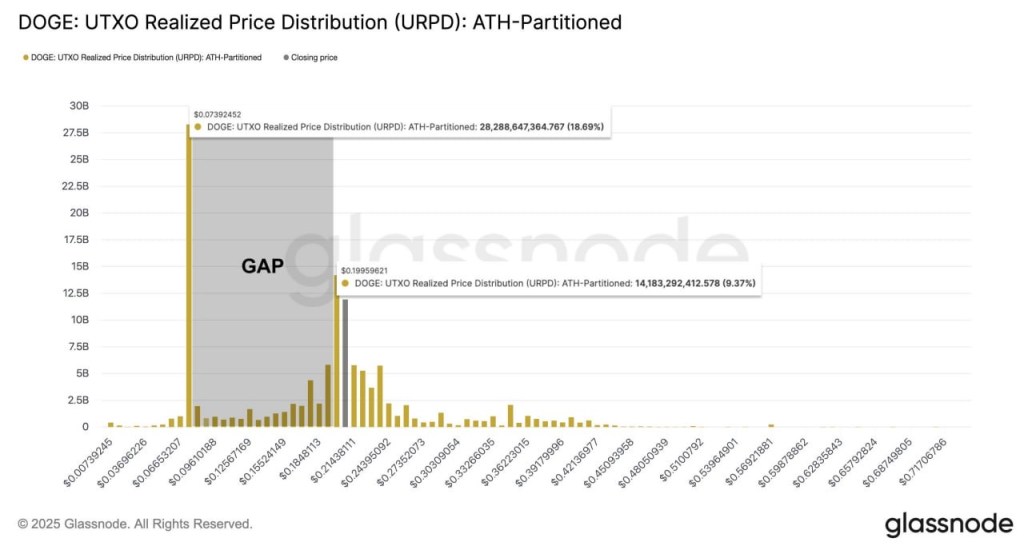

A extensively watched on-chain profile for Dogecoin is flagging a hanging absence of realized price foundation between roughly $0.19 and $0.07—an “air pocket” that would amplify volatility if worth migrates into the vary. Posting a Glassnode UTXO Realized Worth Distribution (URPD): ATH-Partitioned chart, analyst NekoZ (@NekozTek) wrote: “There’s an enormous hole on DOGE between $0.19 and $0.07.”

URPD maps cash by their final on-chain switch worth, a proxy for the place present holders acquired their cash. Dense clusters sometimes align with sturdy assist or resistance; sparsely populated bands suggest fewer cost-anchored holders who may in any other case gradual a transfer.

Within the Dogecoin snapshot shared by NekoZ, the distribution exhibits two dominant cabinets with comparatively little realized provide between them. A big cohort sits close to roughly $0.0739, labeled on the chart with 28,288,647,364.767 DOGE, equating to 18.69% of the measured provide.

Associated Studying

Greater up, one other notable node seems round $0.1996, carrying 14,183,292,412.578 DOGE, or 9.37%. The expanse shaded between these anchors is marked “GAP,” visually underscoring the skinny realized provide throughout that hall.

What Does That Imply For Dogecoin Worth?

For merchants, the structural message is simple however consequential. If spot worth descends from the higher node into the underpopulated band, there are fewer holders with break-even incentives to soak up sell pressure, so draw back can speed up till it encounters the heavier price foundation across the decrease cluster.

The logic is symmetrical on the way in which up: if worth advances from the decrease shelf right into a sparsely held zone, there’s much less overhead provide to impede a rally till it nears the subsequent dense pocket. URPD subsequently speaks to path-dependence and market microstructure somewhat than route in isolation.

Associated Studying

The query embedded within the headline—whether or not a “crash” is imminent—can’t be answered by URPD alone. The distribution just isn’t a timing software and doesn’t incorporate contemporaneous drivers corresponding to order-book depth, derivatives positioning, or exogenous catalysts.

What it does present, with uncommon readability in Dogecoin’s case, is a bifurcated price panorama: a heavy base close to ~$0.07 and a large cluster close to ~$0.20, with comparatively little realized possession in between. Ought to worth traverse that interval, the chart implies the next chance of quick journey throughout the hole and stickier habits when it reconnects with one of many dense cabinets.

NekoZ’s framing—“There’s an enormous hole on DOGE between $0.19 and $0.07.”—captures the core threat. The Glassnode URPD snapshot quantifies it, highlighting that roughly one in 5 measured DOGE resides close to ~$0.074 whereas shut to at least one in ten sits close to ~$0.20, bracketing a broad stretch of skinny realized provide. For market members, the takeaway just isn’t a forecast, however a map: the route between these ranges has fewer pure brakes.

At press time, DOGE traded at $0.198.

Featured picture created with DALL.E, chart from TradingView.com