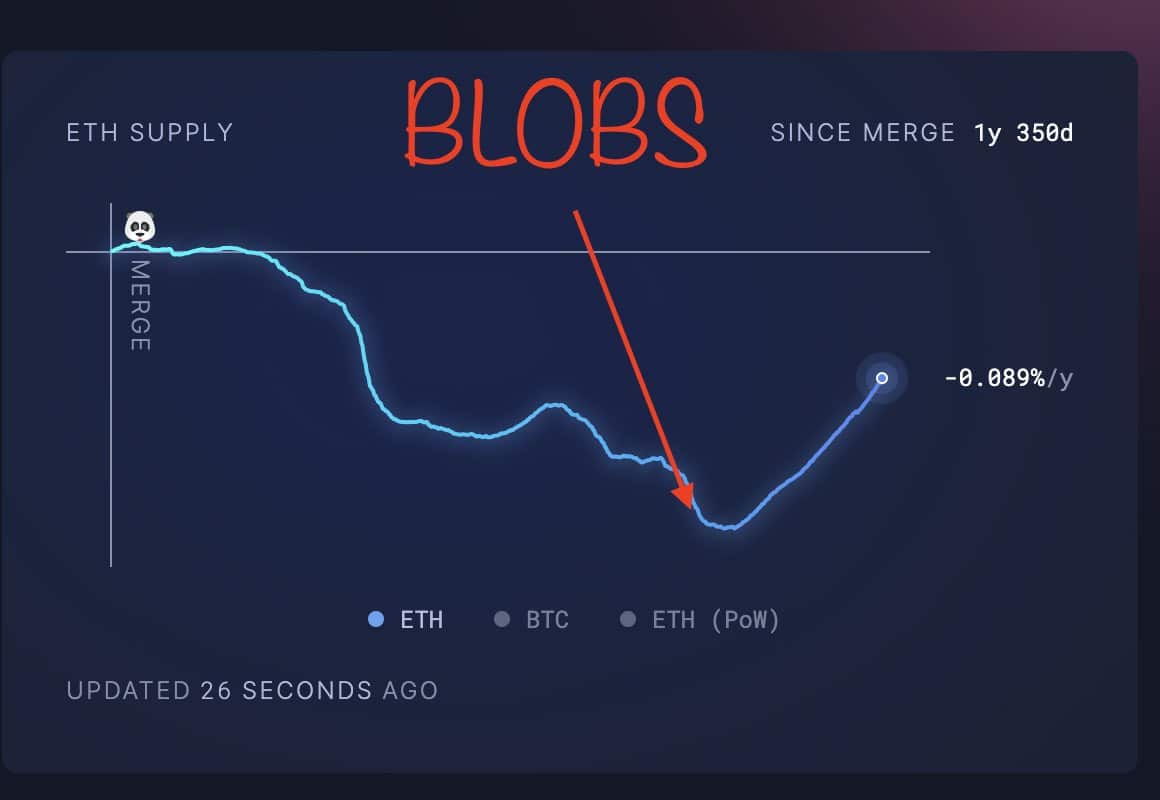

- ETH’s inflation stays elevated after the implementation of the blobs in March

- Analysts are divided on easy methods to deal with inflation with the low-cost blobs

Analysts and insiders are calling for a revision of the present Ethereum [ETH] blobs to mitigate inflation and permit the second-largest altcoin to accrue worth for its L2s (layer 2s).

As soon as praised for making L2s extra environment friendly and vital transaction prices within the ecosystem, Ethereum blobs are actually being scrutinized for escalating ETH inflation. In actual fact, one such analyst, Cygaar, believes that the present relationship between ETH and L2s is lopsided.

“Proper now, the connection between Ethereum L1 and its L2s is sort of lopsided. L2s obtain the advantages of Ethereum safety with out contributing a lot worth again to ETH.”

The issue with Ethereum blobs

For context, earlier than blobs, L2s have been main ETH gasoline shoppers. As a part of Ethereum’s payment construction, the excessive gasoline utilization additionally led to a excessive burn charge (elimination of a part of generated ETH from circulation). The web impression was deflationary to ETH.

Nevertheless, blobs made heavy transactions on L2s comparatively cheaper, decreasing gasoline utilization on L1 and affecting the burn charge. With a low ETH burn charge, the as soon as deflationary asset turned inflationary since blob implementation in March 2024.

Owing to the identical, Cygaar steered growing blob charges within the brief time period.

“Maybe extra short-term, answer is to extend the bottom blob payment. L2s ought to must pay some quantity in charges to make use of Ethereum DA…I might argue that the chains that need to actually inherit Ethereum’s safety will nonetheless pay these prices.”

He added that growing L2 utilization might hike the ETH burn charge and assist obtain deflationary standing in the long term.

“If demand and utilization of L2s will increase, we could attain a state the place the blob pricing curve adequately costs DA blobs, resulting in a wholesome quantity of ETH burning on L1.”

Nevertheless, quite the opposite, the likes of Ethereum neighborhood member Ryan Berckmans sees no must determine on the state of affairs simply but. He claimed,

“I don’t assume there’s a choice to make right here – we’re merely going by way of the preliminary launch part of blobspace and L2 maturation…L2 progress stats are glorious and can inevitably result in blob saturation. This may seemingly then result in vital blob income for the L1.”

Berckmans added {that a} surge in demand for blob areas would enhance the burn charge and charges to L1.

For his half, Doug Colkitt, Founding father of Ambient Finance, downplayed expectations {that a} surge in demand for blob house would enhance the ETH burn charge. He did so by citing the dominance of small dollar-sized transactions on L2s.

“Sadly, blob saturation is unlikely to result in any significant enhance in Ethereum burn.”

That being stated, the low-cost DA (information availability) blobs have been launched solely 5 months in the past. Conservatives like Berckmans really feel that calling for re-adjustment in such a brief interval could be a hasty choice. Nevertheless, different customers imagine ETH’s inflationary standing ought to be addressed promptly.

Whether or not the neighborhood will attain a consensus on the way in which ahead stays to be seen.

Within the meantime, ETH is struggling to carry above $2.5k. The altcoin was down by 38% since blob implementation in March, at press time.