Welcome to the latest edition of the DFS Newsletter!

Let’s get right into what we’ll cover for the month of September:

- Ecosystem news: DeFi and Aave TVL hits ATH, Linea chain growth, Plasma chain’s debut;

- DFS upgrades and launches: Aave DeFi Explore launch, Linea chain integration, Spark and Aave upgrades, Sky staking gone live on DFS;

- Latest DFS Stats for September;

- DFS user position analysis.

Plasma, Linea, and Aave: The triple threat

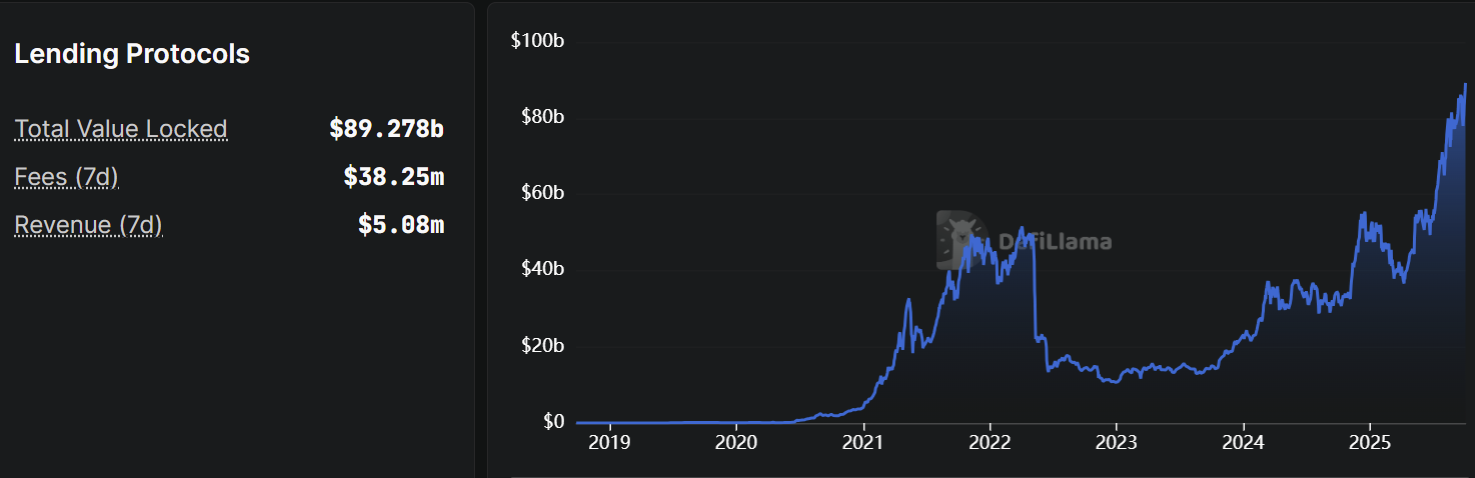

According to DeFiLlama, by September 10, DeFi lending had reached an ATH by $130 billion in TVL, believed to have been fueled by stablecoins, RWAs, and yield-boosting strategies. Aave was leading the pack with $68 billion in TVL, followed by Morpho and JustLend, which are attracting special attention from institutional investors.

And Aave’s ATH in TVL in the midst of the month is to no surprise either.

With the current TVL being around $43.5 billion, this leading protocol has shown tremendous growth since the beginning of this year, when its TVL ranged around $20 billion.

We expect major upgrades from the Aave team going forward, as they have recently released their Aave v4 launch roadmap, promising a fresh user UI, public testnet, a fully open codebase, and much more.

Another ATH for @aave. $73B deposits.

DeFi will win. pic.twitter.com/47kL1Agu5a

— Stani.eth (@StaniKulechov) September 15, 2025

The launch of Plasma and the rapid growth of the zk-rollup Linea have seen Aave emerge as the leading protocol on both networks. In terms of TVL, Linea now competes with optimistic rollups like Arbitrum and Optimism, with a TVL of $1.5 billion. A major leap, considering its TVL at the beginning of July 2025 was around $120M.

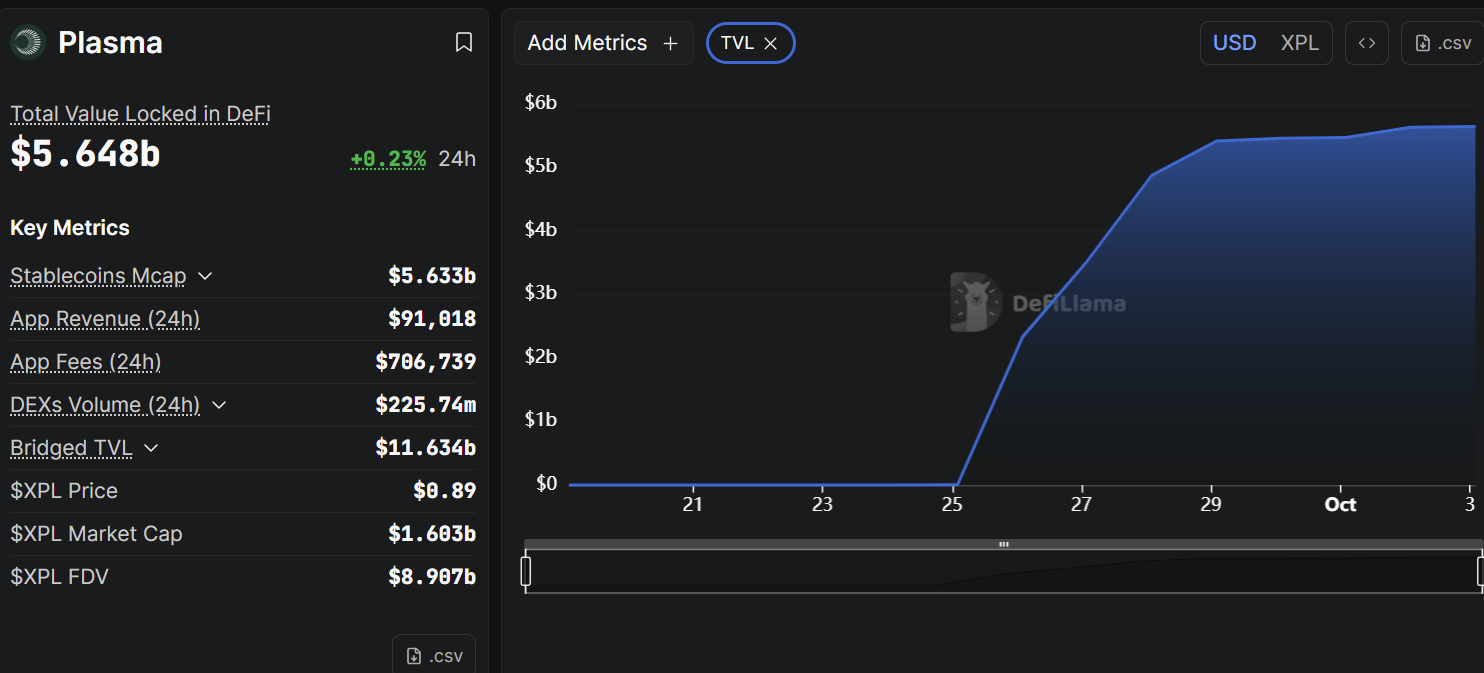

Plasma, however, is an L1 network launched on 25 September this year. Its appeal lies in low-to-no fees for stablecoin transactions, EVM compatibility, as well as its impressive liquidity from day one, with a current TVL of $5.64B.

What both networks have in common is an array of incentives designed to attract liquidity providers and developers. This incentive-driven growth, combined with Aave’s dominance, has positioned Plasma and Linea as two of the most-watched ecosystems in DeFi right now.

DeFi Saver news & updates

September was an exciting month at DeFi Saver, marked by a couple of important milestones for our team and community.

In our effort to provide as much of the DeFi community with the DFS toolkit, we're thrilled to share that the support for Aave on Linea is now live. But that’s not all, as in the meantime we've also rolled out early support for Plasma (do follow our X/Twitter for latest info).

Make sure not to miss any new updates by following our socials, and subscribing to our DFS Blog posts!

Linea x Aave support now live on DFS

We’re excited to share that DFS now supports Aave on Linea, our first zk-based rollup integration, and the first DFS chain integration since 2022.

Linea has quickly become one of the most promising L2s, boasting a growing ecosystem, attractive incentives, and strong adoption. With Aave already the leading lending protocol on the network, this integration brings new opportunities for DFS users as they can now access it through a dashboard and a set of tools they’re already familiar with.

This involves leverage management, collateral and debt swaps, and it’s worth noting that DFS Exchange and Bridge dashboards are also available on Linea, with Automation coming soon.

A new network and a new Aave market supported:

Aave on Linea is now live at DeFi Saver.Starting today you can manage @aave positions on @LineaBuild, including our signature leverage management and collateral and debt switching options.

Try it out at https://t.co/R7cidsExyA. pic.twitter.com/2La1zITNKH

— DeFi Saver (@DeFiSaver) September 11, 2025

DFS introduces Aave DeFi explore page

Say hello to Aave DeFi Explore, a new protocol explorer designed to make Aave v3 position tracking more transparent, efficient, and user-friendly.

We just launched an @aave protocol explorer.👻

Our latest DeFi Explore instance lets you dive deep into Aave with:

– Live feed of latest txs;

– Detailed market stats;

– Full history and state of each position;

– Price change simulations;

& it is available across 6 different EVM… pic.twitter.com/eIqKRyZQMl— DeFi Saver (@DeFiSaver) September 29, 2025

With Aave DFE, you can track real-time stats across six chains (Mainet, Arbitrum, Optimism, Base, Linea, and Plasma), monitor specific positions, and even simulate liquidation risks with the new Price Simulator feature.

Curious what happens to your @Aave position under different price scenarios?

The newly launched Aave DeFi Explore has a feature for exactly that: the Price Simulator.

Watch the walkthrough below to see how it lets you:

• Simulate any price movement to see profit potential &… pic.twitter.com/X2H54y0Vae— DeFi Saver (@DeFiSaver) October 1, 2025

You’ll also find live feeds of transactions, detailed supply and borrow metrics, e-mode data, and even highlighted strategies, such as Aave x Ethena Liquid Leverage, that help you stay informed about trending Aave strategies on all supported chains.

And while we're at it, we’d like to remind you that DeFi Saver recently launched the DFS Trending page and DFS Zaps, which help you stay up to date with popular strategies across all protocols and networks we support. And with DFS Zaps, you can execute them immediately!

Collateral & debt switch updates for Aave and Spark

Collateral and debt swaps for Aave and Spark, are now available for both EOA and smart wallet users, on DeFi Saver.

Collateral & debt switches are now availble for ALL @Aave users.

This means you no longer need to migrate your existing Aave position from a standard Ethereum account (EOA) to do collateral and debt swaps at DeFi Saver.

More details on everything below. pic.twitter.com/wW7DwDbux8

— DeFi Saver (@DeFiSaver) September 10, 2025

Why swap with DeFi Saver? DFS ensures every trade gets the best execution by scanning multiple aggregators, such as 0x, 1inch, Bebop, Kyberswap, Odos, and Velora, to secure the most efficient route.

Collateral & debt switching is now available for all @sparkdotfi users.⚡️

Whether you have a Spark position on a standard Ethereum account (EOA) or a smart wallet (Safe or dsproxy) you can now do instant collateral and debt swaps at DeFi Saver.

More details on everything below. pic.twitter.com/DzqLY9XAGl

— DeFi Saver (@DeFiSaver) September 16, 2025

For flash loans, the app automatically sources Balancer, Spark, Morpho, CurveUSD, Uniswap v3, and Aave v2/v3, always prioritizing zero-fee and lowest gas options.

All while keeping it simple, and available for execution in a matter of a few clicks.

Sky staking now live at DFS

Sky stakingopening is now live on DeFi Saver, enabling users to start earning extra rewards in $SPK or $USDS simply by staking their SKY tokens.

As a reminder, using our Sky dashboard also makes it easy to convert MKR to SKY, access the Sky Saving rate, and convert sDAI savings to sUSDS for extra yield in a single transaction.

An important update for @SkyEcosystem users:

SKY staking is nov available at DeFi Saver.This means you can now access staking rewards ( $SPK or $USDS) or use $SKY to borrow USDS using our dedicated Sky protocol dashboard.

Check it out at: https://t.co/E7BwtOMAUr pic.twitter.com/FoJhsLxnhi

— DeFi Saver (@DeFiSaver) September 26, 2025

DeFi Saver goes to Singapore

Our Nebojša and Nenad, two main product people at DeFi Saver, managed to escape the rainy streets of Belgrade and head to TOKEN 2049, in (still rainy) Singapore, where the conference was taking place from October 1-2.

It was a pleasure connecting with our long-term partners and users alike, as well as exploring the current trends in DeFi and blockchain innovation, all in a beautiful place echoing with the sounds of Formula 1 cars.

September Stats

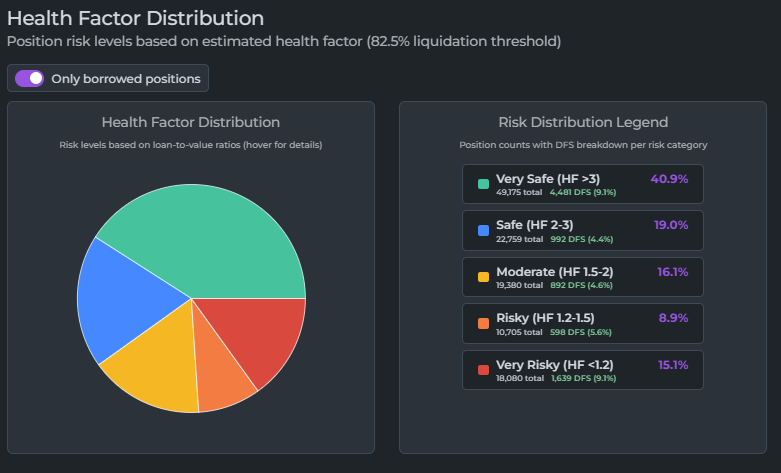

As we mentioned, in September, we launched the Aave DeFi Explore, a tool that not only provides users with expanded capabilities to monitor Aave positions but also allows our team to better understand what role DFS plays in the entirety of the Aave ecosystem. Here is what we found:

- Aave’s total TVL is $41.87B, and DFS users make up for $1.43B;

- In terms of Health Factor Distribution, 40.9% percent of all Aave positions made by DFS users have a HF>3, considered very safe.

- On the other hand, 15.1% fall under the very risky category, with a HF<1.2.

- The top 3 tokens used in Aave, by TVL, are: WETH, weETH, and wstETH;

- While the top 3 tokens DFS Aave users prefer are: WETH, WBTC, and wstETH;

Regarding DFS Automation statistics, there are currently 1,245 active automated positions, with collateralized debt assets totaling $524M.

Position of the month

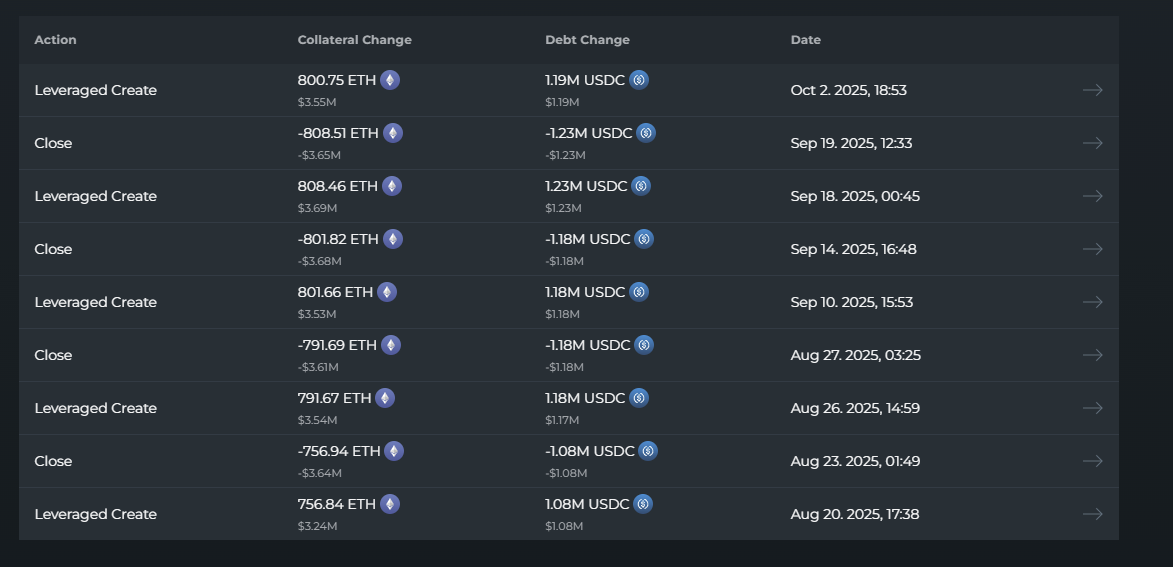

For this month’s analysis, we have a tale of both profit and precaution. We’ll be looking at one DFS whale (a certain 0x3E) that made a profit with some simple leveraged long positions, a bit of foresight, as well as some hefty starting capital.

Looking at their history, we see that they're no stranger to opening a long position and closing it mere days later after reaching an impactful percentage.

- On 20 August, they opened a leveraged long position, with ETH at ~$4139, anticipating a market move upwards;

- Just three days later, as ETH hit $4850, they closed the position, having earned approximately 26ETH;

- We can see that 0x3E has repeated these steps multiple times, however, with mixed success after that initial position.

For example, if they chose to close their current position, opened in late September, they would be walking away with a loss of ~25ETH. This is where the precaution comes in – this position was in profits worth a two-digit amount of ETH, and had they set up a take profit automation at DeFi Saver, they wouldn't have to worry about where the market moves next.

That would be all for this issue of the DFS Newsletter. Thank you all for reading, and see you again next month!

Stay connected:

📢: Official Twitter/X