- ETH has surged by 4.36% over the previous month.

- Ethereum was experiencing an upward momentum, signaling extra positive factors if $2264 assist holds.

Since hitting an area low of $2309, Ethereum [ETH] has seen a robust upward momentum. Thus, the current positive factors have outweighed the losses to show October inexperienced.

In truth, on the time of writing, Ethereum was buying and selling at $2525. This marked a 2.44% enhance over the previous day. Equally, ETH has surged by 4.36% on month-to-month charts with an extension to the bullish development by a 1.53% rise on weekly charts.

Wanting additional, the altcoin has seen a surge in buying and selling actions. As such, its buying and selling quantity has elevated by 35.51% to $12.43 billion.

As anticipated, these market situations have left crypto analysts speaking in regards to the altcoin’s trajectory. One among them is the favored crypto analyst Man of Bitcoin who has urged that the present bullish situation is legitimate if ETH holds above $2264.

Market sentiment

Within the evaluation, Man of Bitcoin posited that ETH is shifting sideways, implying it’s in a consolidation vary.

In response to him, the present actions on worth charts present weak spot thus indicating a possible draw back.

Subsequently, the analysts argue that the bullish situation recognized is barely legitimate so long as ETH trades above $2264.

With the altcoin holding this stage, utilizing the Elliot wave evaluation, the potential subsequent transfer is Wave -C of iii at $3096. This suggests that the value vary is inside the third wave which is strongest and has the potential for additional positive factors.

Nevertheless, if the altcoin fails to carry this stage and experiences a breakdown, it can suggest that Wave -iv is shifting to the draw back.

What ETH charts say..

Undoubtedly, the evaluation offered by Man of Bitcoin gives a cautious future outlook. Nevertheless, it’s important to counter-check and decide what different market indicators suggest.

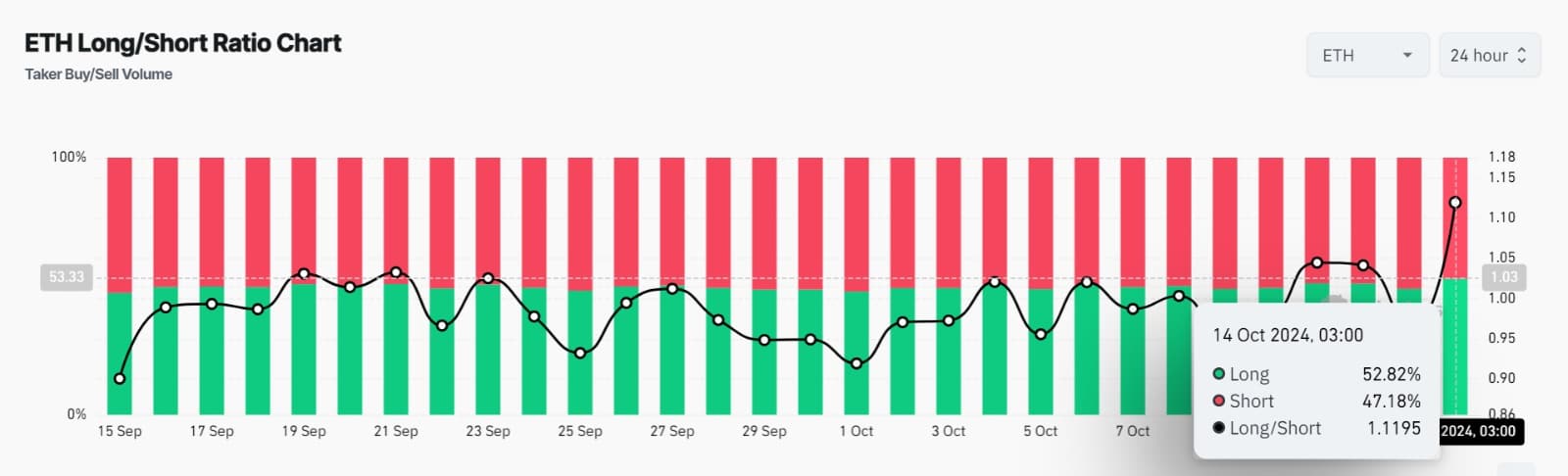

For instance, Ethereum’s Lengthy/Brief ratio has remained above over the previous 24 hours. At press time, ETH’s lengthy/brief ratio was 1.1195 signaling elevated demand for lengthy positions.

As such, lengthy place holders are dominating the market as they proceed to open new trades.

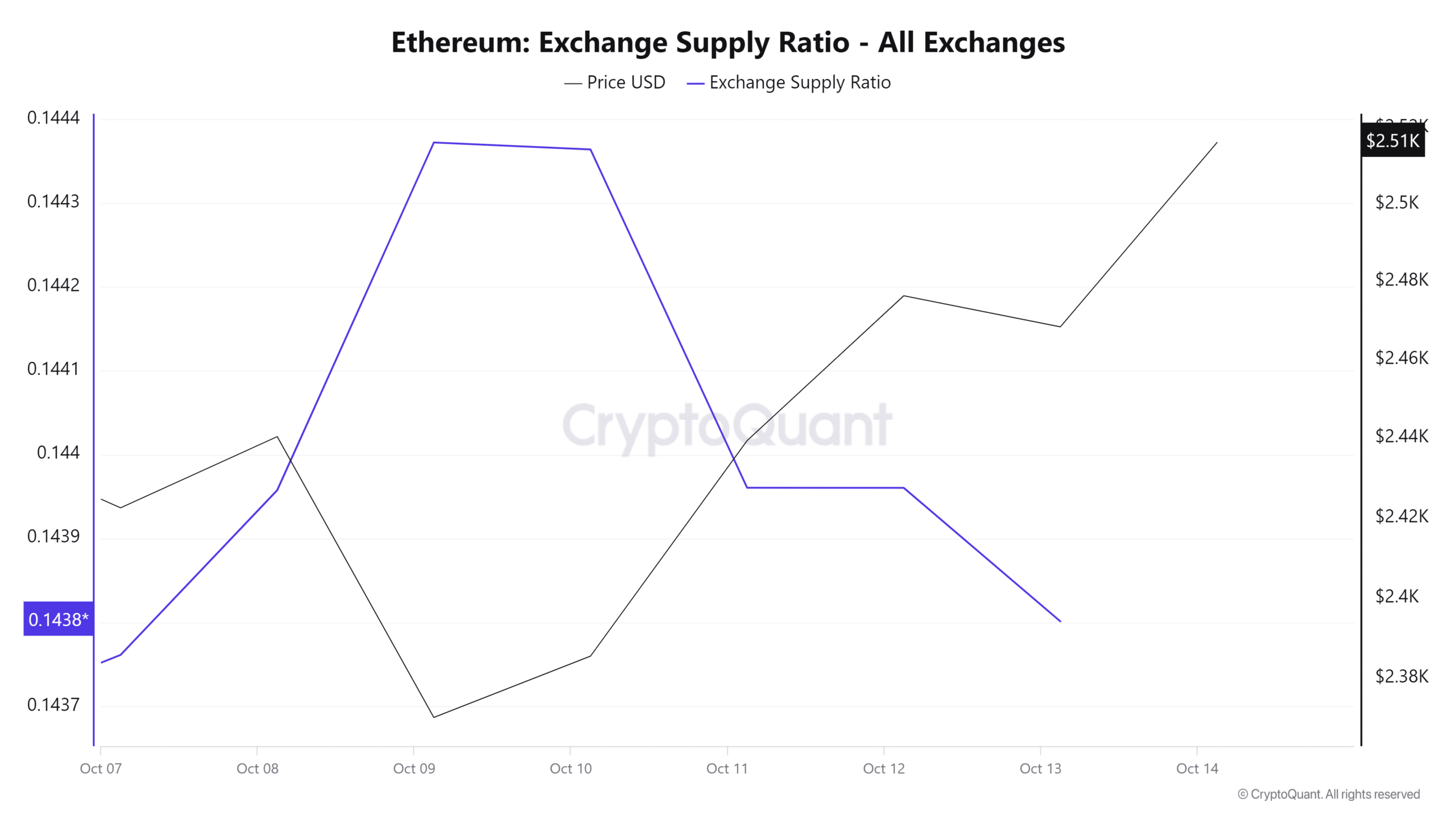

Moreover, Ethereum’s Provide change ratio has skilled a sustained decline over the previous 5 days. A declining provide change provide implies that traders are opting to carry onto their ETH. This normally reduces tokens in provide leading to to produce squeeze.

Supply: Cryptoquant

Learn Ethereum’s [ETH] Price Prediction 2024–2025

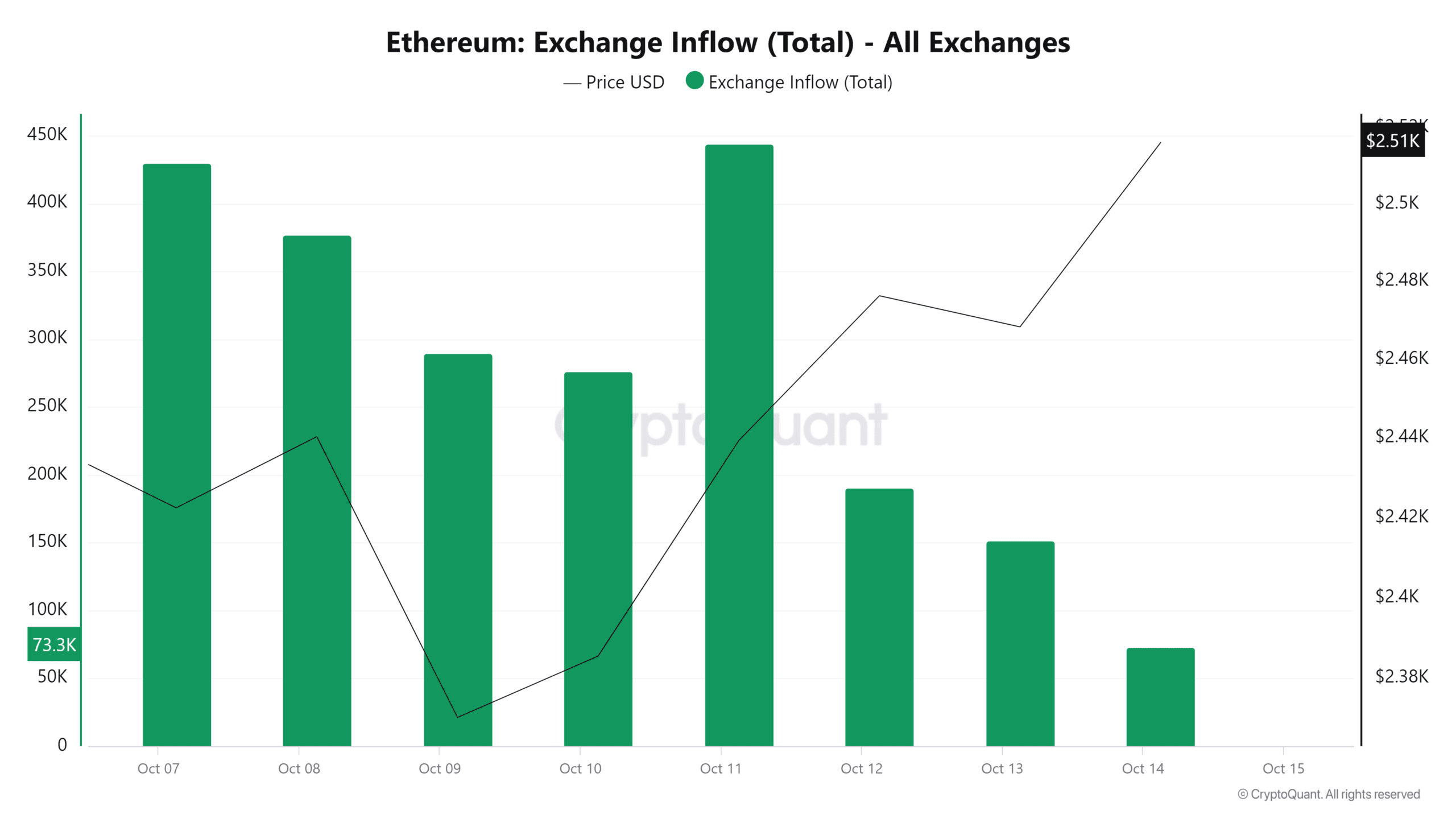

Lastly, ETH change influx has declined for the final 4 days signaling a shift in market sentiment to holding as illustrated by a decline within the provide change ratio.

Merely put, ETH is in a bullish part, and as noticed by the analyst earlier, that is legitimate so long as the $2264 assist holds. Subsequently, with optimistic market sentiment and investor favorability, ETH will try a $2727 resistance stage within the brief time period.