Ethereum skilled one of many craziest days in its historical past final Monday, plunging over 30% in lower than 24 hours amid widespread market panic fueled by U.S. commerce warfare fears. Nonetheless, inside hours, ETH staged a formidable restoration following President Trump’s announcement of negotiations with Canada and Mexico to ease tariff considerations. This sharp rebound has reignited optimism amongst traders, with many now intently watching Ethereum’s subsequent transfer.

Associated Studying

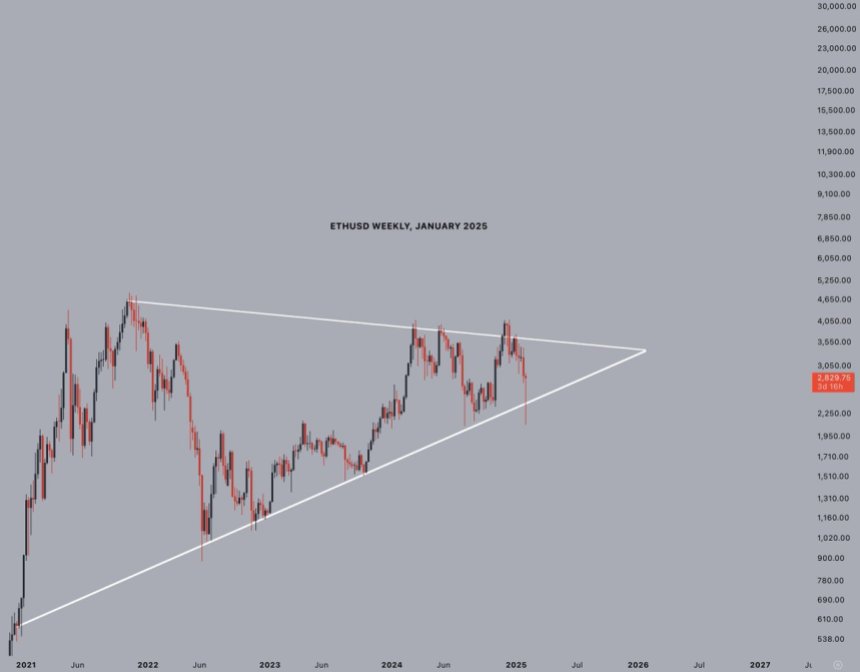

Regardless of the current volatility, prime analyst Jelle shared a technical evaluation revealing that Ethereum continues to be buying and selling inside a large bullish pennant that has been forming since 2021. This long-term construction means that ETH stays in a consolidation section, constructing momentum for a breakout. In line with Jelle, as soon as Ethereum decisively breaks out of this sample, a large rally into worth discovery is anticipated.

As the market stabilizes and traders reassess their positions, ETH stays one of the intently watched belongings. Whereas short-term worth motion is unpredictable, the long-term bullish construction offers robust assist for Ethereum’s development potential. Merchants and analysts alike at the moment are on the lookout for key technical alerts that would verify a breakout and propel ETH into new all-time highs.

Ethereum Struggles Beneath Key Provide Ranges

Ethereum is presently going through critical promoting strain, struggling to reclaim the essential $3,000 mark. Bulls are in bother as ETH stays trapped beneath this stage, resulting in heightened uncertainty and volatility available in the market.

Associated Studying

Day by day that Ethereum trades beneath $3,000 will increase the chance of a deeper correction, as merchants stay cautious and sentiment weakens. The shortcoming to achieve momentum above this psychological stage has left traders involved about ETH’s short-term route.

Nonetheless, regardless of the continued struggles, prime analyst Jelle shared a technical analysis on X, revealing that Ethereum continues to be buying and selling inside a large bullish pennant. In line with Jelle, ETH has deviated from each the highs and the lows of the sample, and now the market is setting its route to tag key provide ranges. Because of this whereas short-term worth motion stays unsure, Ethereum’s long-term construction suggests {that a} breakout might be on the horizon.

Jelle believes that after Ethereum manages to push above the bullish construction, a break above the $4,000 mark will observe. This breakout would verify a rally into worth discovery, setting the stage for Ethereum to achieve new all-time highs. Whereas bears stay in management for now, the long-term bullish formation means that ETH might be gearing up for a significant transfer within the coming months.

Worth Motion Particulars: Technical Ranges

Ethereum is presently buying and selling at $2,820, nonetheless unable to check the crucial $3,000 stage. Worth motion stays weak, as ETH struggles to interrupt above the $2,900 mark, which has now was a short-term provide zone. The failure to push larger alerts that bulls are dropping momentum, and the market stays in a state of uncertainty.

If Ethereum loses the $2,800 assist stage, a deeper correction may unfold, doubtlessly dragging the value right down to the $2,500 area. This could be a big setback for bulls, as it might verify additional draw back strain and will prolong the present consolidation section.

Then again, if ETH manages to reclaim the $3,000-$3,100 stage within the coming days, it might sign renewed bullish momentum. A profitable breakout above this vary may ignite a large surge, pushing Ethereum towards larger provide ranges and setting the stage for a possible run towards $3,500 and past.

Associated Studying

For now, Ethereum stays at a vital juncture, with worth motion signaling each danger and alternative. Merchants and traders are intently watching key resistance and assist ranges, as ETH prepares for its subsequent main transfer.

Featured picture from Dall-E, chart from TradingView