- Bitcoin confronted challenges from the macroeconomic conditions growing within the U.S.

- The on-chain clues confirmed that long-term traders can stay assured of additional features.

Bitcoin [BTC] was buying and selling just 3% under its all-time excessive, however has proven indicators of fatigue lately. The Asian market rally on the ninth of June helped the crypto market, however a dip in Open Curiosity signaled that caution was warranted.

Information of rising core CPI inflation and the 0% likelihood of the Fed introducing a price lower subsequent week soured the bullish sentiment. However, the bullish conviction of long-term traders appeared wholesome primarily based on on-chain metrics.

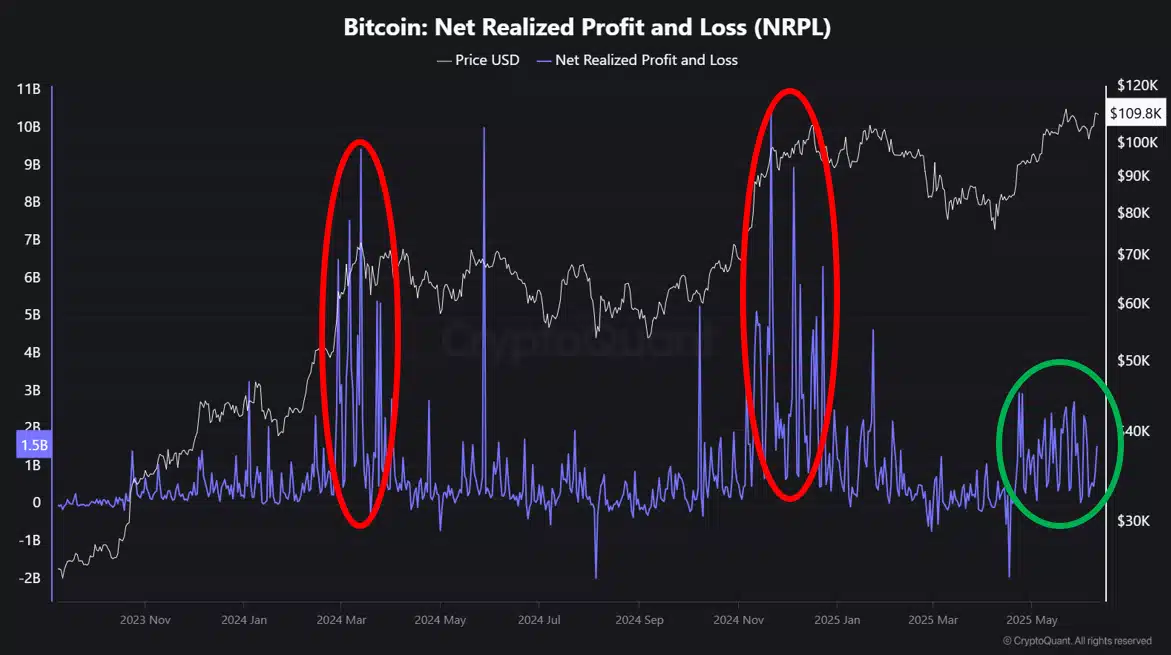

In a publish on CryptoQuant Insights, consumer Crypto Dan identified that Internet Realized Revenue and Loss have been much tamer than ranges seen in November-December 2024.

Revenue-taking was current however noticeably lowered, reflecting whale expectations of upper Bitcoin costs.

The analyst concluded that it was extremely seemingly that we might see new all-time highs this cycle.

Accumulation again underway for Bitcoin?

Supply: Santiment

Even a few years in the past, the concept of Bitcoin experiencing an accumulation part across the $110,000 mark would have been absurd, a minimum of to non-crypto fanatics.

Nonetheless, the value motion and growing institutional adoption would vindicate long-term bulls, besides BTC purists.

The 365-day Imply Coin Age has been trending greater all through 2025. The early June value dip to $105k left a large dent on the metric. This, alongside the large spike within the age consumed, steered a wave of BTC motion on-chain.

This may seemingly have been for promoting functions. Nonetheless, over the previous ten days, the MCA has begun to pattern greater, whilst the value marched towards its ATH as soon as extra.

This signaled network-wide accumulation. The 7 DMA of the age consumed confirmed that the ultimate week of Could noticed sustained token motion that rivaled the November-December 2024 ranges.

Following the huge spike on the 2nd of June, the age consumed metric has been comparatively quiet.

Subsequently, it was affordable for Bitcoin to proceed to pattern greater. Euphoria and market-wide profit-taking that typically mark cycle tops weren’t right here but.