Public corporations are altering how they handle their money. They aren’t simply parking cash in banks anymore. Experiences have disclosed that greater than $100 billion is now held by corporations that deal with Bitcoin as a part of their principal reserves. This transfer has drawn huge names into the combo and caught the attention of traders in all places.

Digital Asset Treasury Firms Take Root

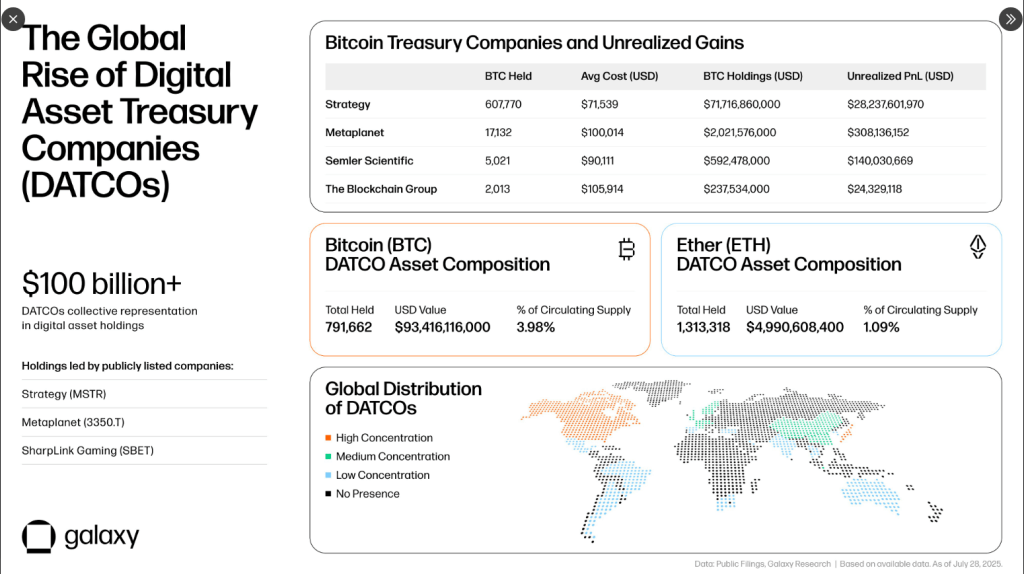

In line with Galaxy Analysis’s newest report, a brand new group of companies—known as Digital Asset Treasury Firms or DATCOs—holds practically 792,000 BTC (about $93 billion) and 1.31 million ETH (about $4 billion).

These figures add as much as practically 4% of all Bitcoin and 1.1% of Ethereum’s complete provide. These corporations combine digital cash with money and possibly gold, staking some ETH to earn extra on belongings they hold idle.

The Rise of Digital Asset Treasury Firms

A brand new wave of public corporations is utilizing crypto as a capital technique.

$100B+ in BTC, ETH, & extra

Right here’s what you’ll want to know 🧵 pic.twitter.com/3z2rQB4a43

— Galaxy Analysis (@glxyresearch) July 31, 2025

Company Playbooks Shift

Many DATCOs aren’t simply shopping for and holding. They use at-the-market fairness choices when their inventory value trades above web asset worth. That lets them flip additional share worth into contemporary crypto buys.

Some lower offers by personal placements or SPAC mergers to drag in funds quick. They report huge unrealized good points when markets rally.

A couple of now sit on billion-dollar paper income. And newer entrants, like gaming or tech companies, add Layer-1 tokens to spice up yield relatively than chase solely value good points.

Whereas most of those corporations are within the US due to deep capital markets entry, the development is spreading. Firms listed overseas now copy the mannequin. Their strikes enhance crypto liquidity and tie inventory efficiency extra carefully to token costs.

However this shift has a darkish facet. If fairness premiums collapse or regulators step in, panic promoting might observe. Some DATCOs commerce at as a lot as 10× the worth of their on-book crypto. That hole hints at a bubble.

Investor Watchpoints

Reports have disclosed that about 160 public companies collectively management near 1 million BTC. Greater than 35 of these companies every maintain over $120 million in digital belongings.

Traders ought to monitor how a lot actual publicity corporations carry, not simply what’s on the books. Huge swings in token costs might hit inventory values onerous.

World markets can be watching if this mannequin retains rising. Some corporations could add stablecoins or different tokens. Others might face more durable accounting guidelines and requires clearer disclosures.

US regulators and abroad authorities will ask questions quickly. When that occurs, the stress might pressure corporations to rethink giant crypto bets.

Featured picture from Unsplash, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.