- Whales have withdrawn 110,000 BTC in 30 days, signaling aggressive accumulation and doable upside momentum.

- Merchants are closely positioned at key ranges, with $496M in longs close to $102.8K and $319M in shorts at $104.8K.

Bitcoin [BTC], the world’s largest cryptocurrency, has shifted the general cryptocurrency market with its spectacular restoration over the previous few days.

The surge appeared largely pushed by whale exercise, which has ramped up throughout each spot and by-product markets.

Whales withdrew 110,000 BTC, time to purchase?

For the reason that day Bitcoin started bleeding, whales and trade giants have seized the chance to purchase the dip.

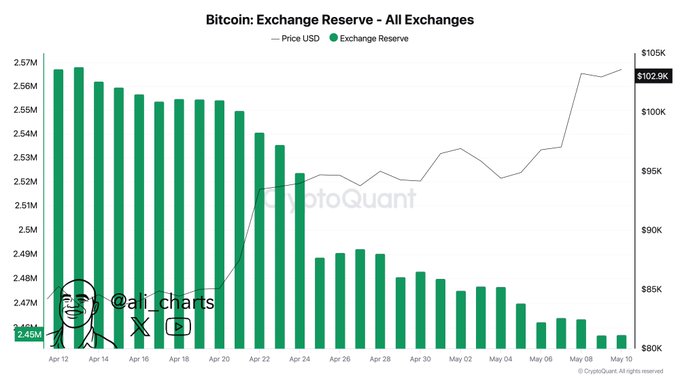

Lately, a outstanding crypto expert shared information on Bitcoin trade reserves over the previous 30 days, revealing that whales have withdrawn over 110,000 BTC throughout this era.

This substantial withdrawal of BTC signifies potential accumulation and will create shopping for stress, resulting in an additional upside rally, which explains Bitcoin’s latest surge.

In the meantime, whales haven’t stopped but, they’ve been constantly accumulating BTC.

In simply 48 hours, whales added one other 20,000 BTC to their wallets.

This steady accumulation of BTC displays the whales’ curiosity and confidence within the asset for the long run.

Retailers least participation

Then again, retail traders have been largely absent throughout this era and have been seen offloading their holdings because of panic.

In keeping with on-chain analysts, retail sometimes returns close to market tops, not throughout recoveries or corrections.

Regardless of BTC buying and selling simply 5% under its earlier peak, retail participation stayed muted, probably limiting frothy hypothesis—for now.

$500 million price of bullish bets

Apart from all this, merchants seem like aligning with the present market sentiment, as revealed by the on-chain analytics device Coinglass.

Knowledge exhibits that merchants are presently overleveraged on the $102,819 stage on the decrease aspect (assist) and $104,871 on the higher aspect (resistance).

At these ranges, merchants have constructed $496.55 million price of lengthy positions and $319.26 million price of quick positions.

This metric signifies that bulls are presently dominating the market, hoping that the BTC worth gained’t fall under the $102,819 assist stage anytime quickly.

At press time, BTC traded round $104,300—up 0.75% in 24 hours. Nevertheless, buying and selling quantity dipped 7%, hinting at decrease engagement.

Bitcoin worth motion & technical evaluation

In keeping with AMBCrypto’s technical evaluation, BTC seems bullish and is poised for a brand new excessive. The each day chart reveals that the asset is heading towards the important thing resistance stage of $106,800.

If this upward momentum continues and the value breaks by this resistance, there’s a sturdy chance that BTC may expertise a notable surge and doubtlessly attain a brand new all-time excessive.

BTC’s Relative Energy Index (RSI) stood at 74, indicating that the asset is in overbought territory.

There’s a sturdy chance that it may expertise a worth correction till the RSI strikes out of the overbought zone.