- Bitcoin whales amassed giant quantities of BTC over the previous few days.

- Holder profitability grew, and miner income declined.

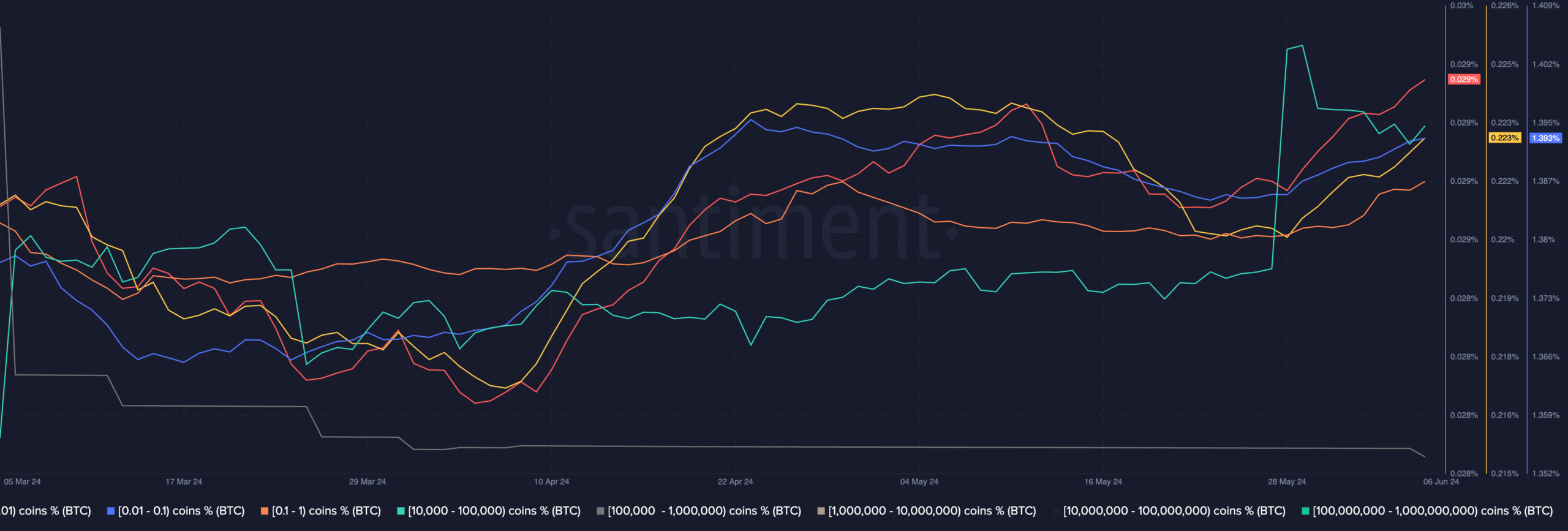

Bitcoin [BTC] witnessed a large surge in whale accumulation over the previous few days. Regardless of the value being extraordinarily near its latest all-time excessive, many whales haven’t misplaced conviction within the king coin.

Bitcoin: Large gamers make investments

The rising urge for food of whales indicated that there was a excessive expectation that BTC will surpass present worth ranges.

The story remained the identical for retail traders as effectively. Over the previous few days, the curiosity from retail traders for BTC had grown materially.

Addresses holding wherever between 0.01 to 1 BTC had grown considerably. The push from each whale traders and retail traders might help BTC break previous beforehand claimed ranges.

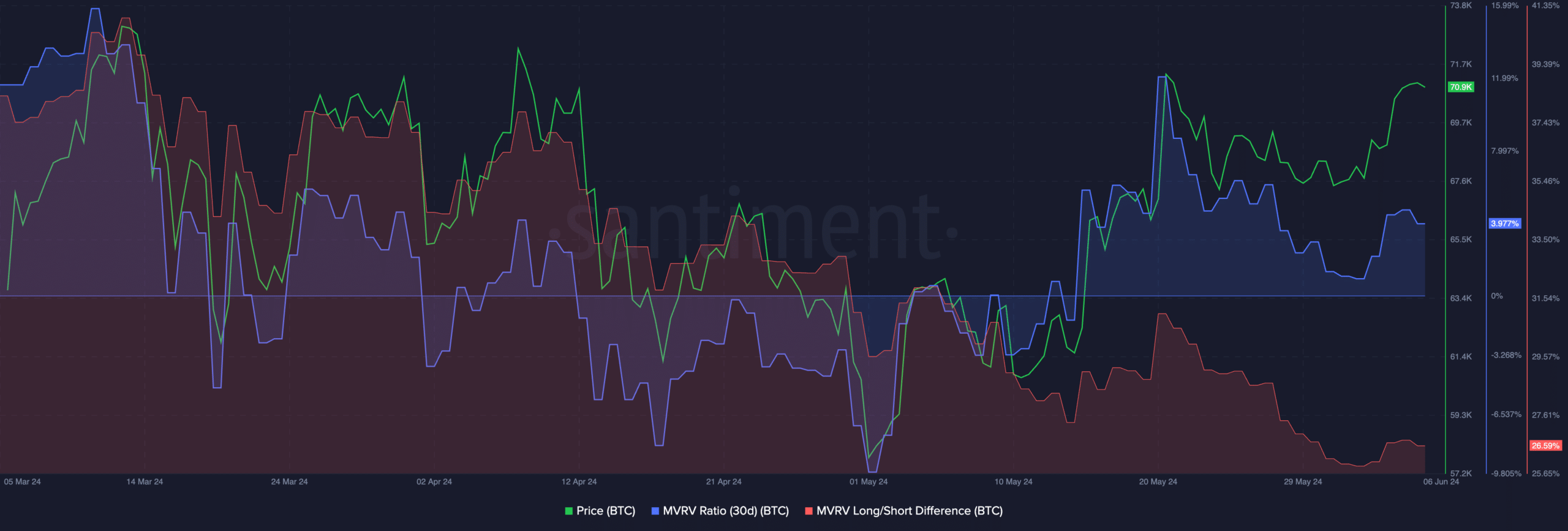

Nevertheless, as BTC’s worth rises, so does the MVRV ratio. AMBCrypto’s evaluation of Santiment’s knowledge revealed that the MVRV ratio for BTC holders had grown considerably.

This indicated that almost all holders have been worthwhile on the time of writing. Because of this, the inducement for these holders to promote additionally grows, which may add promoting stress on Bitcoin.

Coupled with that, the Lengthy/Quick distinction for Bitcoin had declined.

This meant that the variety of new addresses holding BTC had grown, and the proportion of long-term holders who’ve held BTC for big durations of time had declined.

Quick-term holders usually tend to promote their holdings amidst worth fluctuations and uncertainty.

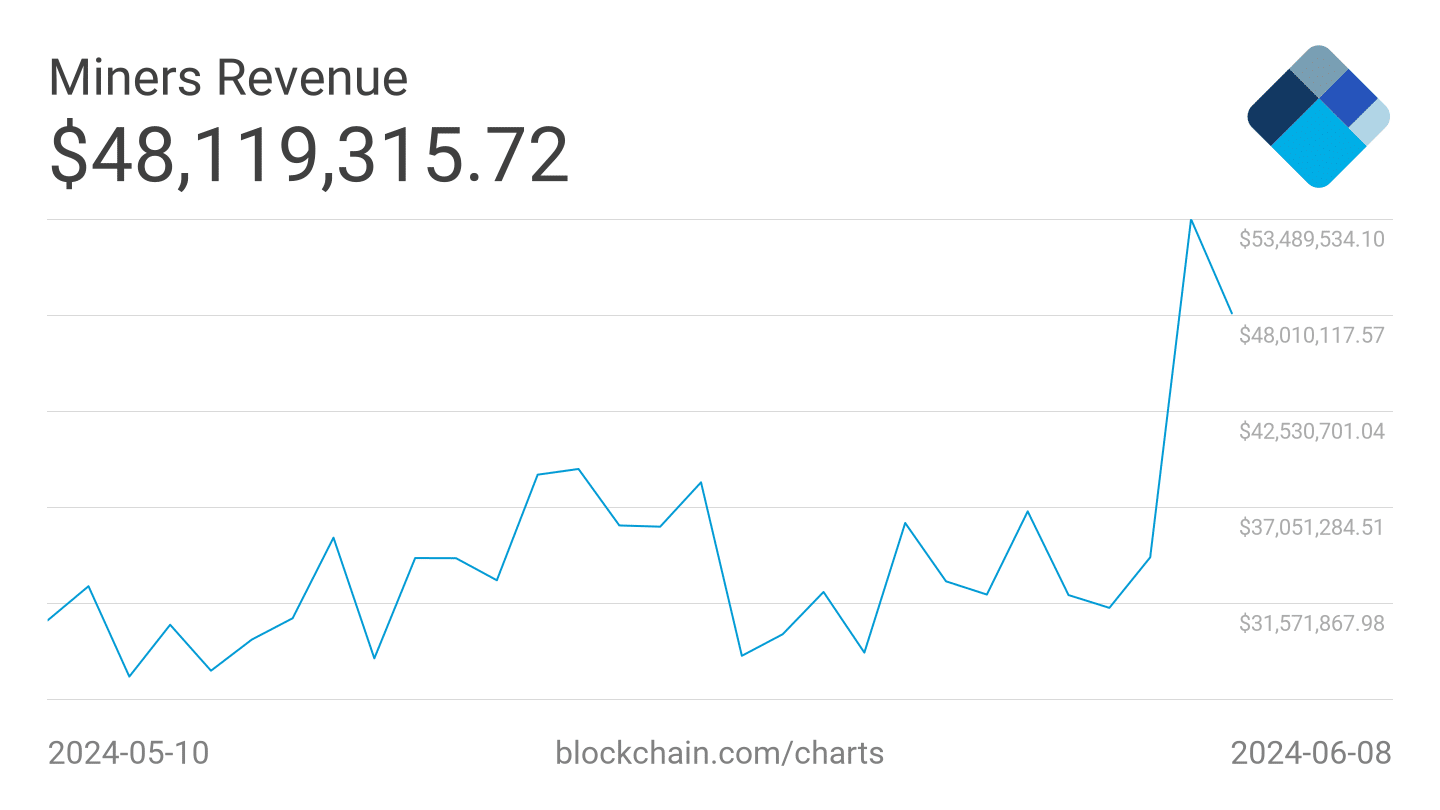

Miner income declines

One other issue that might affect the state of BTC can be how the miners are doing. Throughout the previous few days, the income collected by miners had fallen from $53.48 million to $48 million.

If this pattern continues, miners must promote their holdings to stay worthwhile. This might additional add promoting stress on BTC and drive costs down additional.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

What might assist ease off the promoting stress round BTC can be the curiosity in BTC ETFs. For the reason that thirty first of Might, ETF inflows have been extraordinarily constructive.

If curiosity in BTC continues to rise at this charge and extra institutional traders proceed to purchase BTC, there could possibly be extra upward worth motion sooner or later.