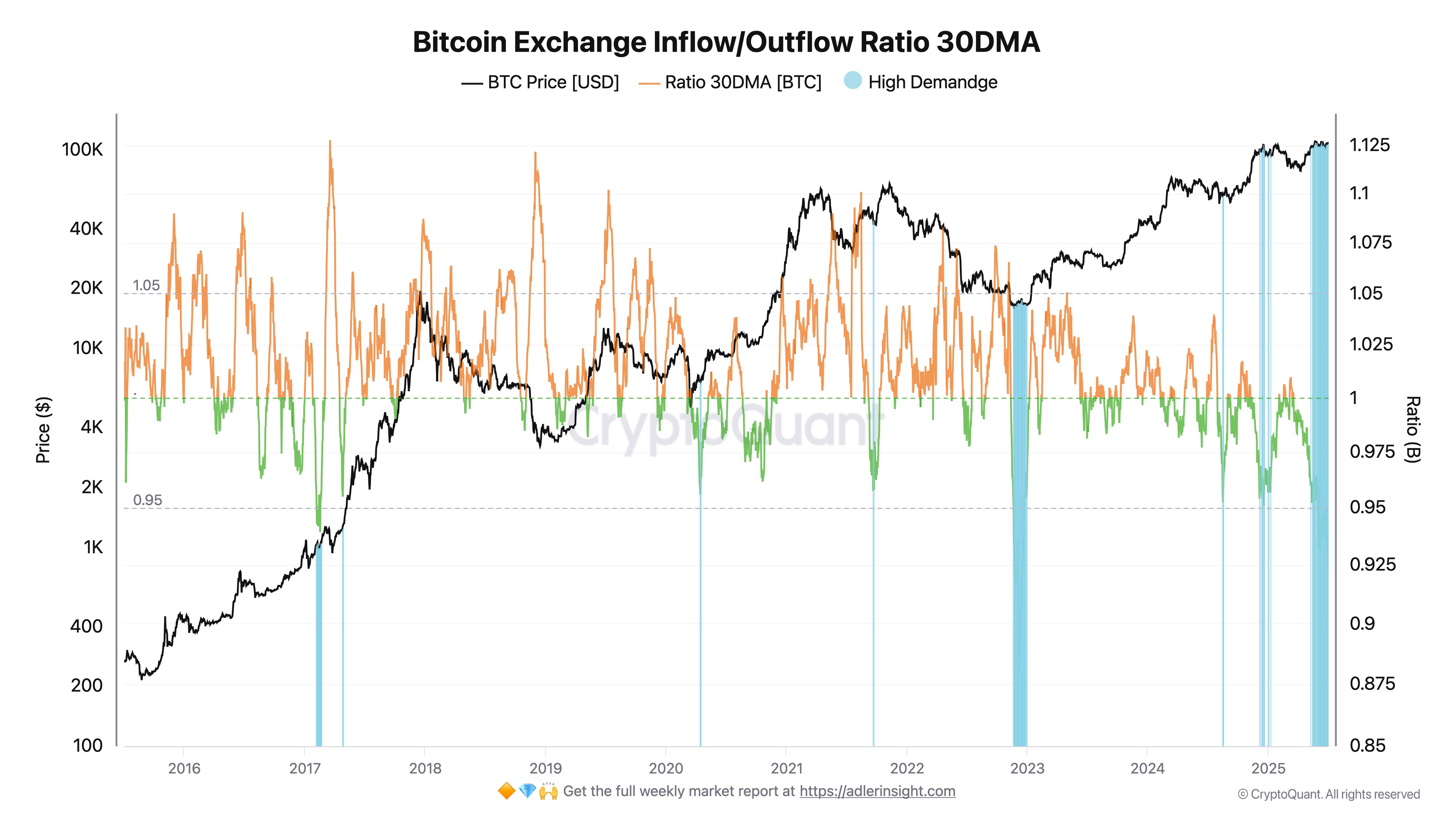

Bitcoin Trade Influx/Outflow Ratio Under 1: On-Chain Analyst

In a July 5 submit on the X platform, an on-chain analyst with the pseudonym Darkfost revealed that Bitcoin has continued to movement out of centralized exchanges over the previous few months. The net crypto pundit talked about that this pattern displays the rising confidence of traders in the long run.

This on-chain remark is predicated on the Bitcoin Trade Influx/Outflow Ratio 30DMA, a metric that measures the quantity of BTC flowing out and in of centralized exchanges over a interval of 30 days. A excessive ratio (>1) signifies extra inflows than outflows into exchanges, signaling elevated promoting strain for the premier cryptocurrency.

However, a low ratio (<1) implies that extra cash are flowing out of relatively than into centralized exchanges. When the Trade Influx/Outflow Ratio has a low worth, it means that traders are accumulating and holding their cash in the long run.

In keeping with Darkfost, the Bitcoin month-to-month outflow/influx ratio just lately fell to round 0.9, its lowest degree for the reason that bear market of 2023. With the metric now beneath the 1 threshold, it implies that Bitcoin trade outflows are dominant, reflecting a strong and sustained demand on the spot market.

The on-chain analyst mentioned:

As of right now, demand stays current as outflows proceed to dominate, with a rising variety of long-term holders stepping in.

Finally, Darkfost believes that the boldness being proven in Bitcoin’s long-term promise is predicted, contemplating the rising adoption by main firms and governments, most notably in the USA. “BTC is steadily evolving right into a retailer of worth, more and more used to strengthen treasury methods,” the crypto analyst added.

Bitcoin Worth At A Look

As of this writing, the worth of BTC stands at round $108,103, reflecting a mere 0.3% enhance prior to now 24 hours.