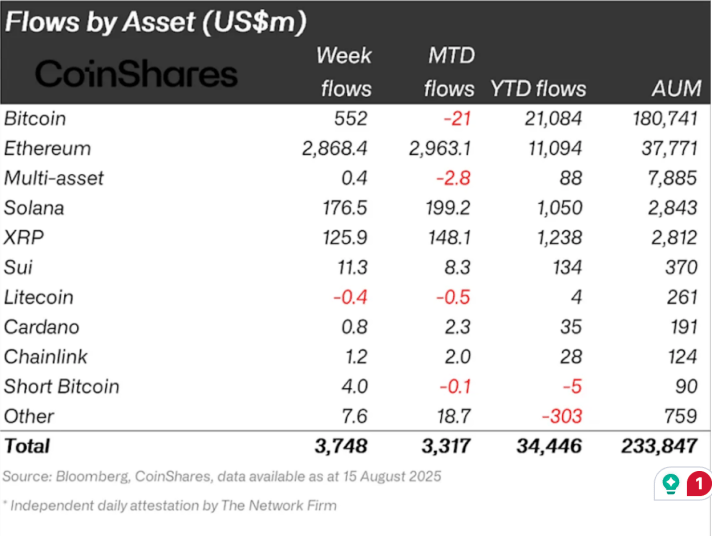

In accordance with CoinShares’ newest Digital Asset Fund Flows Weekly Report, inflows into crypto-products had been $3.75 billion final week, the fourth-largest on document. Unsurprisingly, Ethereum was the standout after attracting the vast majority of capital with record-breaking inflows. Solana and XRP additionally skilled spectacular demand, leading to each cryptocurrencies receiving inflows exceeding 10% of the year-to-date whole flows.

Ethereum’s Document-Breaking Numbers

Ethereum witnessed the most activity final week because the 2021 bull run that took many crypto buyers abruptly. By way of crypto-based merchandise, Ethereum managed to displace Bitcoin’s supremacy final week by main with $2.87 billion in inflows, representing 77% of the full $3.75 billion. This efficiency introduced its year-to-date inflows to $11.094 billion, which is about 29% of whole Ethereum property beneath administration.

Associated Studying

The depth of institutional demand had a right away affect on Ethereum’s market worth motion. Notably, the Ethereum price surged to $4,776 final week, its highest stage because the 2021 bull market.

By way of geographical location, many of the inflows got here from the US, with $3.725 billion in inflows, greater than 99% of the full. This focus was mostly by iShares ETFs. Smaller however significant contributions got here from Canada with $33.7 million, Hong Kong with $20.9 million, and Australia with $12.1 million. Then again, Brazil and Sweden posted outflows of $10.6 million and $49.9 million, respectively.

Though Bitcoin additionally managed to push to a new all-time price high of $124,128 final week, the main cryptocurrency took a step again in institutional inflows. Bitcoin introduced in $552 million final week. Though its year-to-date inflows are bigger in absolute phrases at $21.08 billion, they symbolize solely 11.6% of its whole property beneath administration (AuM), in comparison with Ethereum’s 29%.

XRP And Solana Be a part of The Social gathering

Though Ethereum captured many of the inflows, each Solana and XRP additionally attracted notable inflows that present the altcoins are gaining power amongst institutional buyers, regardless of the absence of spot crypto ETFs for these property within the US market.

Associated Studying

Solana-based products recorded $176.5 million, bringing its month-to-month flows to $199.2 million and its year-to-date determine to $1.05 billion. Successfully, which means Solana-based merchandise witnessed 89% of their whole month-to-month influx and 16.8% of their year-to-date inflow last week.

XRP witnessed about $125.9 million value of inflows final week, boosting its month-to-month whole to $148.1 million and its 2025 whole to $1.238 billion. As such, XRP-based merchandise additionally witnessed 85% of their whole month-to-month influx and 10% of their year-to-date influx final week.

Sui, Cardano, Chainlink, and Quick Bitcoin merchandise additionally witnessed $11.3, $0.8 million, $1.2 million, and $4 million in inflows, respectively, final week. The one main exception was Litecoin, which diverged from the broader pattern and recorded web outflows of $400,000.

Featured picture from Getty Photos, chart from Tradingview.com