- Ethereum’s trade reserves stay at historic lows, doubtlessly signaling a supply-driven value improve.

- The extended low reserves may result in upward value stress within the close to time period.

Ethereum [ETH] seems to nonetheless be lagging behind regardless of the broader crypto market bullish sentiment.

Whereas Bitcoin [BTC] created but once more one other all-time excessive, final week, ETH continues to nonetheless battle to interrupt previous main resistance.

Nonetheless, on the time of writing the asset is up 4% prior to now day with a press time buying and selling value of $3,195.

Amid all of those, one vital issue influencing Ethereum’s value actions is the reserve ranges on spot exchanges.

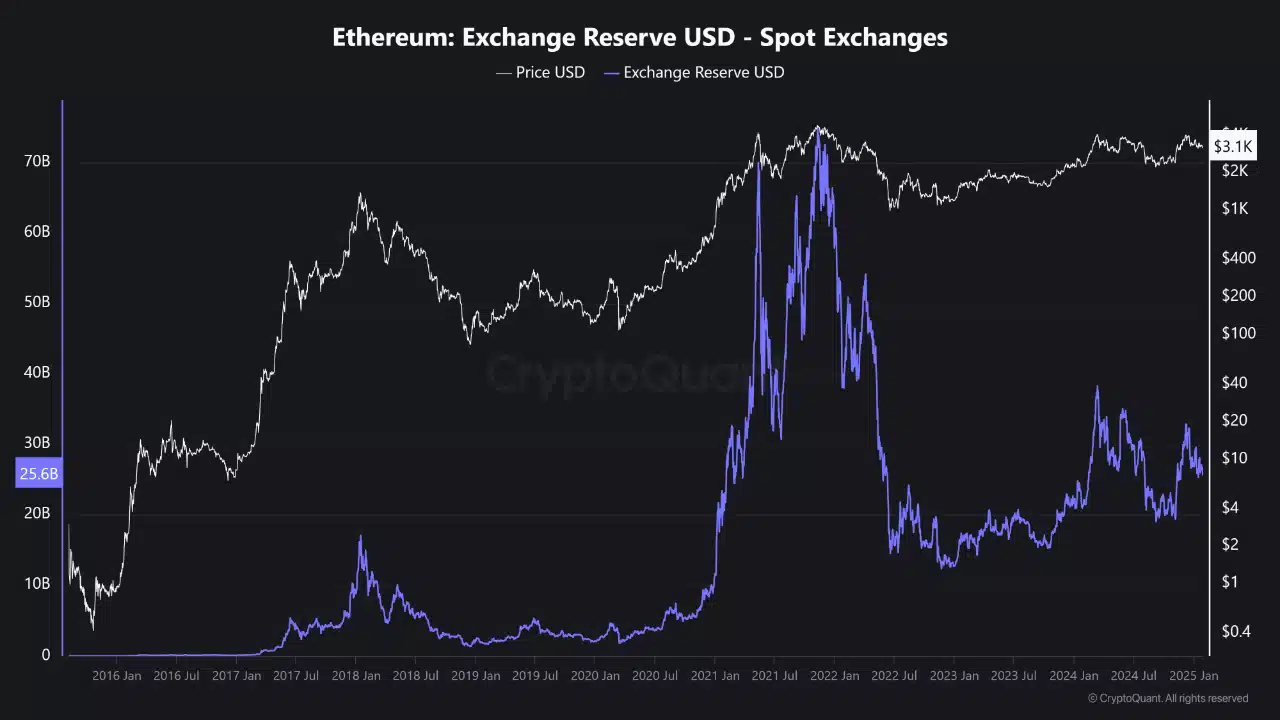

In response to an evaluation revealed on the CryptoQuant QuickTake platform, Ethereum reserves have exhibited notable historic tendencies.

Monitoring Ethereum reserves over time

The analyst outlined how Ethereum’s reserve ranges have shifted over time, highlighting their potential influence on value.

Throughout the 2017–2018 bull market, reserves steadily elevated, reaching a peak in early 2018. This surge coincided with the heightened curiosity in Ethereum and associated tasks.

With the rise of decentralized finance (DeFi) in 2020 and 2021, Ethereum reserves noticed one other vital increase as customers poured property into protocols and platforms constructed on the Ethereum community.

Nonetheless, because the market matured, the top of 2021 marked the start of a notable decline in reserves. Giant-scale withdrawals from exchanges set the stage for persistently low reserve ranges in 2023 and past.

These traditionally low reserve ranges have vital implications for Ethereum’s value.

The continued drop means that many market individuals want to maneuver their Ethereum holdings off exchanges, doubtlessly for long-term storage.

This conduct usually signifies confidence in Ethereum’s worth as a long-term asset.

Present tendencies and market implications

As of 2024, Ethereum reserves on spot exchanges stay close to historic lows. This restricted provide on exchanges may contribute to upward value stress, as fewer cash are available for buying and selling.

Over time, such circumstances can result in stronger value actions if demand will increase.

Though Ethereum’s present value stays beneath essential resistance ranges, the continuing low reserve atmosphere might set the stage for a brand new bullish development.

For now, it’s value monitoring different on-chain metrics to realize insights into Ethereum’s potential short-term trajectory.

For instance, data from CryptoQuant indicated a latest improve in a single specific metric from 0.58 on the fifteenth of January to 0.63 on the 18th of January, adopted by a slight lower to 0.61 on the twenty seventh of January.

Learn Ethereum’s [ETH] Price Prediction 2025–2026

This fluctuation suggests a interval of consolidation, the place market individuals are adjusting their positions in response to altering circumstances.

If the metric continues to carry above sure thresholds, it may sign rising confidence amongst traders and doubtlessly pave the best way for upward value actions.