A sudden transfer by a big holder and deep-pocketed early house owners are being linked to a pointy wobble in Bitcoin costs this week.

Associated Studying

Previous Whales Maintain Deep Revenue

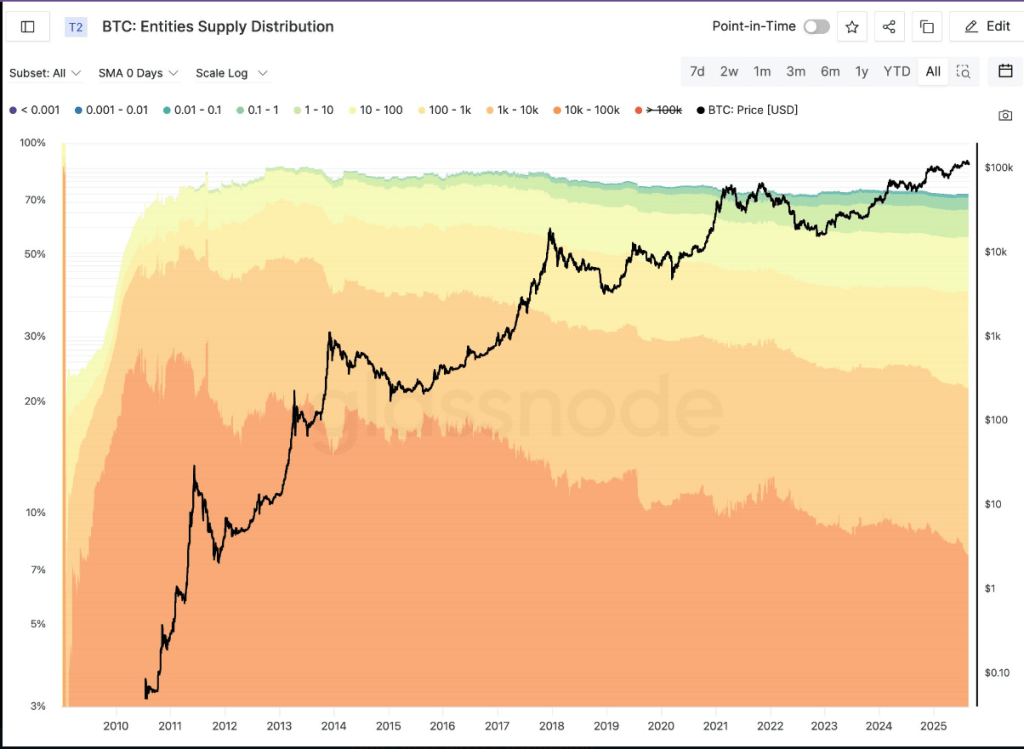

In line with Willy Woo, provide is tightly held by OG (“original gangster”) whales who constructed large positions round 2011 when Bitcoin traded at about $10.

He warned that the hole in value foundation makes a distinction: it now takes roughly $110,000 of recent capital to soak up every Bitcoin these holders select to promote.

That math, he says, helps clarify why worth motion has been sluggish at the same time as general market curiosity grows.

In line with market observers, a single whale’s rotation from Bitcoin into Ether helped set off a fast sell-off that briefly knocked roughly $45 billion off Bitcoin’s market cap.

Why is BTC shifting up so slowly this cycle?

BTC provide is concentrated round OG whales who peaked their holdings in 2011 (orange and darkish orange).

They purchased their BTC at $10 or decrease. It takes $110k+ of recent capital to soak up every BTC they promote. pic.twitter.com/7CbWXsvX2l

— Willy Woo (@woonomic) August 24, 2025

Flash Crash Unfolded Rapidly

Based mostly on studies, Bitcoin slid from $114,500to $112,980 in 9 minutes, briefly touching $112,050, CoinMarketCap data exhibits.

Ether fell 3.8% in the identical window, dropping from $4,925 to $4,680. Costs later recovered about half of these losses. Merchants level to a sequence of transfers that set the transfer off.

Whale Rotations And Massive Transfers

Blockchain.com data present that roughly 24,000 BTC — about $2.7 billion on the time — was despatched to the decentralized perpetuals platform Hyperliquid throughout six transfers starting Aug. 16.

Of that sum, 18,142 BTC has been offered and far of the proceeds had been rotated into 416,590 ETH, an analyst referred to as MLM reported. A piece of these ETH — 275,500 — was staked, value about $1.3 billion.

Strategic Positioning And Massive Positive aspects

It was additionally reported that the whale took on massive leveraged positions, longing 135,260 ETH on Hyperliquid for a complete publicity close to 551,861 ETH, valued at greater than $2.6 billion.

That arrange a commerce that netted round $185 million, based on the identical analyst. The longs boosted ETH prices as different merchants adopted the flows, and when the whale started closing positions, fast reversals led to cascading promote orders.

Associated Studying

Forces At Work

Stories have disclosed the whale nonetheless controls 152,874 BTC throughout a number of addresses, and people funds initially moved off an trade about six years in the past.

Market watchers say there are two forces at work: long-dormant holders sitting on large unrealized positive aspects, and lively merchants utilizing massive rotations to seize short-term strikes.

If extra of the 152,874 BTC strikes to market, sellers might take a look at demand once more. Then again, the quantity of ETH being staked factors to not less than some longer-term intent from large gamers.

Featured picture from Meta, chart from TradingView