- Bitcoin just lately reached a brand new all-time excessive of $93,477, however is now stabilizing above $90,000.

- Analysts consider metrics like MVRV and change outflows to gauge potential continuation or cooling of BTC’s rally.

After every week of hitting a number of new all-time highs, Bitcoin [BTC] seems to have taken a breather, with its value momentum exhibiting indicators of cooling. The main cryptocurrency just lately reached a document excessive of $93,477 on thirteenth November.

Since then, it has skilled a modest pullback of two.8% and has stabilized above the $90,000 mark. As of now, Bitcoin is buying and selling at $90,959, marking a slight 0.6% improve over the previous 24 hours.

Is there nonetheless room for upward momentum?

Amid this shift in Bitcoin’s value motion, market analysts are carefully analyzing whether or not there may be nonetheless potential for additional good points.

Yonsei Dent, a CryptoQuant analyst, provided his insights on Bitcoin’s present state, specializing in the MVRV ratio—a key on-chain indicator that compares realized worth to market worth, offering a gauge of market overvaluation or undervaluation.

Dent highlighted that in previous market cycles, peaks within the MVRV ratio usually coincided with market tops. As an example, in 2013, 2017, and 2020, Bitcoin’s market cycle peaks aligned with a downtrend line noticed in MVRV.

Dent then famous that whereas the MVRV ratio peaked at 2.78 in March 2024—slightly below the historic downtrend line—it has since recovered to 2.6 within the wake of Bitcoin’s latest rally.

He identified {that a} month-to-month shifting common golden cross over the annual shifting common signifies potential upward momentum.

Though predicting whether or not the MVRV will attain the two.9–3.0 vary stays unsure, it means that Bitcoin should still have some room for additional value will increase.

Key metrics indicating Bitcoin’s subsequent strikes

Along with the MVRV ratio evaluation, it’s essential to discover different main Bitcoin metrics to gauge the asset’s outlook.

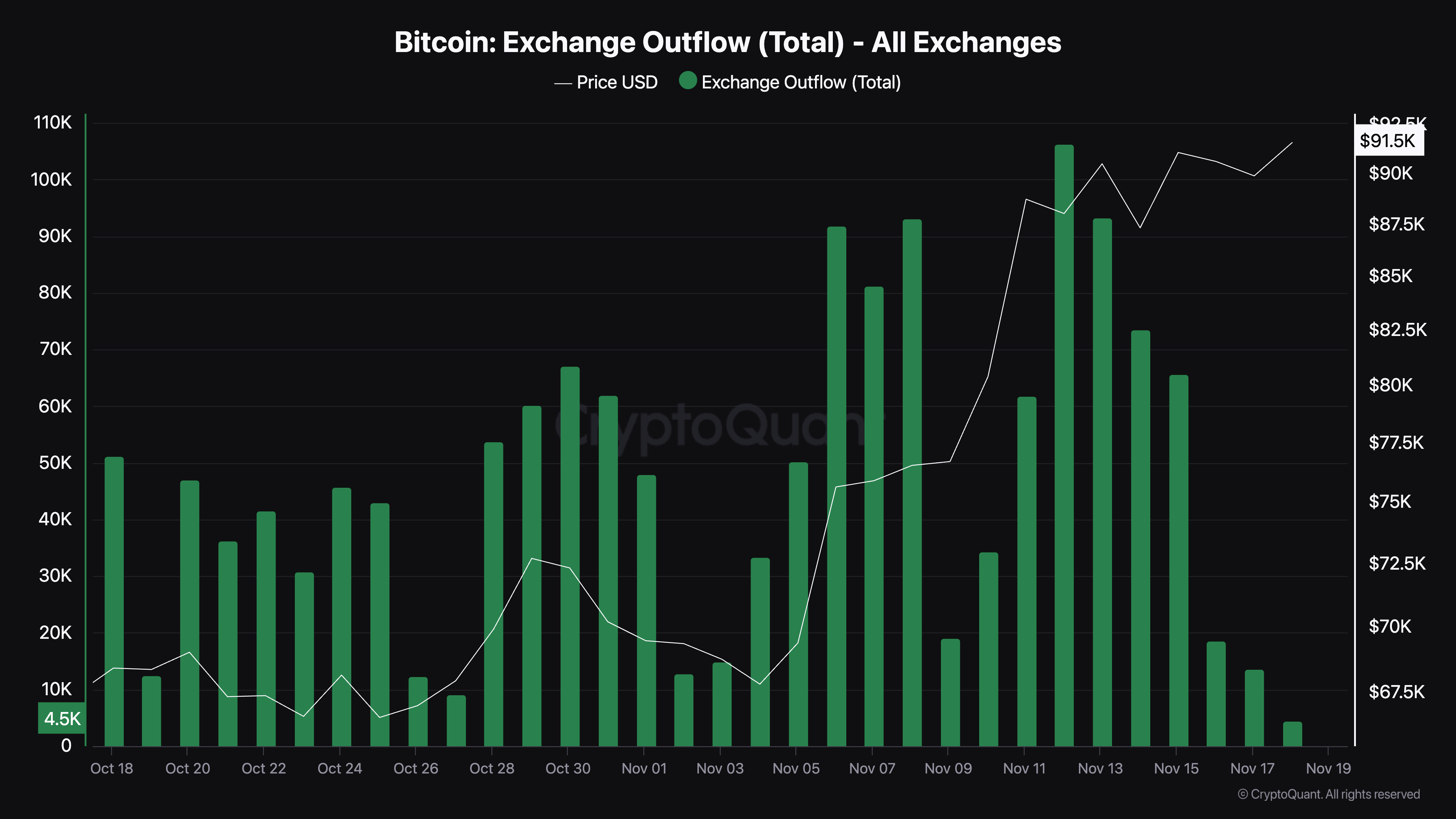

Based on data from CryptoQuant, Bitcoin’s change outflows have persistently risen alongside its value over the previous week. Nonetheless, this development seems to be slowing down initially of the brand new week.

Particularly, on Sunday, seventeenth November, complete BTC outflows from exchanges amounted to roughly 13,617 BTC—a notable drop from over 30,000 BTC recorded the earlier Sunday.

This decline in outflows might point out a shift in investor sentiment, suggesting that market individuals could also be pausing their accumulation or holding off from withdrawing property from exchanges.

Such a growth might replicate warning amongst buyers and sign a interval of consolidation or lowered demand stress.

One other metric price analyzing is Bitcoin’s open curiosity, as reported by Coinglass. Bitcoin’s open curiosity has elevated by 2.76%, reaching a present valuation of $56.22 billion.

This rise aligns with a rise in Bitcoin’s open curiosity quantity, which has surged by 16.42% to $61.83 billion. An uptick in open curiosity signifies rising participation available in the market, usually reflecting heightened buying and selling exercise and investor curiosity.

Learn Bitcoin (BTC) Price Prediction 2024-25

Nonetheless, a rise in open curiosity, significantly within the futures market, can even introduce potential volatility.

As extra merchants interact in spinoff positions, the market might expertise sharp value actions in response to important developments or shifts in sentiment.