The on-chain analytics agency Santiment has revealed that Dogecoin and Cardano are two property that look “very bullish” in keeping with this metric.

Dogecoin & Cardano At present Have Low 30-Day MVRV Ratios

In a brand new post on X, Santiment has mentioned about how a number of the high property within the cryptocurrency sector are trying like proper now by way of the Market Value to Realized Value (MVRV) Ratio.

The MVRV Ratio is a well-liked on-chain indicator that retains observe of the ratio between the market cap and realized cap for any given coin. The market cap right here naturally refers back to the easy whole valuation of the asset’s provide on the present value.

The realized cap can also be a way of calculating the valuation of the cryptocurrency, however the twist right here is that this mannequin doesn’t take the worth of all tokens in circulation the identical because the spot value. Relatively, this mannequin assumes that the “actual” worth of any coin is identical as the worth at which it was final transferred on the blockchain.

Associated Studying

Typically, the final transaction will be assumed to be the final level at which the coin modified fingers, so the worth at its time might be thought of to be its present value foundation. As such, the realized cap mainly calculates the sum of the price foundation of each coin in circulation.

One solution to view the mannequin, subsequently, is as a measure of the overall quantity of capital that the buyers have used to buy the overall Bitcoin provide in circulation.

For the reason that MVRV ratio compares the market cap, which represents the worth that the buyers are holding proper now, towards this preliminary funding, its worth can inform us in regards to the profit-loss standing of the market as a complete.

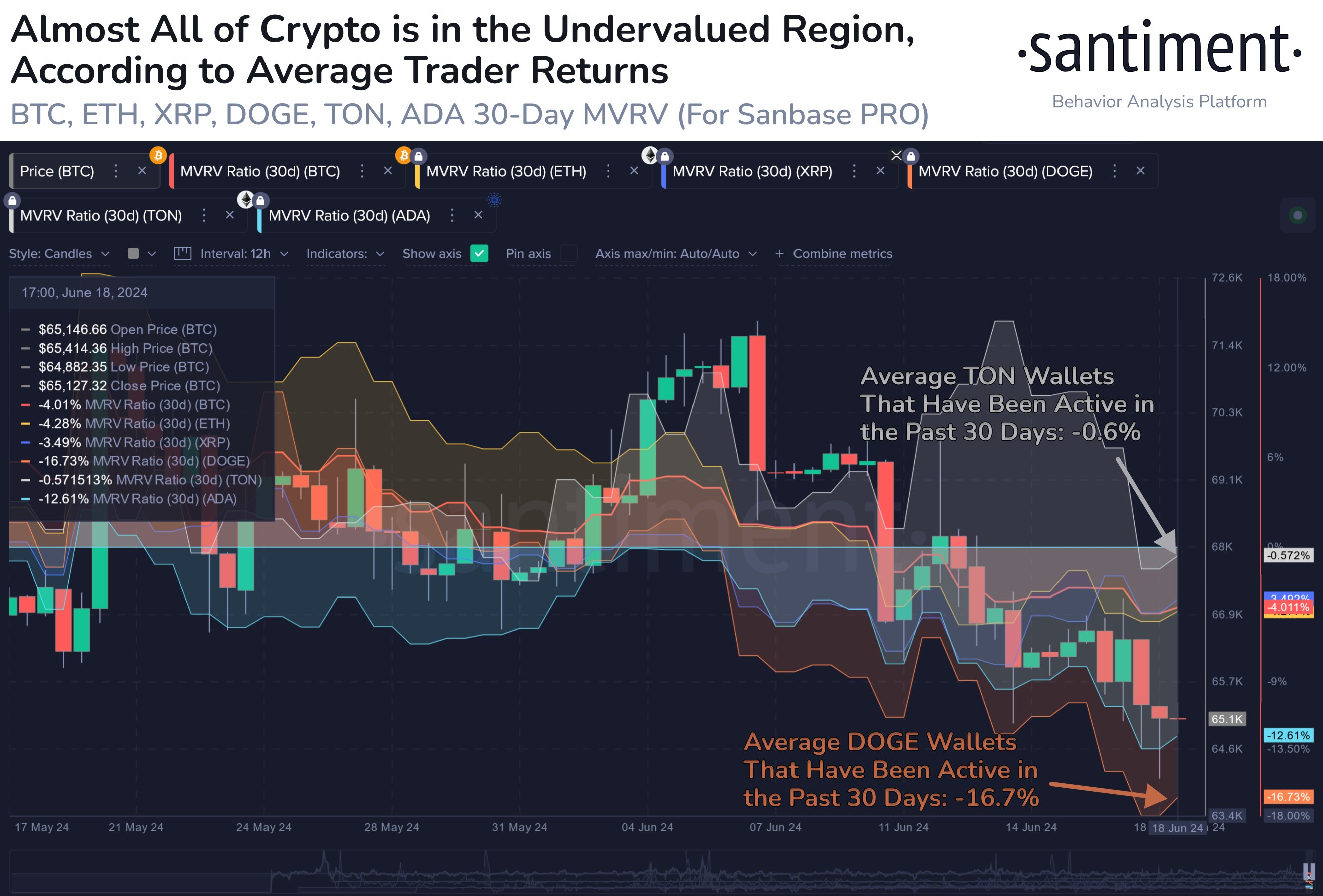

Now, right here is the chart shared by the analytics agency that reveals the current development within the 30-day MVRV ratio of six high cash: Bitcoin (BTC), Ethereum (ETH), XRP (XRP), Dogecoin (DOGE), Toncoin (TON), and Cardano (ADA).

The 30-day MVRV Ratio solely consists of the info for the buyers who purchased their cash throughout the previous month. Thus, its worth displays the profit-loss stability of those new patrons.

From the graph, it’s seen that the indicator is at damaging ranges for all of those property proper now, implying that the 30-day buyers could be at a loss. This will not really be dangerous, although, as Santiment notes, “the decrease a cryptocurrency’s 30-day MVRV is, the upper the probability we see a short-term bounce.”

At current, Bitcoin, Ethereum, and XRP are seeing small damaging values, suggesting that these property could also be barely undervalued. The metric stands at simply -0.6% for Toncoin, although, implying that TON is kind of impartial at present.

Associated Studying

Dogecoin and Cardano, then again, stand out with their 30-day MVRV Ratios of -16.7% and -12.6%, respectively. These values are deep sufficient that Santiment has labelled these cash as “very bullish.”

It now stays to be seen how DOGE and ADA develop within the coming days, given this potential constructive sign within the MVRV Ratio.

DOGE Worth

Dogecoin has been using on bearish momentum over the past couple of weeks as its value has now dropped to $0.125.

Featured picture from Dall-E, Santiment.web, chart from TradingView.com