- ETH has crossed $2700 and will set off a bullish reversal.

- Ought to ETH eye $4K, the present worth may provide a fantastic purchase alternative.

Ethereum [ETH] logged 11% positive factors final week, crossing $2700, a vital degree famend analyst Peter Brandt had projected may set off a bullish reversal.

Brandt maintained the outlook as ETH crossed the neckline resistance ($2700) of a bullish inverse head-shoulder sample.

“$ETH closing worth chart inverted H&S sample. I’m flat in ETH.”

Will the ETH uptrend lengthen?

One other market analyst, Crypto McKenna, shared an analogous ETH bullish ETH projection.

He cited that reclaiming $2850 (Q2/Q3 assist) may set the altcoin in the direction of $3600, particularly if Trump wins the upcoming elections.

“Right here $ETH actually does seemed bottomed and primed for a transfer larger. A reclaim of $2850 and that is the sign for me to be risk-on.”

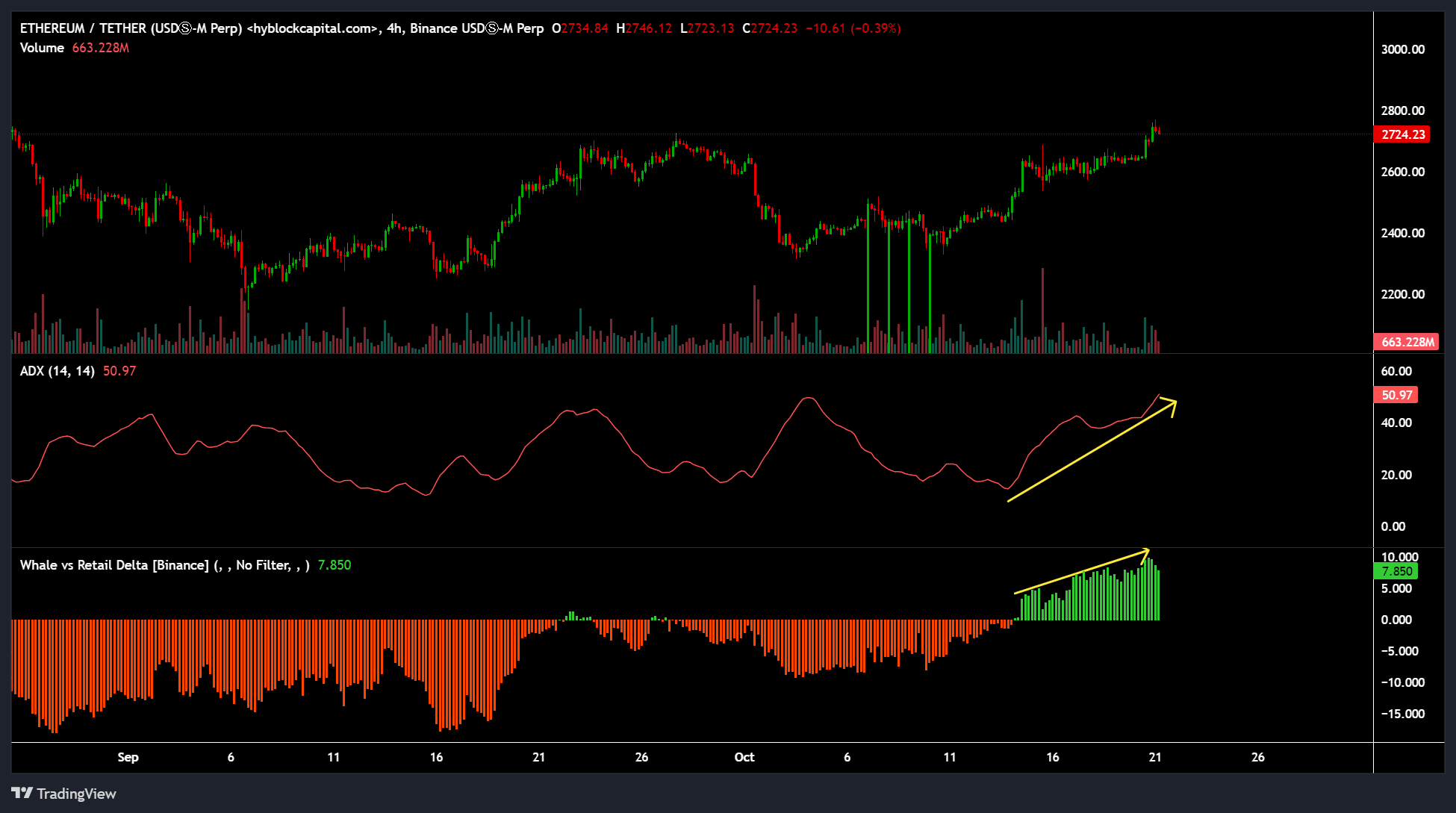

The above outlook was additionally supported by rising whale curiosity for the previous few weeks.

In keeping with Hyblock’s Whale vs. Retail Delta, the metric turned inexperienced and hit ranges final seen throughout the July approval of US spot ETFs.

This meant that whales added extra lengthy positions than retail on the Futures’ perpetual market. This underscored sensible cash’s urge for food and upside expectation for ETH.

Moreover, the latest uptrend was robust, as indicated by the Common Path Index (ADX) studying of fifty.

If the uptrend prolonged, it may push ETH ahead, particularly amid a surge in latest trade netflow.

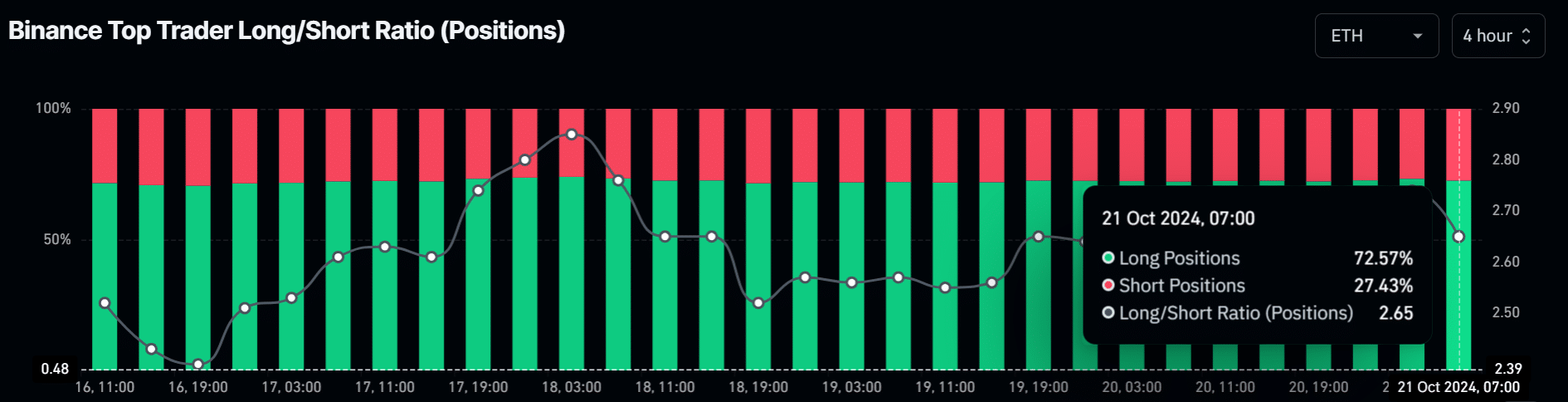

The sensible cash bullish sentiment on ETH was additional supported by the Binance Prime Dealer Lengthy/Quick ratio. At press time, the metric’s studying confirmed practically 73% of positions have been lengthy on ETH.

Learn Ethereum [ETH] Price Prediction 2024-2025

This meant that high merchants on the trade anticipated ETH’s rally to proceed, echoing Mckenna and Brandt’s bullish outlook.

At press time, ETH was valued at $2,723, about 48% away from this cycle excessive of $4K. That meant that ETH’s present worth provided a fantastic risk-reward ratio and an uneven alternative if the uptrend eyes the March excessive of $4K.