- Constructive funding charges have continued regardless of consolidation, with charges hitting 0.075% in January 2025

- MA cross between 50-day (98,870.83) and 200-day (76,229.51) averages bolstered the bullish construction

Bitcoin’s [BTC] current worth motion round $104,000 positive factors deeper context when analyzed alongside perpetual futures funding charges. This, as a result of such an evaluation reveals essential insights into market sentiment and potential directional strikes.

Bitcoin’s technical panorama and worth motion

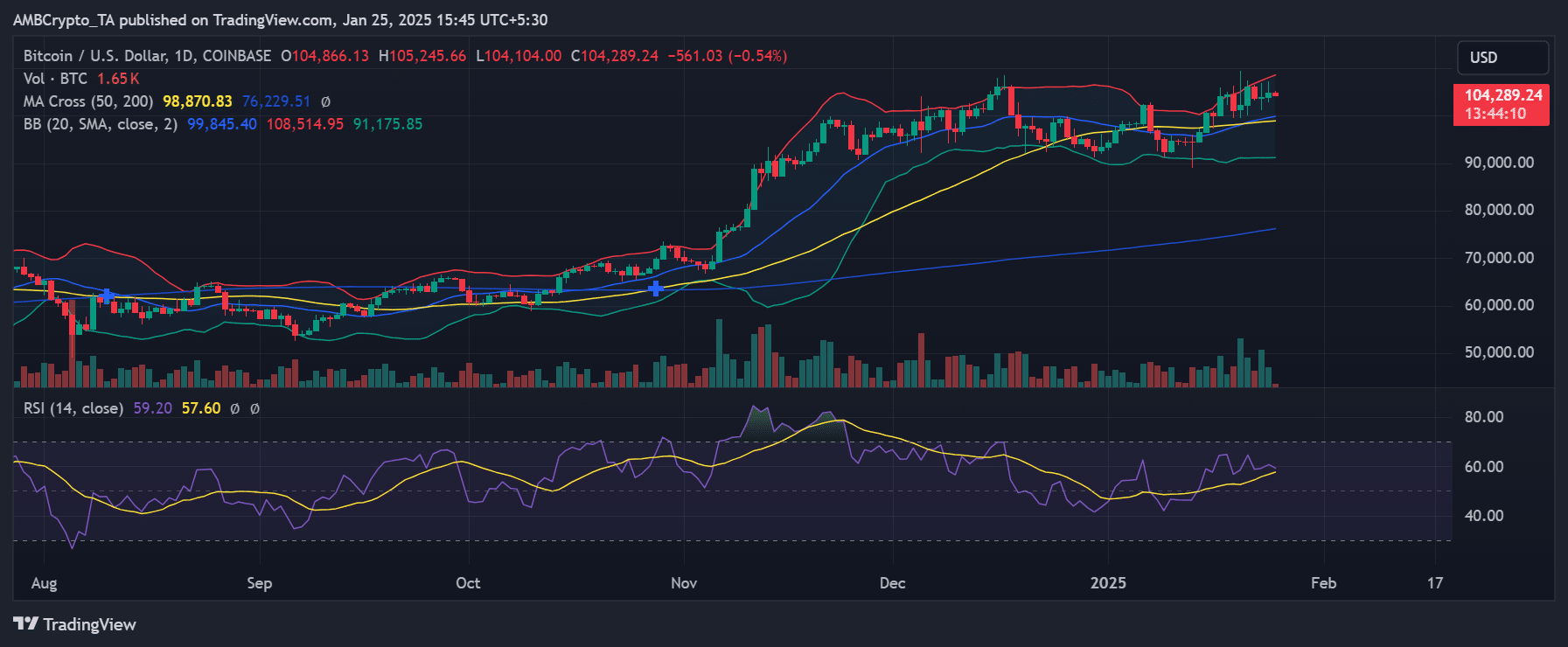

The every day chart recommended that Bitcoin has been consolidating close to $104,289, with a slight decline of 0.54% at press time. The MA cross between the 50-day (98,870.83) and 200-day (76,229.51) transferring averages maintained a bullish construction for the cryptocurrency.

All whereas the Bollinger Bands (91,175.85 – 108,514.95) hinted at contained volatility, regardless of the market’s current actions.

The RSI’s studying of 59.20 alluded to average bullish momentum, with out climbing to overbought territory. This appeared to suggest that there’s nonetheless room for upward motion on the charts.

Buying and selling volumes of 1.65k BTC additional demonstrated sustained market participation, although not at peak ranges.

Funding charge evaluation and implications

The perpetual futures funding rate chart revealed important patterns since Might 2024, with January 2025 exhibiting a notable uptick in funding charges throughout main exchanges. Charges have climbed to 0.075% on some platforms, signaling strengthening bullish sentiment amongst Futures merchants.

This growth gained explicit significance when seen in opposition to the backdrop of historic funding charge actions since October 2024. The development confirmed that the transferring common has maintained a predominantly optimistic trajectory, one coinciding with Bitcoin’s worth appreciation.

Inspecting exchange-specific patterns revealed some very attention-grabbing dynamics, significantly in the course of the unstable durations of November and December 2024. Throughout these months, important divergences emerged between main exchanges, with BitMEX and OKX noting pronounced spikes that hinted at intense leveraged buying and selling exercise.

These non permanent disconnects between exchanges supplied beneficial insights into market participant conduct in periods of heightened exercise.

Market implications for Bitcoin and buying and selling dynamics

The correlation between funding charges and worth motion presents a complete view of market sentiment. The prevailing setting, characterised by sustained optimistic funding regardless of worth consolidation, appeared to trace at a complicated accumulation section – One the place merchants preserve lengthy positions no matter short-term worth stagnation. Such a divergence between regular costs and optimistic funding highlighted the constructing strain for a possible directional transfer, supported by the technical indicators.

Nevertheless, a sustained optimistic funding charge setting additionally presents some inherent dangers. The numerous presence of leveraged positions, highlighted by elevated funding charges, fuels vulnerability to potential lengthy squeezes if the value fails to interrupt increased.

This dynamic requires cautious monitoring of Bitcoin’s key help ranges, significantly across the 50-day transferring common at $98,870.

– Learn Bitcoin (BTC) Price Prediction 2025-26

The mixture of technical indicators and funding charge patterns means it is a important juncture for Bitcoin, one that would see the crypto register some upside.

This outlook stays legitimate so long as the market construction maintains integrity above its essential help ranges, with explicit consideration to quantity patterns and funding charge trajectories throughout main exchanges.