Key Notes

- Ethereum worth surged above $4,000 as optimism grew over Trump’s upcoming commerce assembly with China’s Xi Jinping.

- Treasury companies holding ETH have overtaken Bitcoin in provide dominance, pushed by yield-seeking institutional demand.

- Brief merchants deployed $650 million in leverage close to $4,150, signaling resistance amid heightened market hypothesis.

Ethereum worth reclaimed the $4,000 degree on Sunday, October 26, boosted by optimism round Trump’s go to to Asia, climaxing in commerce talks scheduled with Xi Jinping in Korea on Friday, Oct 30. Ethereum treasury companies maintained an aggressive accumulation outlook throughout the mid-October market dip, overtaking Bitcoin counterparts by way of circulating provide dominance. Amid the market weekend restoration, ETH stays topic to intense hypothesis, with bear merchants concentrating leverage positions across the $4,100 mark on Sunday.

Ethereum strikes above $4,000 as Trump Asia Meet Ignites Optimism

Ethereum worth rebounded to $4,099 on Sunday, October 26, up 10% from its seven-day low of $3,811 recorded final Wednesday. ETH’s rebound mirrored broader market positive factors, the place all prime 10 cryptocurrencies, together with BTC, SOL, and XRP, posted consecutive inexperienced days over the weekend.

Ethereum (ETH) worth crosses $4,000 on October 26 | CoinMarketCap

Ethereum’s rebound was linked primarily to Trump’s Asia go to, which started on a constructive word as he oversaw a peace treaty signing between Cambodia and Thailand, in Malaysia on Saturday. The event eased geopolitical tensions forward of the much-anticipated commerce talks with China’s Xi Jinping, slated for Friday, October 30.

Yield-In search of Ethereum Treasury Corporations Overtake Bitcoin in Provide Dominance

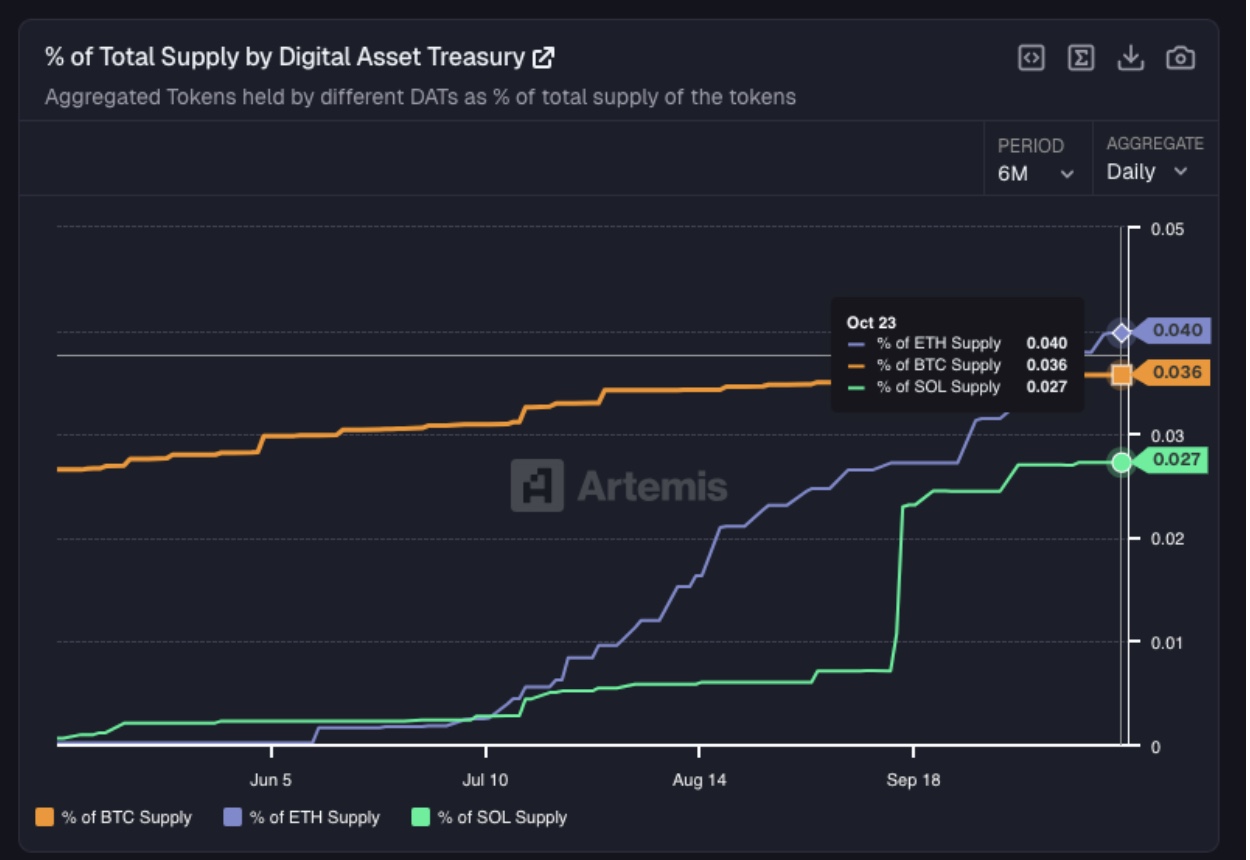

Regardless of volatility in ETH’s worth in October, Ethereum treasury companies, led by Tom Lee’s Bitmine (BMNR), maintained an aggressive accumulation tempo. Notably, Artemis data exhibits that publicly-listed companies holding ETH have now leapfrogged their Bitcoin counterparts by way of provide dominance.

On October 23, Complete ETH provide held by Digital Asset Treasury companies hit 3.2 million ETH, 0.40% outpacing Bitcoin’s company traders, which collectively maintain 640,040 BTC, accounting 0.36% of the entire 19 million BTC in circulation.

Digital Treasury Holdings as share of circulation provide, Oct 2026 | Supply: Artemis

This displays that demand for Ethereum Treasury continues to outpace Bitcoin in 2025, boosted by the crypto regulatory framework and ETH ETF staking approval in 2025.

Ethereum claimed plaudits after its Proof-of-Stake (PoS) transition dramatically lowered its power consumption (by 99%) whereas concurrently introducing a yield-bearing function, making it extra enticing to world conglomerates and portfolio managers with sustainable and clear power mandates.

Artwork Malkov, strategic advisor at Electroneum, an eco-friendly blockchain, supplied insights affirming that yield is the extra enticing issue for company treasuries and institutional traders.

“We’ve noticed that establishments focus on yield in each dialog, however point out power effectivity solely when compliance groups are within the room.

Company treasuries are fiduciaries first. ETH staking yields (at present 3-4% APY) present a revenue-generating different to money reserves, which is their core mandate. The inexperienced credentials primarily serve to fulfill ESG checkboxes that permit institutional entry—they take away a barrier moderately than create demand. – Artwork Malkov, Electroneum CEO.

Ethereum Worth Forecast: ETH Faces Main Resistance at $4,150 as Bears Deploy $650M Leverage

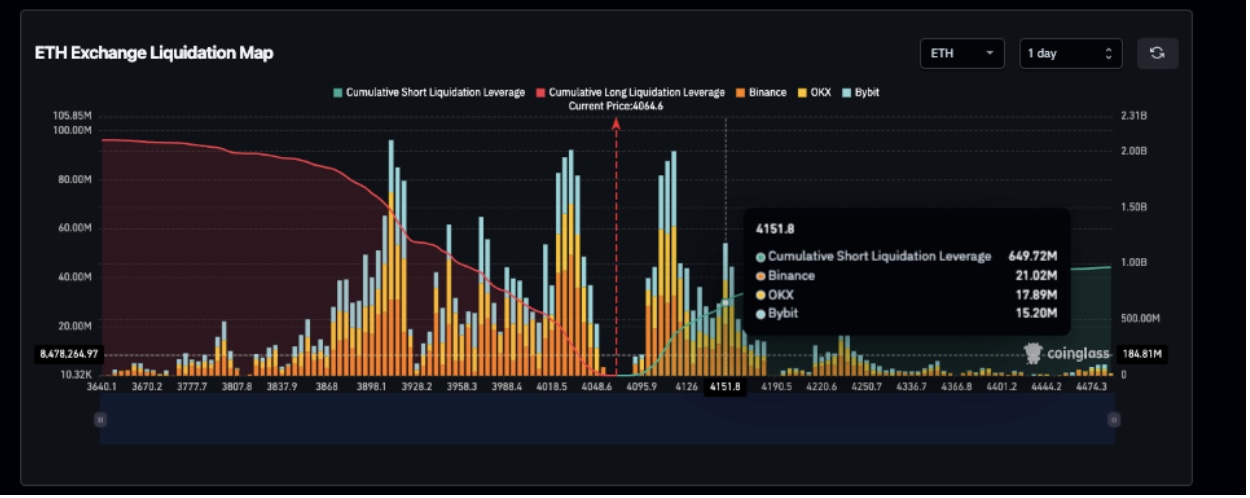

Ethereum worth posted a 3% acquire, stabilizing close to $4,077 at press time on Sunday, October 26, after rejecting the $4,099 intraday peak. Nevertheless, derivatives market information culled from Coinglass signifies that the majority new ETH contracts opened on Sunday leaned bearish.

ETH’s 24-hour buying and selling quantity rose 54%, whereas open curiosity elevated by 5.88%. The long-to-short ratio fell to 0.82, signaling that extra brief contracts had been opened than lengthy ones. Brief contracts exceeding longs throughout a rally typically recommend traders are bracing for a possible worth reversal.

With Trump’s assembly with China and the upcoming U.S. Federal Reserve fee choice looming giant, merchants look like hedging in opposition to potential draw back dangers, as any of those occasions may set off large-scale crypto liquidations, as seen in prior weeks.

Ethereum Liquidation Map, October 25, 2025 | Supply: Coinglass

When it comes to ETH worth projections for the week forward, bears have concentrated roughly $650 million in brief contracts across the $4,150 degree, accounting for 76% of the $840 million in whole brief leverage deployed inside the previous 24 hours.

If Ethereum breaches this resistance, it faces comparatively lighter opposition till the $4,240 zone, the place one other vital provide cluster lies. Conversely, failure to interrupt above $4,100 may set off liquidations, dragging ETH costs again towards short-term assist close to $3,911, the place bulls have deployed roughly $1.5 billion in lengthy ETH contracts.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm data by yourself and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting numerous Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at present learning for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.