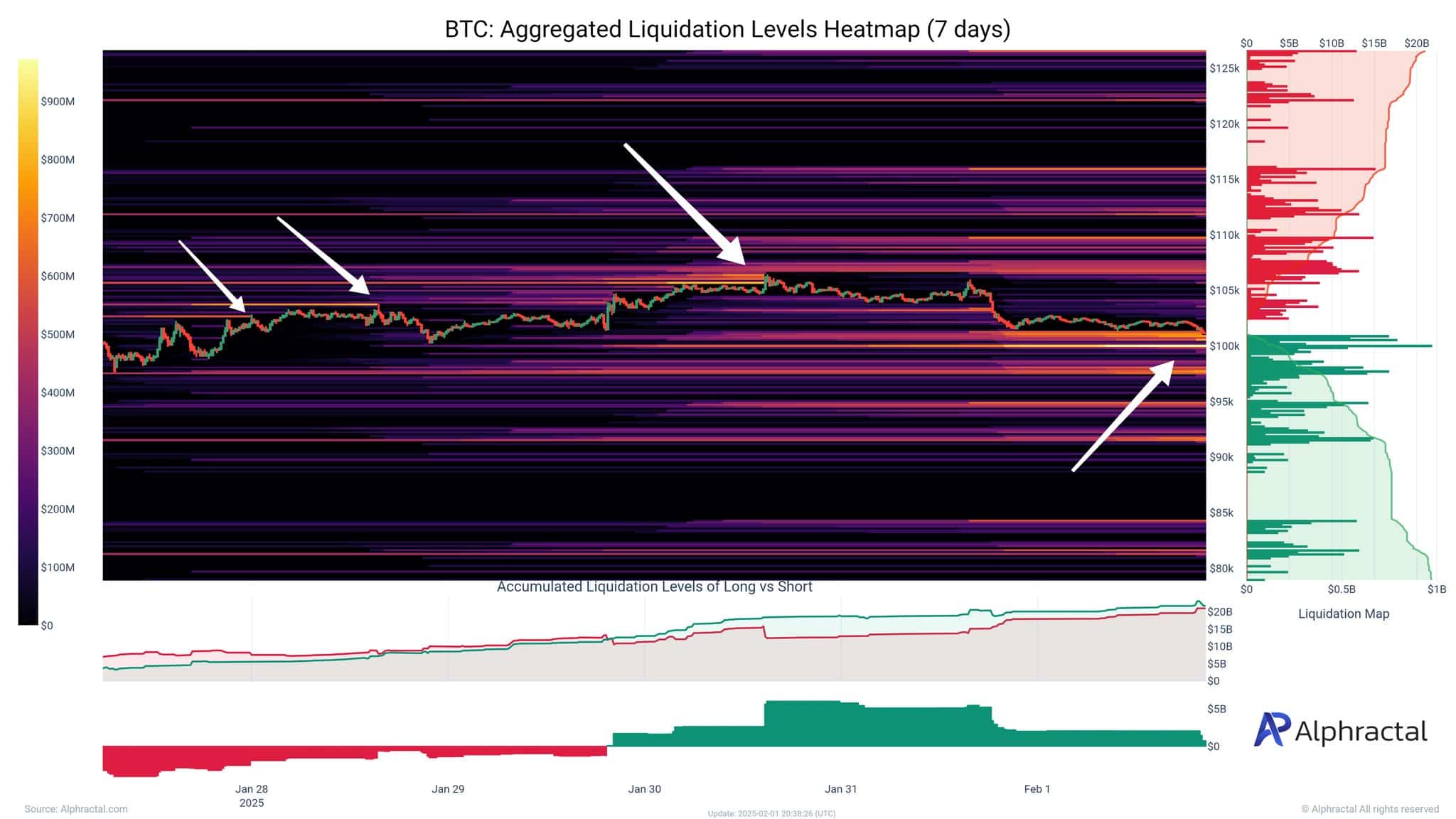

- The market has witnessed intense liquidation exercise, with the best focus occurring between $101,500 and $99,800.

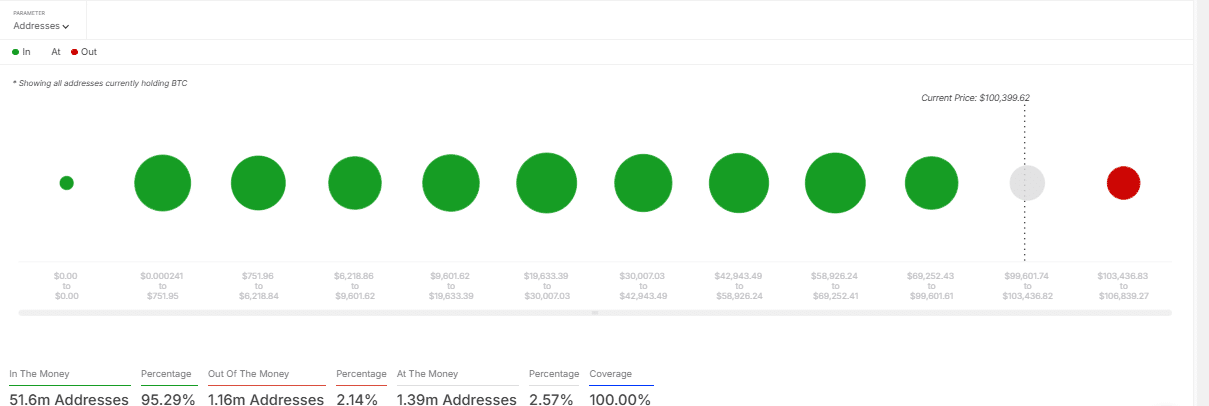

- Bitcoin’s present distribution of holders offers insights into potential market tendencies.

Bitcoin’s [BTC] current value fluctuations have captured the eye of merchants as volatility intensifies, resulting in a surge in liquidations.

As market members navigate these speedy value adjustments, a number of crucial elements form Bitcoin’s trajectory.

Bitcoin’s value efficiency and key ranges

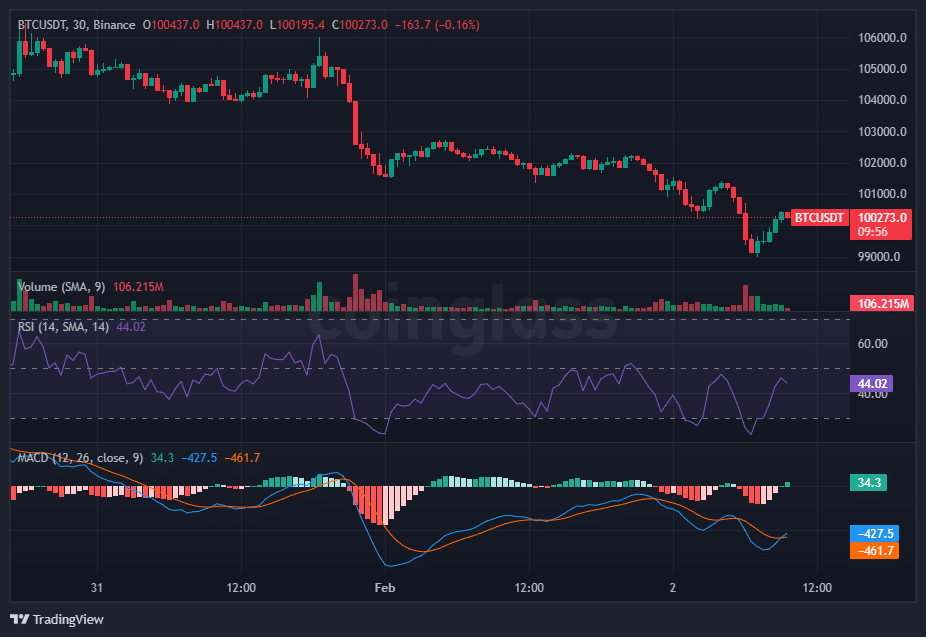

AMBCrypto’s take a look at BTC’s value confirmed a current downtrend adopted by a small restoration. The value has dropped considerably, however was making an attempt a bounce from the $99,000 stage, buying and selling at $100,273 at press time.

Additionally, the RSI was at 44.02, indicating impartial momentum however approaching oversold ranges.

The MACD histogram, then again, was turning much less destructive, suggesting a possible bullish crossover, however the sign line remained under the zero line, that means that the downtrend had not totally reversed but.

Quantity has spiked through the sell-off however stays comparatively decrease on the bounce. Total, whereas there’s a slight restoration, the pattern remains to be bearish

Dealer sentiment and market reactions

The market has witnessed intense liquidation exercise, with the best focus occurring between $101,500 and $99,800.

This zone represents the utmost ache level, the place each lengthy and brief positions have been liquidated at an accelerated fee.

The speedy unwinding of positions has amplified value instability, forcing merchants to reassess their methods.

As liquidity will get absorbed throughout these liquidation occasions, sudden value swings turn out to be extra frequent, reinforcing the significance of threat administration in such unstable situations.

Investor positioning and market affect

Bitcoin’s present distribution of holders supplied insights into potential market tendencies. At press time, 95.29% of Bitcoin addresses, or 51.6 million, remained in revenue.

In the meantime, 1.16 million addresses have been “out of the cash,” whereas 1.39 million have been “on the cash.”

With most buyers sitting on unrealized positive aspects, market sentiment remained secure, however profit-taking may introduce promoting stress.

Learn Bitcoin’s [BTC] Price Prediction 2025–2026

If a good portion of worthwhile holders resolve to exit their positions, Bitcoin may face extra downward motion, making help ranges much more crucial within the coming periods.

Bitcoin’s value actions stay extremely reactive to market situations, with liquidation patterns, volatility ranges, and investor positioning enjoying a vital function.