Key Notes

- BitMine’s huge $6.6 billion crypto treasury represents a $1.7 billion weekly enhance in digital asset holdings.

- Ethereum faces technical strain at $4,250 assist stage following latest 11% pullback from August peak ranges.

- Institutional backing from ARK, Founders Fund, and Galaxy Digital strengthens BitMine’s place in crypto markets.

BitMine Immersion Applied sciences (BMNR) has consolidated its place because the world’s largest Ethereum

ETH

$4 326

24h volatility:

5.2%

Market cap:

$522.06 B

Vol. 24h:

$34.86 B

treasury after saying crypto holdings of $6.612 billion in an official press launch on August 18. The disclosure marks a major milestone in institutional crypto adoption, positioning BitMine as a significant power within the digital asset panorama.

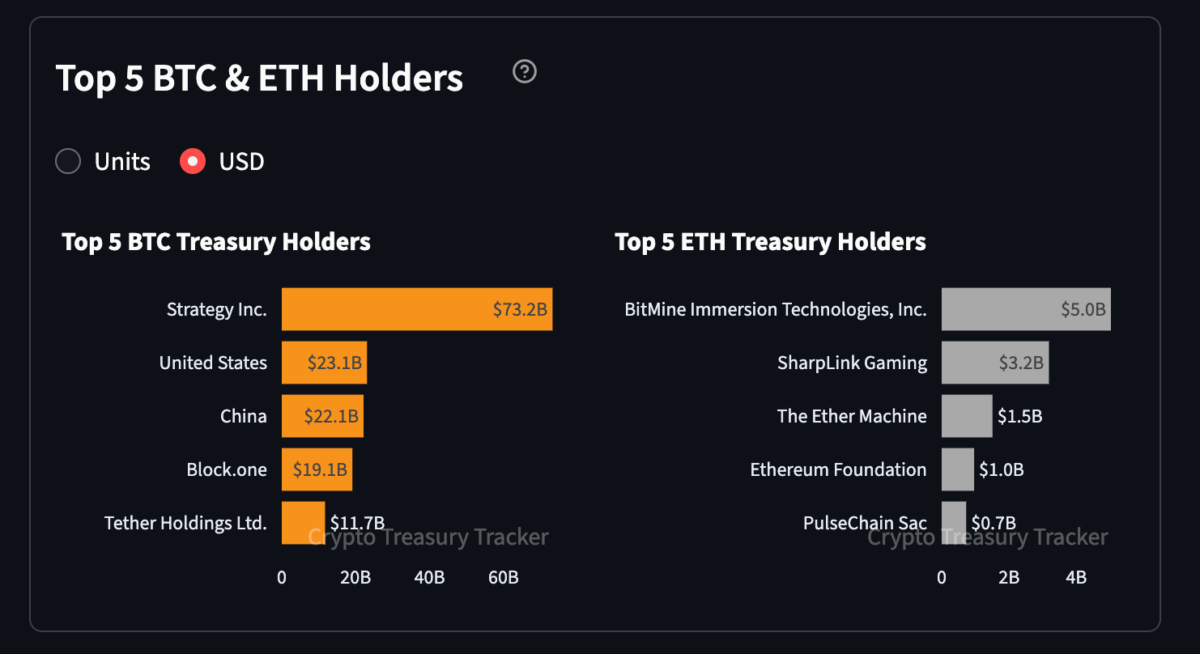

In its announcement, BitMine disclosed holdings of 1.52 million ETH and 192 BTC, representing a $1.7 billion enhance from the earlier week. This huge accumulation locations BitMine because the world’s largest Ethereum treasury and the second-largest international crypto treasury, trailing solely Strategy’s $73 billion Bitcoin

BTC

$114 293

24h volatility:

0.9%

Market cap:

$2.27 T

Vol. 24h:

$41.91 B

holdings at press time, according to Sentora Research dashboards.

Prime 5 Bitcoin and Ethereum Treasury Holders | Supply: Sentora Analysis, August 2025

Buyers obtained the information positively, with BitMine’s (BMNR) inventory surging in buying and selling exercise, averaging $6.4 billion in each day turnover over the past week, making it the tenth most liquid US-listed inventory by greenback quantity.

“As we proceed to say, we’re main crypto treasury friends by each the speed of elevating crypto NAV per share and by the excessive buying and selling liquidity of our inventory,” stated Thomas Lee of Fundstrat, Chairman of BitMine.

Institutional corporations together with ARK’s Cathie Wooden, Founders Fund, Pantera, Galaxy Digital, and Kraken are amongst prime backers of the BitMine inventory, as the corporate targets possession of 5% of Ethereum’s circulating provide.

Ethereum Value Evaluation: ETH Assessments $4,250 Assist

Amid BitMine’s announcement, Ethereum dipped under $4,250 on Monday, August 18, extending its pullback with a 2.18% intraday loss. The decline follows a pointy 42% rally between August 3 and August 14, the place ETH climbed from $3,356 to $4,831.

Since reaching that native peak, purchaser fatigue and market-wide revenue taking has pushed an 11% retracement over 4 days, with ETH buying and selling as little as $4,232 on Monday. Weak weekend momentum carried into US morning buying and selling, inserting Ethereum on track for its fourth purple session within the final 5 days.

Technical indicators presently present combined alerts for the short-term outlook. The ETHUSD 24-hour chart reveals buying and selling momentum stays marginally optimistic, with the MACD line holding above the sign line, whereas narrowing bars point out weak demand. Furthermore, widening Bollinger Bands replicate elevated volatility, with ETH buying and selling close to the higher band however going through resistance at $4,886.

Ethereum Value Forecast

The important thing stage to look at is $4,250, which serves as a vital assist threshold. A break under might ship ETH towards the 20-day easy shifting common at $4,058, whereas a profitable maintain above this stage and subsequent break of $4,886 resistance might propel ETH into worth discovery above $5,000.

Regardless of latest profit-taking, persistent institutional inflows led by BitMine might set off expectations of an imminent rebound because the week unfolds.

Ethereum Rally Boosts Curiosity in Finest Pockets’s $14M Presale

Ethereum’s renewed market exercise this week has additionally pushed consideration towards safe multi-chain wallets resembling Finest Pockets (BEST).

Finest Pockets Presale

The undertaking has already raised over $14 million in its presale, providing buyers low transaction prices, enticing staking rewards, and early entry to decentralized functions.

Finest Pockets’s presale momentum alerts robust demand from Ethereum customers looking for each security and yield. Buyers can nonetheless be part of at discounted tiers by means of the official Best Wallet site earlier than the subsequent worth enhance.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm data by yourself and seek the advice of with an expert earlier than making any selections based mostly on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting numerous Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is presently finding out for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.