- An ICO-era whale has dumped $12 million ETH on Kraken.

- ETH’s market sentiment and demand had been nonetheless weak.

Ethereum [ETH] recorded key promote stress from a notable whale from the 2017 ICO (preliminary coin providing) period.

In line with analyst EmberCN, the whale obtained 150,000 ETH (price) via the ICO.

Nonetheless, on the eighth of October, the entity transferred 5K ETH ($12.22 mln). Since September, the whale has reportedly dumped over $113 million ETH (45K cash), per the analyst.

“The whale who obtained 150,000 ETH via the ICO transferred one other 5,000 ETH ($12.22M) to Kraken 4 hours in the past. He has bought 45,000 ETH ($113.2M) prior to now two weeks, with a mean value of $2,516.”

Regardless of the most recent sell-off, the whale nonetheless held over $200 million price of ETH.

ETH’s value response

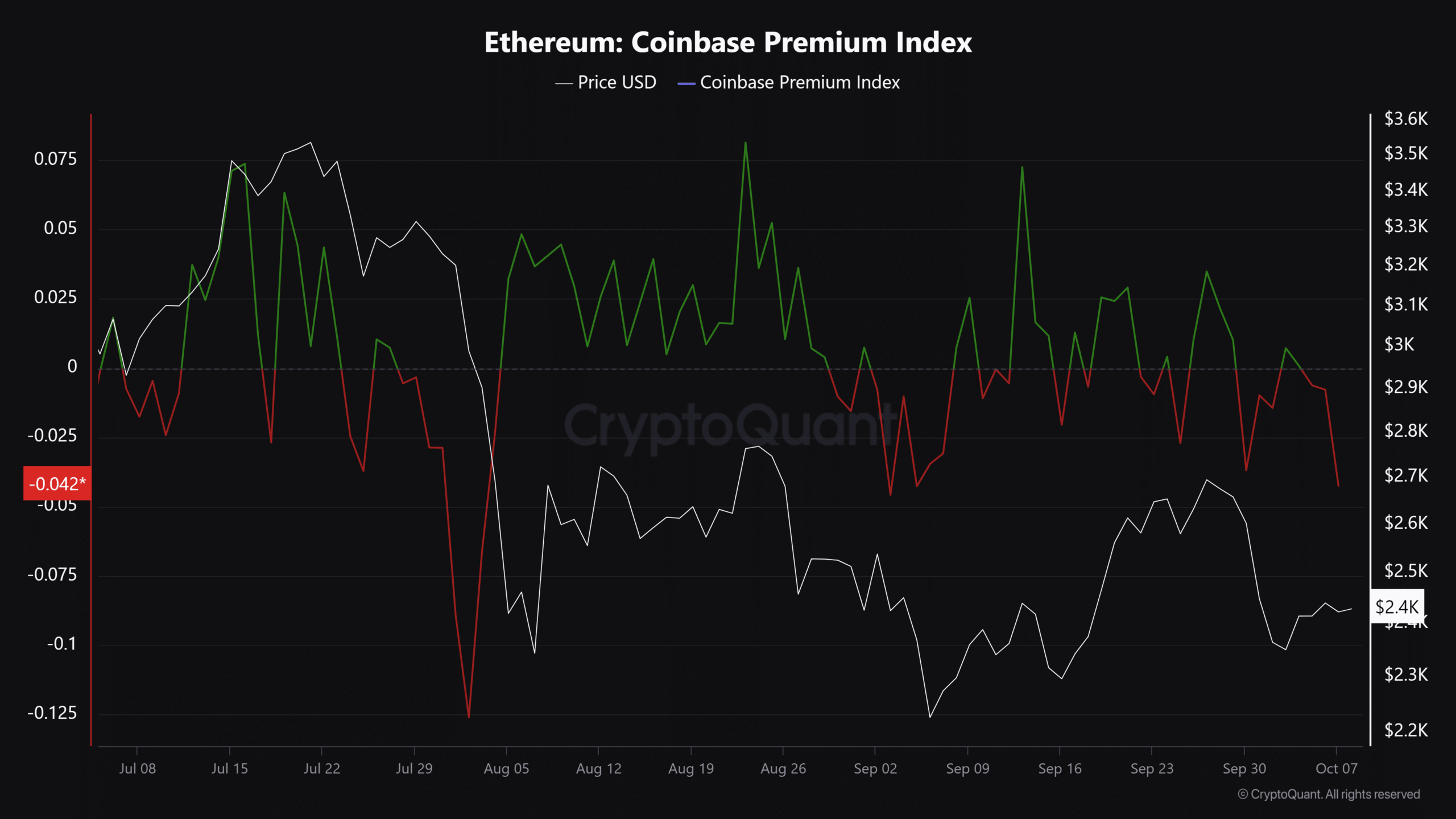

Curiously, the whale’s dump mirrored the general weak demand for ETH from U.S. traders. As illustrated by the adverse studying on the Coinbase Premium Index, there was little curiosity in ETH at press time.

That stated, the low demand might delay the anticipated sturdy rebound for ETH following the latest plunge beneath $2500.

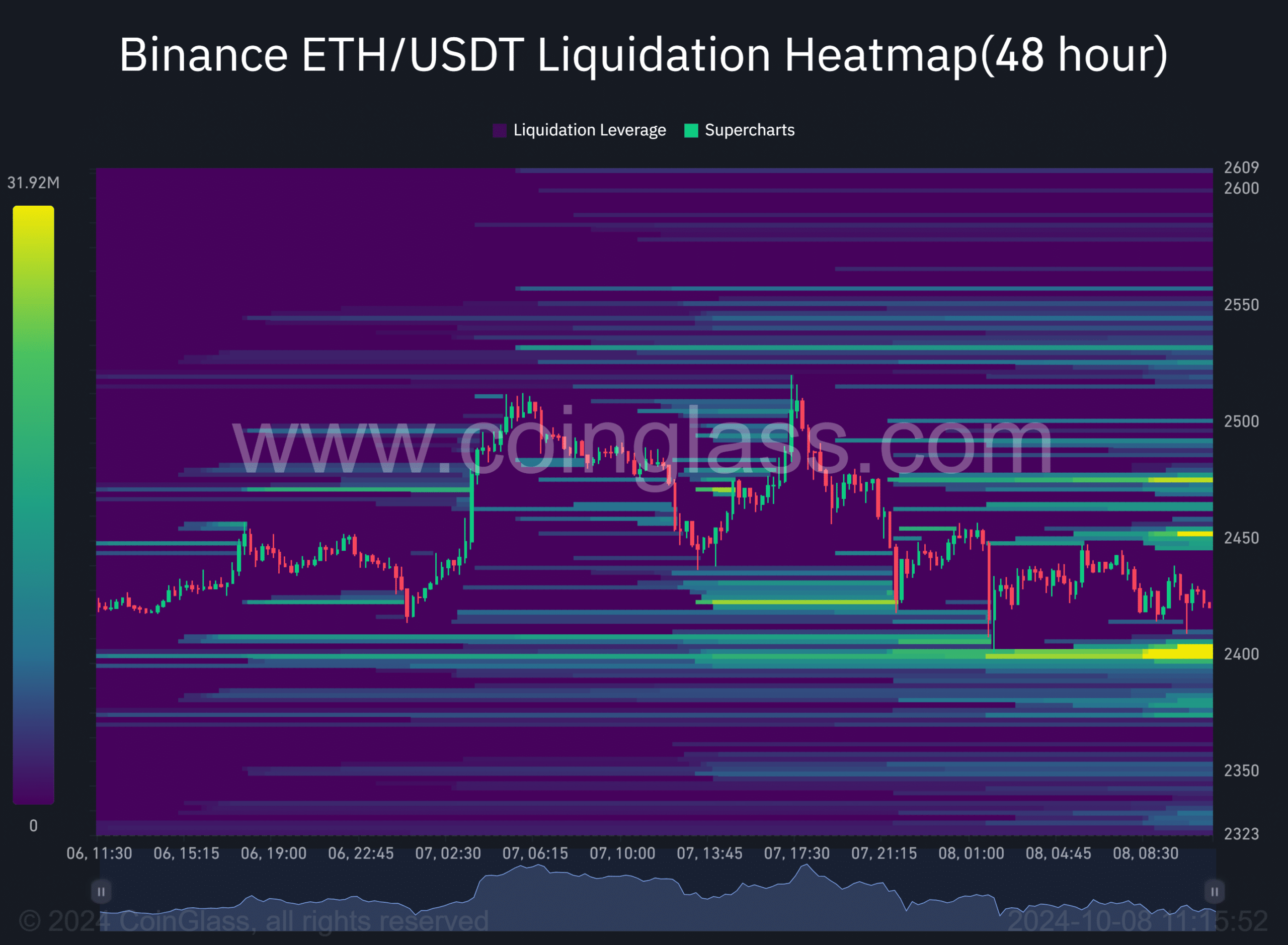

Within the quick time period, whale order knowledge and liquidation heatmaps instructed that $2400 and $2550 had been essential targets to look at.

If a liquidity seize ensued, appreciable lengthy positions at $2400 may very well be liquidated (shiny cluster). This might entice value motion.

Then again, vital overhead quick positions had been constructing close to $2450 and $2550.

Whale order evaluation knowledge supported the above liquidation knowledge. Notably, at press time, the Binance alternate had a promote wall at $2500-$2520 (crimson traces) and a purchase wall at $2400 (inexperienced traces).

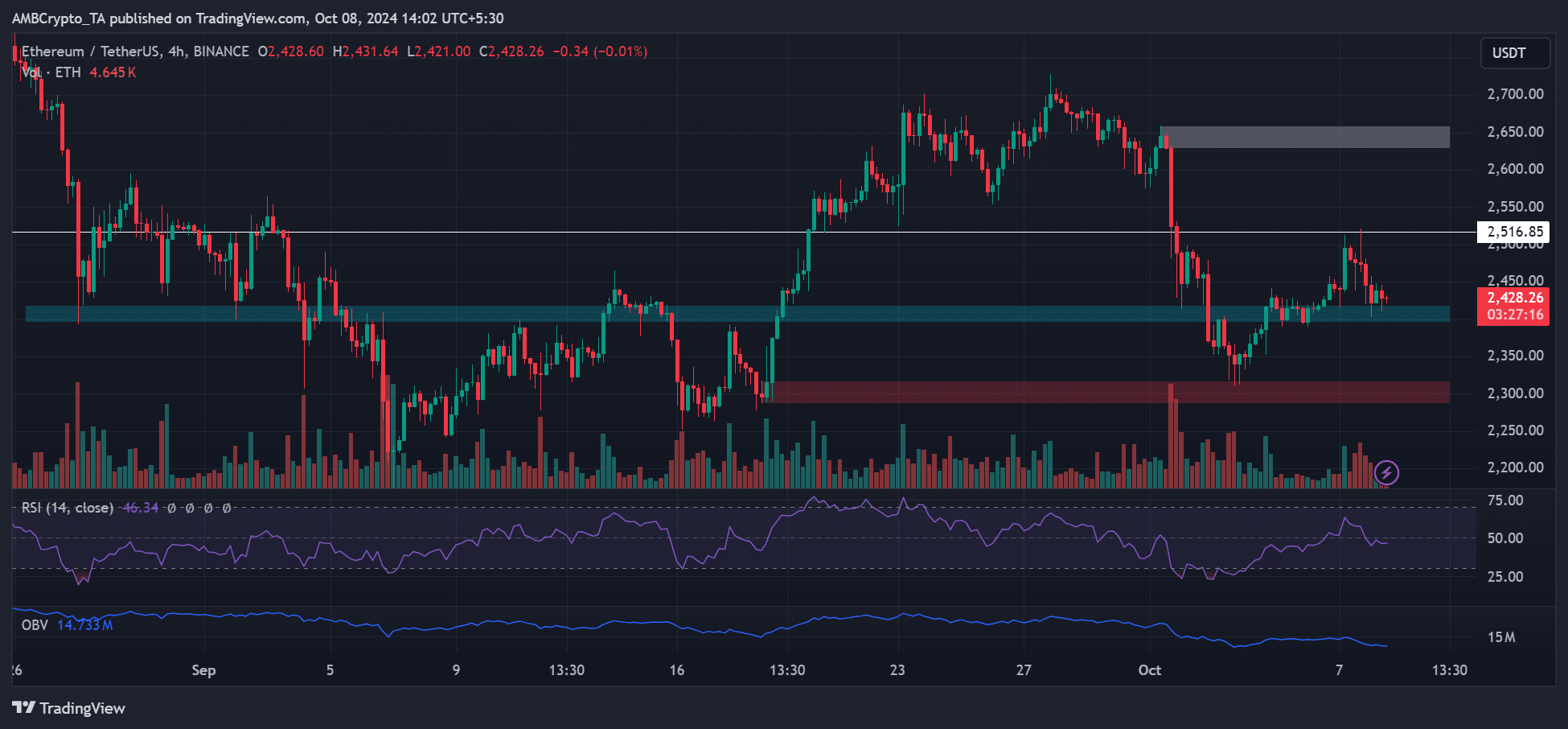

On decrease timeframe charts, ETH has dropped to short-term help simply above $2400. At press time, it was valued at $2.42K, down 8% prior to now seven days of buying and selling.

Nonetheless, technical indicators’ readings had been weak. With RSI toiling beneath common and a dip in buying and selling quantity, ETH’s short-term rebound might rely upon staying above $2400 and reclaiming the $2500 degree.