Key Takeaways

Why did crypto markets crash?

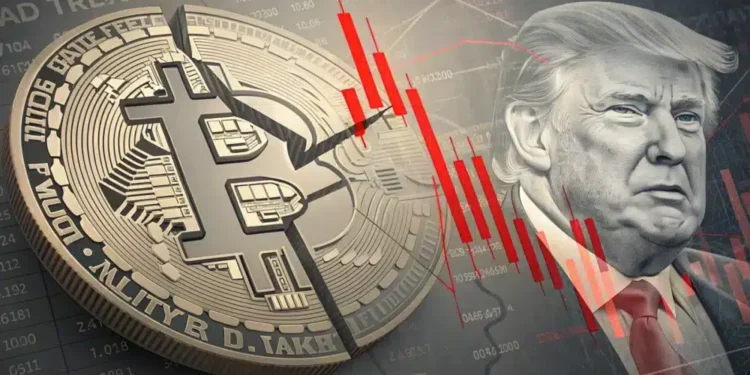

A shock 100% tariff announcement from President Trump triggered over $19 billion in liquidations; the biggest leveraged wipeout in crypto historical past.

Has Bitcoin hit the true market backside?

Not but. Traders are nonetheless in revenue, that means full capitulation and emotional reset haven’t occurred.

International crypto markets noticed their largest leveraged wipeout on file on the tenth and eleventh of October, with over $19 billion in positions liquidated.

The crash adopted a shock tariff announcement from President Donald Trump and a well-timed quick by a serious crypto whale.

The sudden crash worn out weeks of speculative positive factors in each Bitcoin [BTC] and altcoins. Now, the group stays uncertain if the market has cleared out all the surplus leverage or if extra draw back continues to be to come back.

The $19 billion domino impact

In lower than 24 hours, the markets witnessed an unprecedented liquidation cascade, with greater than $19 billion in leveraged positions erased and over 1.6 million merchants worn out.

The set off? A sudden 100% tariff announcement from President Trump that hit simply minutes after a crypto whale reportedly opened huge quick positions.

In accordance with The Kobeissi Letter, inside half an hour of the submit, liquidations soared previous $19.5 billion, with $16.7 billion of these coming from overleveraged longs. Platforms like Hyperliquid [HYPE] alone noticed over $10 billion in lengthy positions flushed.

The crash confirmed how weak weekend liquidity and excessive investor greed made the market fragile. One political shock was sufficient to set off the largest wipeout in crypto historical past.

A market purge, however not but a backside

Whereas the $19 billion liquidation cleared out extreme leverage, it didn’t trigger full-blown capitulation.

Stories confirmed that the Web Unrealized Revenue/Loss (NUPL) held round 0.51 at press time, that means most buyers stay in revenue regardless of the sell-off.

The crash was quick and mechanical, extra panic than give up.

Nonetheless, exchanges like Binance played a stabilizing role.

Information confirmed whales transferring funds and inflows surging simply earlier than the drop, proving a deliberate danger reset. Binance’s Spot Buying and selling Quantity jumped to $12.6 billion, absorbing a lot of the chaos.

The outcome was a cleaner market construction, however with out the emotional washout that normally signifies a real macro backside.

The calm earlier than the true reset

Regardless of the record-breaking liquidation, Bitcoin may not have hit its true bottom but.

In previous bear markets like March 2020 and November 2022, the NUPL metric dropped under zero, displaying buyers have been deep in losses; a transparent signal of capitulation.

This time, it stayed constructive close to 0.5, that means many merchants are nonetheless in revenue.

That optimism usually comes earlier than one other drop, as concern hasn’t absolutely taken maintain. Leverage could also be cleared out, however sentiment hasn’t reset.

A stronger restoration might solely come if panic deepens and NUPL falls additional.