- One analyst highlighted ETH’s place to recommend a breakout may very well be imminent if demand surges

- Additional evaluation hinted that the buildup section might take longer to resolve itself

Ethereum’s [ETH] progress has moderated itself following a sturdy rally in current months, one throughout which the asset gained by 46.65%. During the last 24 hours although, ETH slipped by 0.13% – An indication of a short lived slowdown.

In keeping with AMBCrypto, this slowdown could also be in step with the continuing accumulation section—A promising signal for long-term progress. Nonetheless, uncertainty stays about how lengthy the market will keep on this sample.

Is ETH on the verge of a breakout? Analysts weigh in

In keeping with crypto analyst Crypto Jelle, ETH gave the impression to be buying and selling inside a bullish pattern often known as a symmetrical triangle (An accumulation section) at press time, with the identical indicated by white strains on the chart.

Traditionally, this sample suggests {that a} rally might observe, with the buildup section representing patrons buying ETH at a reduction earlier than a surge in demand drives the value greater. If this transfer materializes, ETH may doubtlessly climb to $8,500, based mostly on the chart’s projections.

Nonetheless, AMBCrypto’s evaluation revealed that whereas the buildup section bodes properly for ETH’s long-term prospects, it’s unlikely to set off a rally simply but.

Market contributors are nonetheless bidding at lower cost ranges, suggesting {that a} breakout might take extra time to develop.

ETH’s market sees lively bidding amid accumulation section

On the time of writing, ETH’s market was noting lively bidding – Indicators of an ongoing accumulation section. This has resulted in ETH sustaining its oscillatory motion—Bouncing between the converging assist and resistance ranges of the symmetrical triangle.

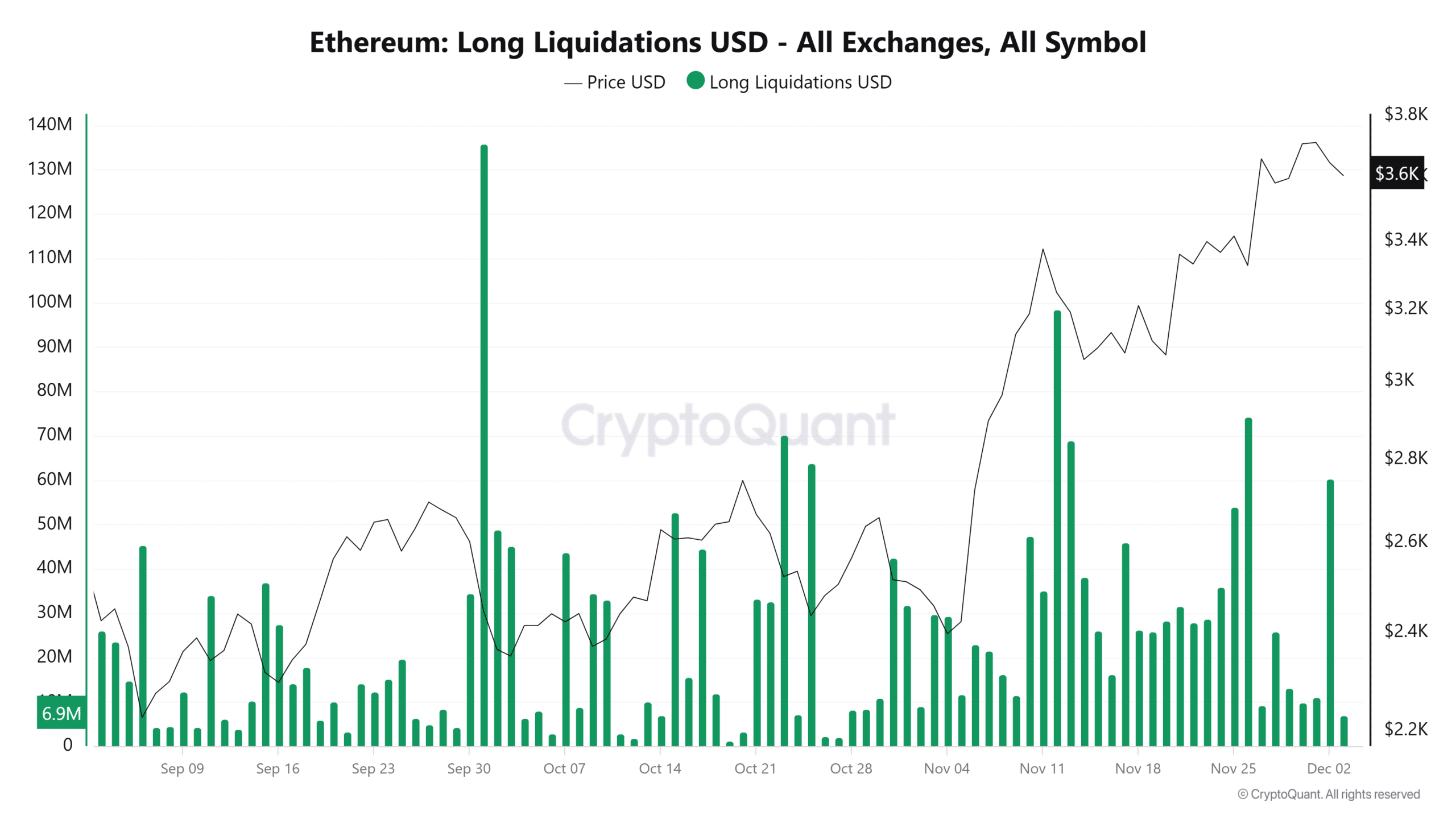

This pattern could be evidenced by the spike in lengthy liquidations, which have greater than doubled in comparison with brief liquidations. With $31 million in lengthy liquidations recorded, the market gave the impression to be prepared for a downward pattern.

AMBCrypto additionally discovered that this motion has been fueled by a hike in lively addresses, with the identical climbing to over 406,000 as many holders bought ETH to lock in earnings. This marked a notable enhance from 365,000 lively addresses recorded only a day earlier.

If lengthy liquidations proceed to rise and lively addresses stay excessive, ETH is prone to pattern downwards inside its ongoing accumulation section.

Revenue-taking exercise limits ETH’s rally

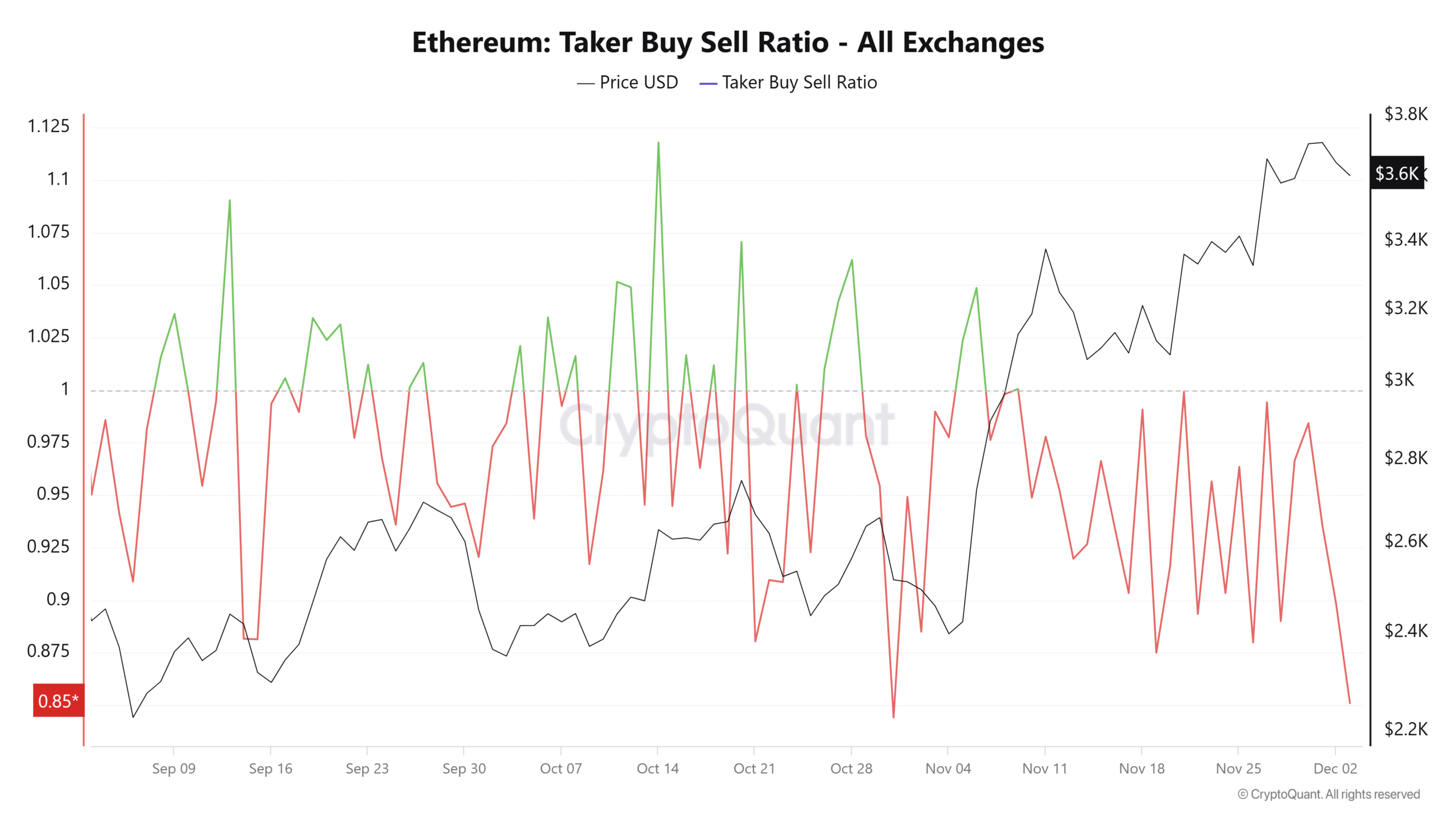

ETH’s rally has been constrained by ongoing profit-taking, as mirrored by the Taker Purchase Promote Ratio tracked by CryptoQuant.

At press time, the ratio stood at 0.85, indicating that promoting quantity outweighed shopping for quantity. This imbalance has pushed ETH’s worth decrease, contributing to the asset’s downward trajectory.

If this pattern persists, ETH is prone to stay confined inside its press time buying and selling channel, delaying any vital upward motion.