- BSC now leads in uncooked block output, clocking 115,200 blocks/day, 8x greater than Ethereum’s projected quantity

- Does this efficiency hole mirror deeper on-chain traction too?

As blockchain use circumstances quickly develop into mainstream finance, Layer-1 chains are tightening their protocols to stake their declare as the subsequent Web3 powerhouse.

In reality, BNB Chain [BSC] isn’t ready round. Whereas Ethereum [ETH] devs debate block time reductions, the Maxwell improve has already slashed BSC’s block time from 1.5s to 0.75s.

This transfer goals to spice up pace, consumer expertise, and throughput throughout the community. However does this daring step give BNB Chain an actual edge over Ethereum?

BNB chain doubles down on pace with Maxwell improve

As AMBCrypto flagged, Ethereum is deliberating a block time discount from 12 seconds to six seconds as a part of the upcoming Glamsterdam improve, anticipated in 2026.

In the meantime, BNB Chain has already taken motion. Its Maxwell upgrade has slashed block time from 1.5 seconds to 0.75 seconds.

Statistically, decrease block time interprets to greater block frequency. With Maxwell in place, BSC now produces roughly 4,800 blocks per hour, or 115,200 per day.

Even when Ethereum implements the 6-second slot time, it will generate solely 14,400 blocks per day. Meaning BSC is on tempo to provide practically 8x extra blocks every day, giving it a big edge in transaction throughput and settlement pace.

Nevertheless, pace alone doesn’t assure community dominance. So, does this architectural divergence translate into measurable beneficial properties in BSC’s on-chain exercise, DeFi liquidity flows, and value momentum?

Can efficiency beneficial properties drive BSC’s ecosystem influence?

On the time of writing, on-chain numbers appeared to recommend that BSC’s pace increase may truly be paying off. It’s seeing 2.04 million energetic addresses, practically 5 instances greater than Ethereum’s 411,000 – A transparent signal of broader consumer exercise.

The DEX quantity backed it up too – $7.38 billion on BSC in simply 24 hours, in comparison with $1.44 billion on Ethereum. That form of liquidity move means BSC’s quicker block instances are serving to gasoline actual utilization throughout DeFi.

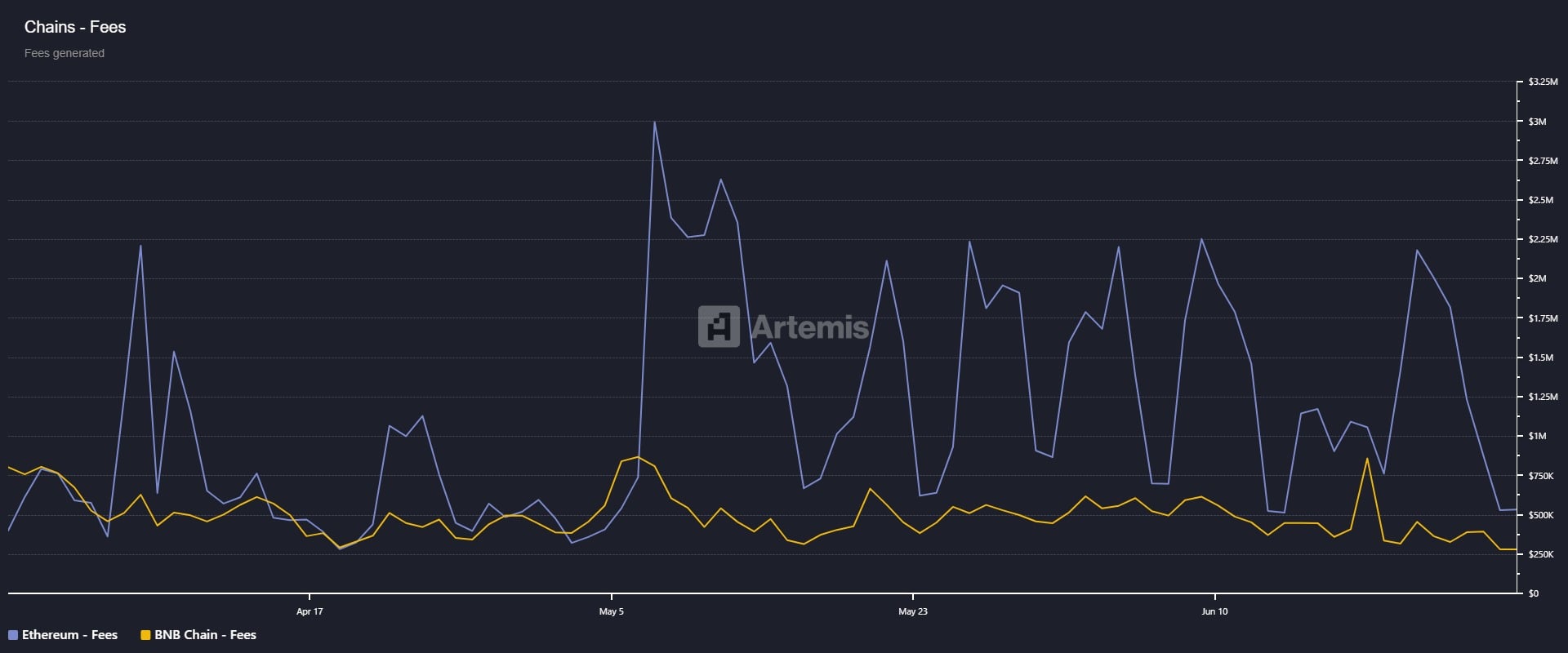

And but, BSC nonetheless lags behind Ethereum in whole worth locked (TVL) and protocol income. This means that whereas BSC excels in consumer exercise, Ethereum continues to draw deeper capital and higher-value DeFi interactions.

The divergence alludes to a structural distinction too – BSC is optimized for scale and pace, whereas Ethereum stays the first venue for capital-intensive, yield-bearing protocols.

In essence, one chain is shifting quicker, whereas the opposite remains to be holding extra worth. Meaning whereas the Maxwell improve could drive greater engagement, it nonetheless operates nicely beneath Ethereum’s dominance in TVL and price seize.

If Ethereum’s Glamsterdam upgrade efficiently improves block instances with out compromising decentralization, it might neutralize BSC’s pace benefit. In flip, tightening the race for DeFi relevance.

![Security alert [Implementation of BLOCKHASH instruction in C++ and Go clients can potentially cause consensus issue – Fixed. Please update.] Security alert [Implementation of BLOCKHASH instruction in C++ and Go clients can potentially cause consensus issue – Fixed. Please update.]](https://bitcoininstock.com/wp-content/uploads/2025/10/1761828602_eth-org-120x86.jpeg)