Ethereum is exhibiting early indicators of restoration after a dramatic sell-off on Friday that despatched costs plunging to $3,450. The drop got here amid what analysts describe as the biggest liquidation occasion in crypto market historical past, wiping out billions in leveraged positions throughout main exchanges. Whereas bulls briefly misplaced management in the course of the panic, ETH has since begun to stabilize, with renewed shopping for curiosity rising close to key demand zones.

Associated Studying

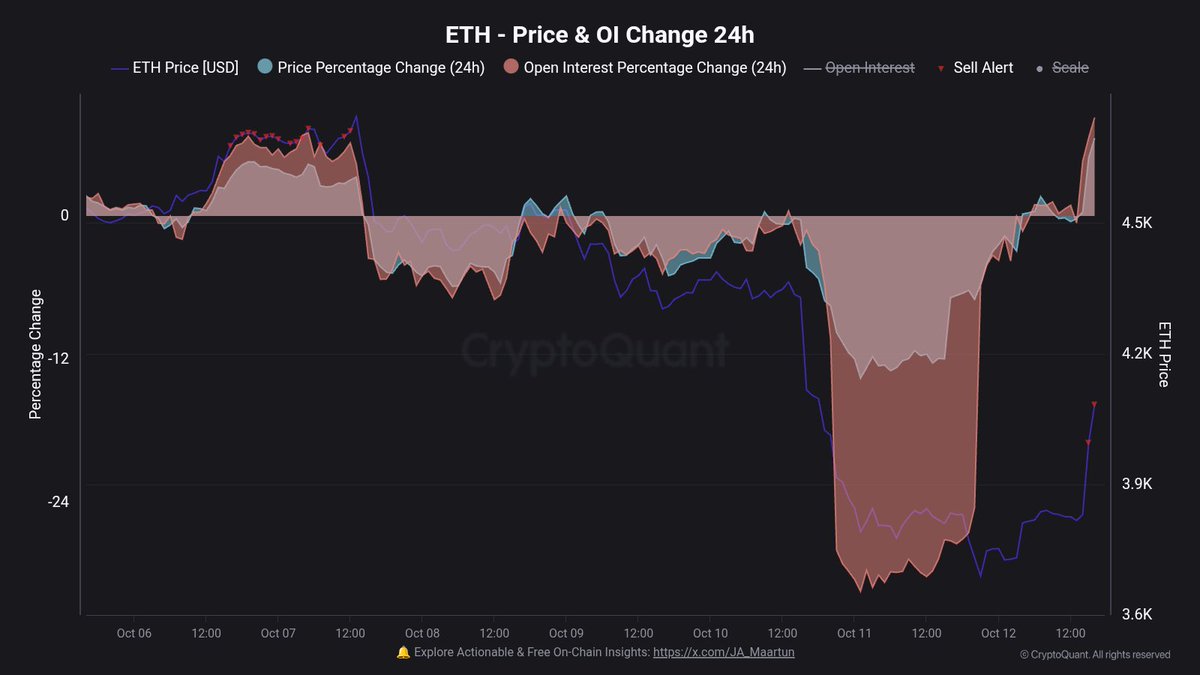

Onchain analyst Maartunn highlighted that leverage is as soon as once more increase on Ethereum, signaling that merchants are returning to the market following the reset. In keeping with his knowledge, open curiosity on ETH surged considerably over the previous 24 hours — an indication that speculative exercise is resuming as volatility cools. This renewed leverage may set the stage for one more decisive transfer, both fueling a short-term reduction rally or inviting additional liquidations if momentum fades.

The approaching days can be essential for Ethereum, as bulls try to reclaim the $4,000 degree to substantiate a sustainable restoration. Market sentiment stays cautious however optimistic, with onchain data exhibiting massive holders and establishments persevering with to build up ETH regardless of current turbulence — a possible sign of long-term confidence within the asset’s resilience.

Leverage Returns to Ethereum: A Dangerous Revival In Market Exercise

In keeping with Maartunn, Ethereum’s Open Curiosity has surged by +8.2% inside the previous 24 hours — a transparent signal that leverage is flowing again into the market. This speedy rise comes simply days after the biggest liquidation occasion in crypto historical past, the place overleveraged merchants have been worn out in the course of the sudden crash. Now, it appears many try to “commerce their a refund,” reigniting short-term volatility and hypothesis throughout exchanges.

Maartunn notes that whereas these so-called “revenge pumps” usually create sturdy intraday rallies, they hardly ever maintain long-term momentum. Traditionally, round 75% of comparable leverage-driven recoveries are likely to revert, resulting in renewed pullbacks as soon as liquidity and funding charges normalize. Solely about 25% handle to increase into lasting uptrends, sometimes when supported by contemporary spot shopping for or renewed institutional inflows.

This knowledge underscores the precarious steadiness Ethereum at present faces. The soar in Open Curiosity alerts revived market participation, but in addition introduces the danger of one other wave of pressured liquidations if merchants overextend their positions. For now, ETH’s short-term restoration stays largely fueled by derivatives exercise relatively than spot demand.

The following few days can be pivotal in figuring out Ethereum’s route. If value holds above the $4,000 area with sustained quantity, it may verify that bulls are regaining management. Nonetheless, a sudden drop in Open Curiosity or sharp funding spikes may sign that the rally is overextended — setting the stage for one more correction.

Associated Studying

Ethereum Rebounds, However Resistance Looms Forward

Ethereum is exhibiting a stable restoration after final week’s dramatic sell-off that drove costs right down to the $3,450 degree. The day by day chart reveals that ETH shortly rebounded from the 200-day transferring common (pink line), confirming it as a significant space of demand. Value is now consolidating close to $4,150, making an attempt to construct momentum after a robust bullish candle on excessive quantity — a possible signal that consumers are regaining management.

Nonetheless, ETH faces speedy resistance close to the $4,250–$4,300 zone, which coincides with the 50-day transferring common (blue line). This space beforehand acted as sturdy help, and reclaiming it will be important for confirming a shift again into bullish construction. The 100-day transferring common (inexperienced line) is now flattening, reflecting the market’s cautious sentiment following the large liquidation occasion.

Associated Studying

If bulls handle to maintain value motion above $4,000, the subsequent targets lie close to $4,500 and finally $4,750. Conversely, failure to carry the 200-day MA may open the door to a deeper retest of $3,600 or decrease. For now, Ethereum’s restoration stays technically constructive, but it surely should overcome these resistance ranges to substantiate that the current rebound is greater than only a short-term response to oversold circumstances.

Featured picture from ChatGPT, chart from TradingView.com