- An unprecedented transfer by the BOJ is inflicting a market shift.

- Bitcoin’s bearish sentiment helps total crypto market decline however nonetheless not but time to promote.

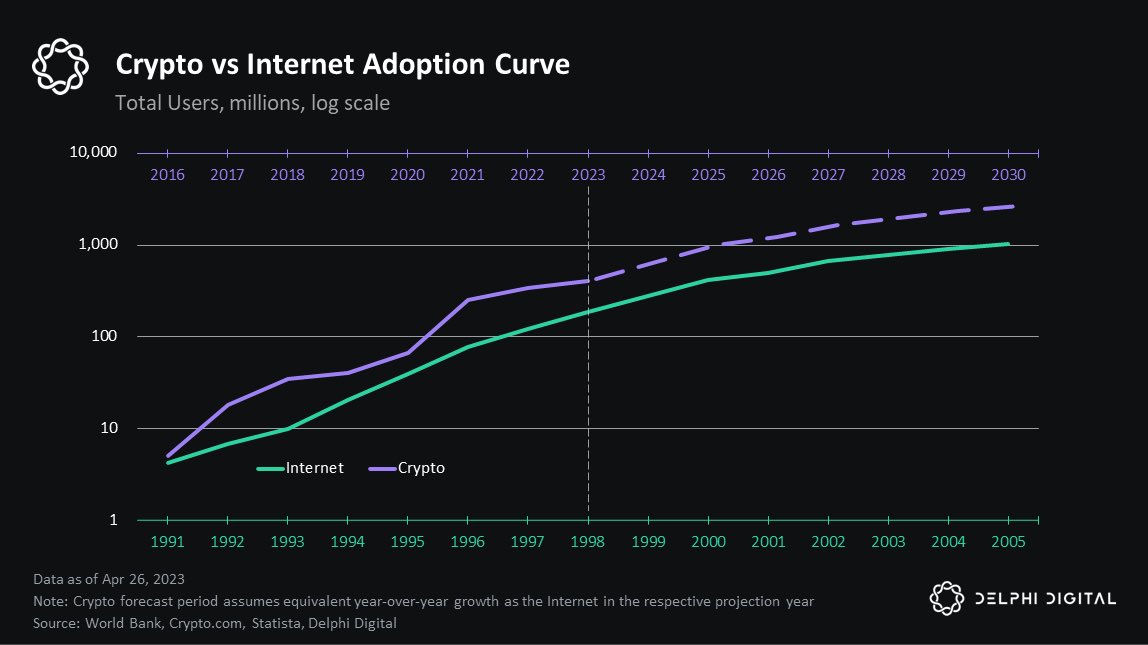

Crypto is rising quicker than the web, heralding Internet 3’s arrival. Not like the web, whose worth took time to acknowledge, cryptocurrency’s price is instantly obvious as Crypto vs Web Adoption Curve signifies.

As crypto surges, understanding its intricacies will make sure you keep knowledgeable and prepared for the following huge shift.

The long run development of cryptocurrency will undoubtedly surpass any funding, regardless of inevitable brief time period market declines because of rate of interest hikes.

Why crypto markets aren’t proof against curiosity hikes?

After 30 years of 0% curiosity, Japan’s price hike made traders unwind $4 trillion in trades, impacting world markets as fashionable analyst Nicholas Mugalli noted, and crypto is just not proof against the impression.

This unprecedented transfer by the BOJ is inflicting a market shift as Japanese traders, who beforehand used low-cost financial institution cash for world investments like crypto, started promoting property to repay loans, inflicting a sell-off that impacted world markets.

Historic context reveals related situations in 2001 and 2008 led to market downturns. Whereas world tensions and Federal Reserve insurance policies play a task, Japan’s rate of interest hike is a big catalyst for the current market decline.

This sudden transfer triggered widespread asset liquidation, creating ripple results throughout worldwide markets and contributing to the present downturn.

What’s occurring with Bitcoin?

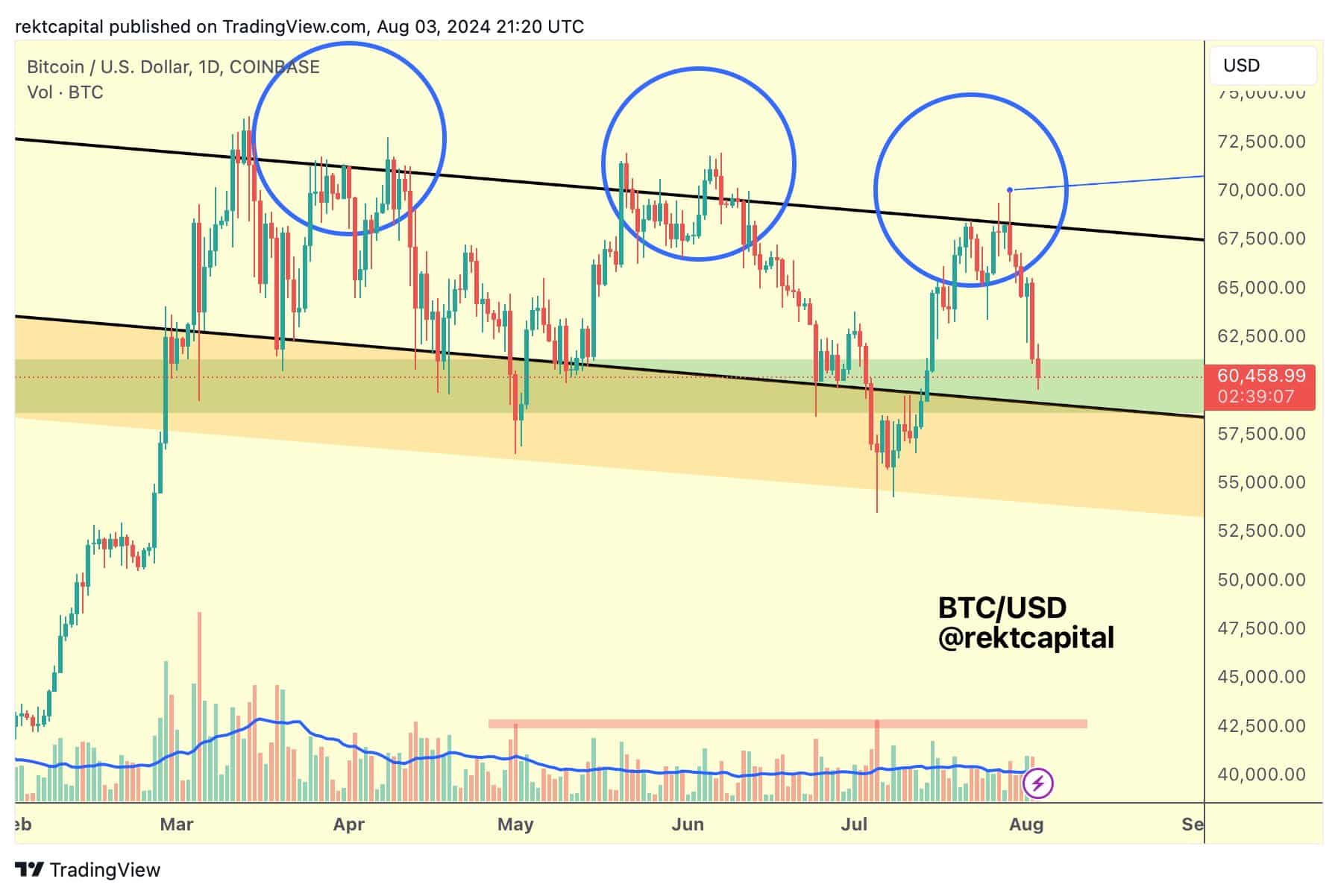

The earlier two bottoms in Bitcoin’s value motion fashioned when above-average sell-side quantity occurred, indicating vendor exhaustion.

This sample, marked by crimson packing containers on the amount chart, suggests an identical development is required earlier than a value decline can happen. Bitcoin has not but reached this stage of sell-side quantity, implying extra promoting strain should come first.

The three tops in value motion, mixed with bearish sentiment, present additional insights into the anticipated sell-off for Bitcoin and different crypto property.

This bearish sample highlights the necessity for elevated sell-side quantity earlier than the market can see a swift value decline, confirming a extra profound bearish development.