That is the third and last publish on a sequence on tips on how to use the Ethereum Pockets to create your individual autonomous organisations. On the first post we detailed how to create a token, and on the second we shown how to generate a digital democracy controlled by these tokens. Now we’ll do the complete circle and create a token managed by the Organisation!

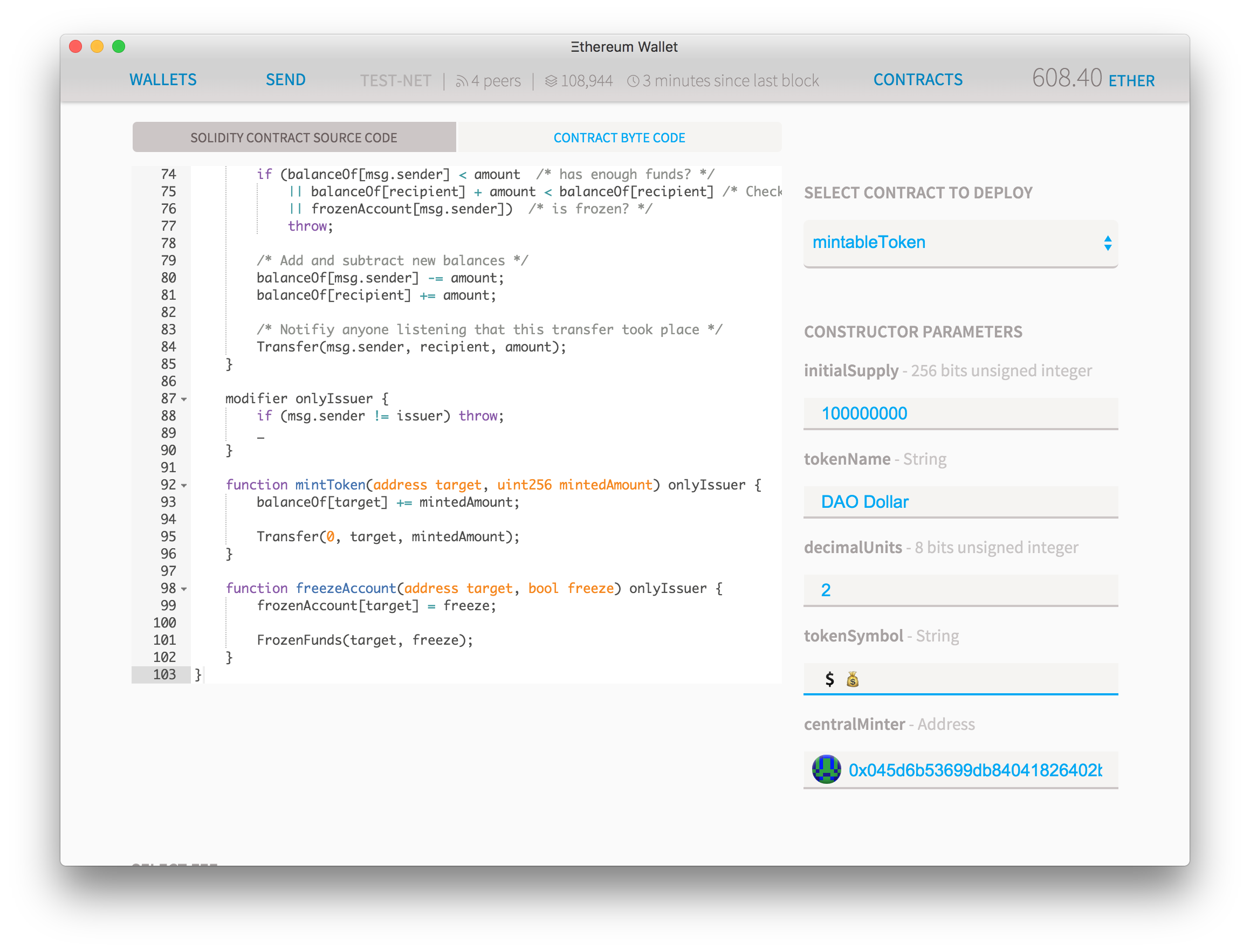

We’re going to modify the token contract to permit it to be minted by your DAO. So save the handle of your present DAO in a observe pad (take note of the icon) and grab this source code and the drill: contracts > deploy new contract > solidity supply code > decide contract

You may fill the parameters any means you need (sure, emojis are permitted on the string fields) however you may discover one new discipline that did not exist earlier than: Central Minter. Right here add the handle of your newly created democracy contract.

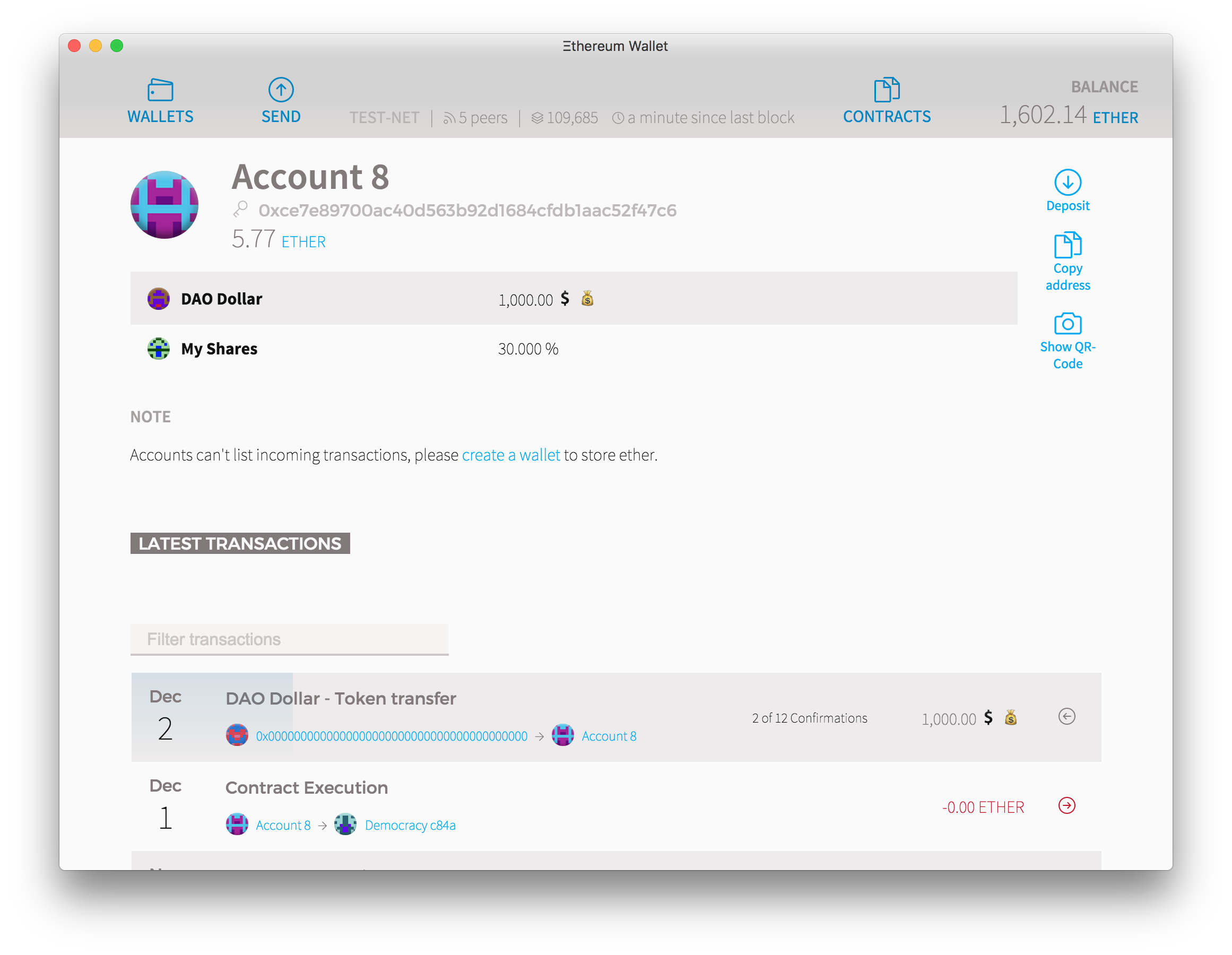

Click on Deploy and let’s look ahead to the transaction to be picked up. After it has at the least two confirmations, go to your democracy contract and you will discover that now it owns 1,000,000 of your new cash. Now in the event you go to the Contracts tab you may see that there’s a new DAO greenback (admin web page) contract in your assortment.

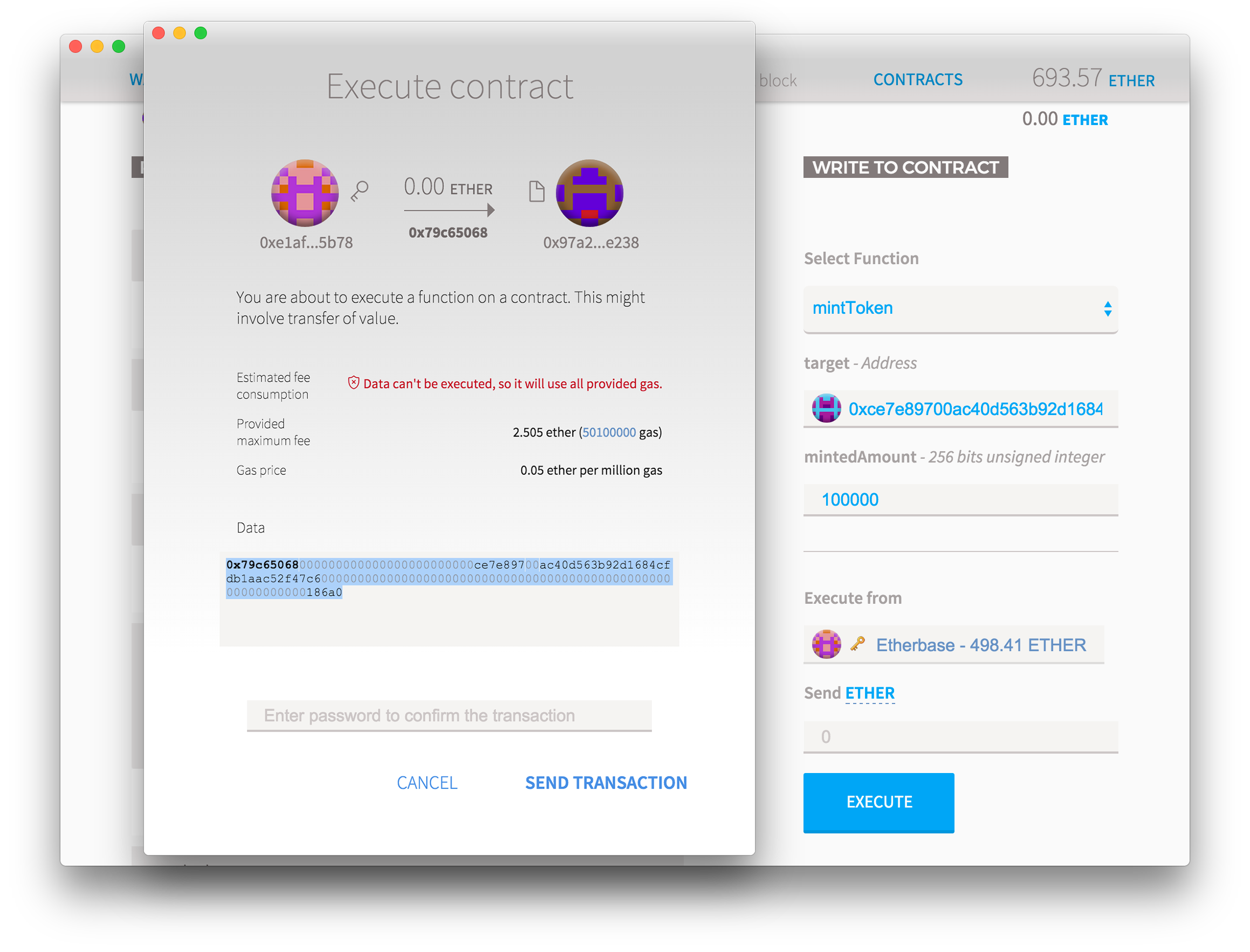

Choose the “mintToken” perform to your proper after which put any handle you personal because the “goal”, after which the quantity of recent mints you need to create from skinny air of their account. Press “execute” however do not press ship! You may discover that there’s a warning saying that the transaction cannot be executed. This occurs as a result of solely the Minter (which is at the moment set to the DAO handle) can name that perform and you might be calling it along with your major account. However the calling code is identical, which is why you possibly can merely copy it.

As a substitute, copy the contract execution code from the “knowledge” discipline and put it apart on a notepad. Additionally get the handle of your new “Mint” contract and reserve it someplace.

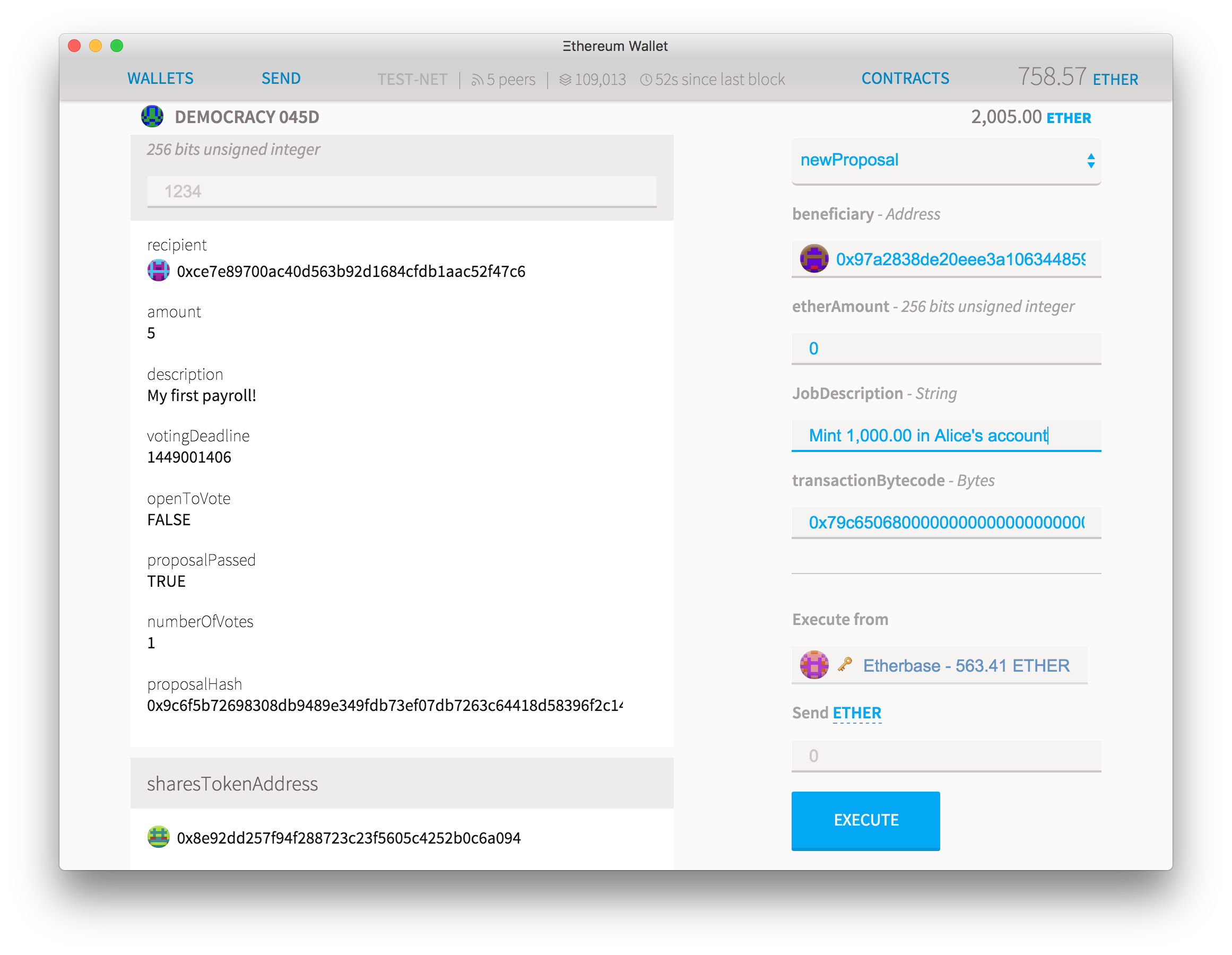

Now return to the democracy contract and create a brand new proposal with these parameters:

- Because the beneficiary, put the handle of your new token

- Go away etherAmount clean

- On the jobDescription simply write a small description that you’re minting new cash

- On the transactionBytecode, paste the bytecode you saved from the info discipline on the earlier step

In just a few seconds it’s best to be capable to see that the main points on the proposal. Not like the opposite fields, transactionBytecode may be extraordinarily prolonged and due to this fact costly to retailer on the blockchain. So as a substitute of archiving it, the individual executing the decision later will present the bytecode.

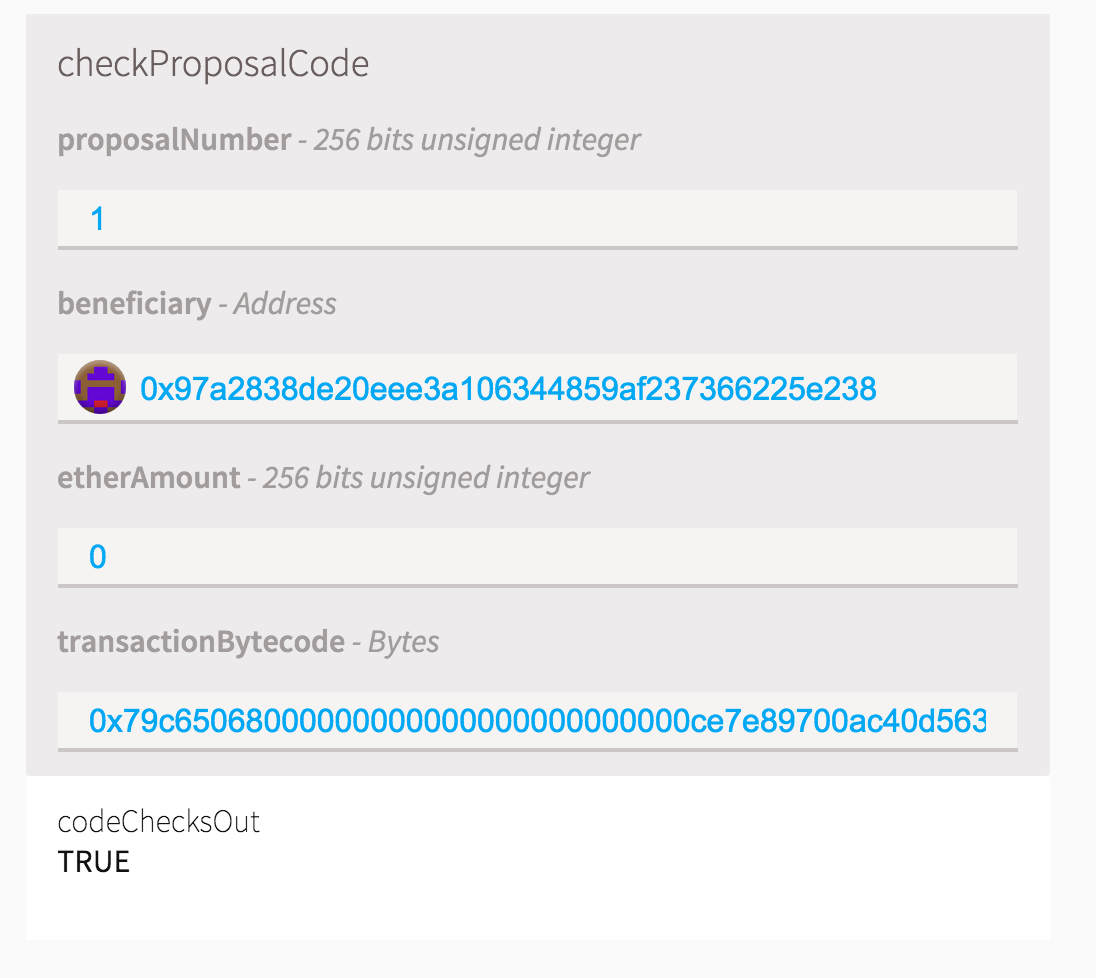

However that in fact creates a safety gap: how can a proposal be voted with out the precise code being there? And what prevents a consumer from executing a special code after the proposal has been voted on? That is why we maintain the hash of the bytecode. Scroll a bit on the “learn from contract” perform record and you will see a proposal checker perform, the place anybody can put all of the perform parameters and test in the event that they match the one being voted on. This additionally ensures that proposals do not get executed until the hash of the bytecode matches precisely the one on the offered code.

It’s an older code, but it checks out

Now everybody can vote on the proposal and after the voting interval has handed, anybody with the right bytecode can ask the votes to be tallied up and the contract to be executed. If the proposal has sufficient assist then the newly minted cash ought to seem on Alice’s account, as if it was a switch from handle Zero.

Why a switch from handle zero? As a result of doing the alternative, sending a coin to 0x00 is a method to successfully destroy it, however extra importantly, as a result of it says so on the contract code. You may change that as you choose.

Why a switch from handle zero? As a result of doing the alternative, sending a coin to 0x00 is a method to successfully destroy it, however extra importantly, as a result of it says so on the contract code. You may change that as you choose.

And now you’ve a central minter contract that exists solely on the blockchain, completelly fraud-proof as all their actions are logged transparently. The mint can even take cash from circulation by merely sending the cash it has to deal with Zero, or by freezing the funds on any account, however it’s mathematically unimaginable for the Mint to do any of these actions or generate extra cash with out the assist of sufficient shareholders of the mint.

Doable makes use of of this DAO:

- The creation of a common secure crypto foreign money. By controlling the whole quantity of cash in circulation the Mint shareholders can try to create an asset whose worth does not fluctuate too wildly.

- Issuance of certificates of backed belongings: the cash can symbolize an exterior foreign money or gadgets that the Mint owns and might show to it is shareholders and token holders. When the Mint acquires or sells extra of those belongings it might probably burn or generate extra belongings to ensure that their digital stock will all the time match their actual counterpart

- Digitally backed belongings. The Mint can maintain ether or different ethereum based mostly digital currencies and use that to again the worth of the currencies circulating

Enhancements Solutions

There are a number of ways in which this construction may be but improved, however we’ll depart it as an train and problem to the reader:

- Proper now votes are made by shareholders based mostly on freely tradable tokens. Can as a substitute membership be based mostly on invitation, every member getting a single vote (or perhaps use quadratic voting or liquid democracy)?

- What about different voting mechanisms? Perhaps the vote as a substitute of being a boolean could possibly be a extra versatile association: you may vote to postpone the choice, or you can also make a vote that’s impartial however nonetheless rely to the quorum

- Presently all proposals have the identical debating interval. Are you able to make that proportional to the worth switch being proposed? How would you calculate that to tokens?

- Are you able to create a greater token that may be mechanically created by sending ether into it, which might then be retrieved by burning the token, at a fluctuating market value?

- What else can the DAO personal or do, apart from tokens?