- Purchase/Promote Ratio hit 1.1 because the UTXO bands confirmed revenue holding amongst short-term holders

- Lengthy-term holder conviction climbed on the again of brief bias, hinting at potential brief squeeze

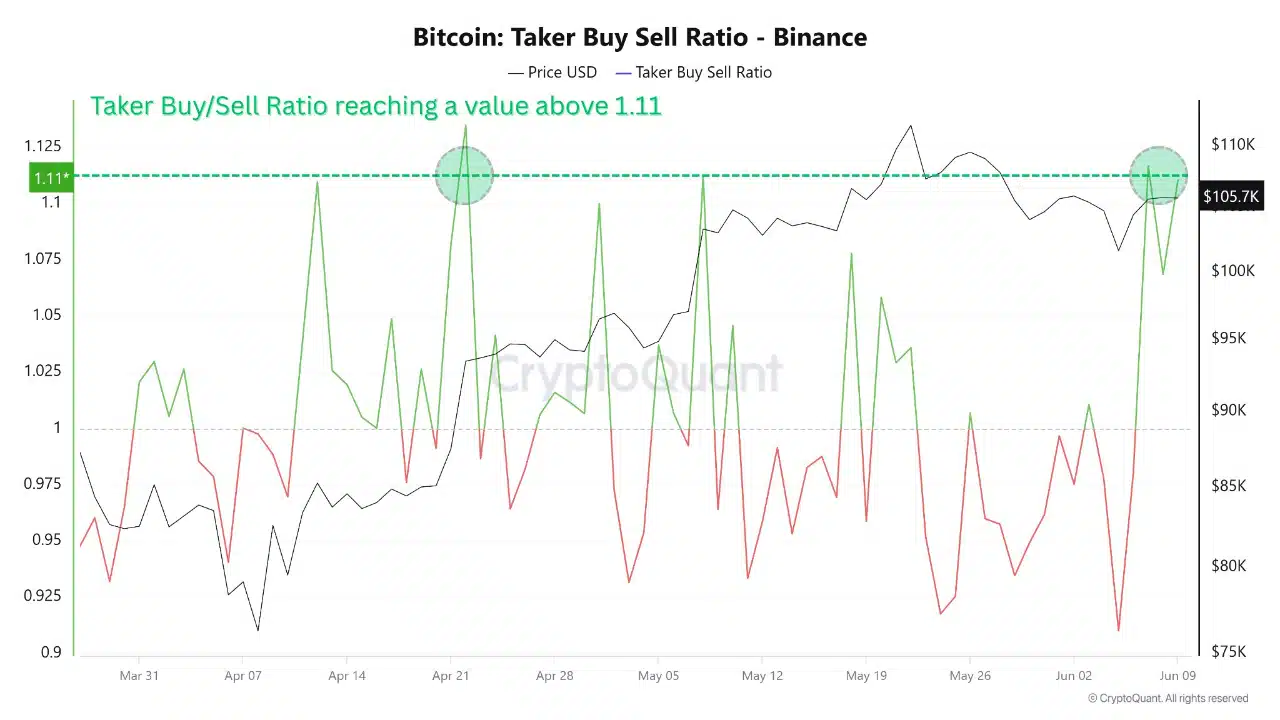

Bitcoin [BTC] is within the information at present after its Taker Purchase/Promote Ratio hit 1.1 whereas its value surged to $107,642. This, after each day beneficial properties of 1.84% amid bullish UTXO and long-term holder alerts.

The aforementioned uptick within the Purchase/Promote Ratio could possibly be an indication of rising aggressive demand from takers. Equally, the UTXO bands revealed that current patrons have been holding on to income. Such a behavioral shift normally implies that short-term merchants are anticipating additional beneficial properties, moderately than exiting early.

Mixed with a broader bullish context, these metrics solely reinforce market confidence and will present a stable base for one more upward transfer.

Are long-term holders setting the tone for the following surge?

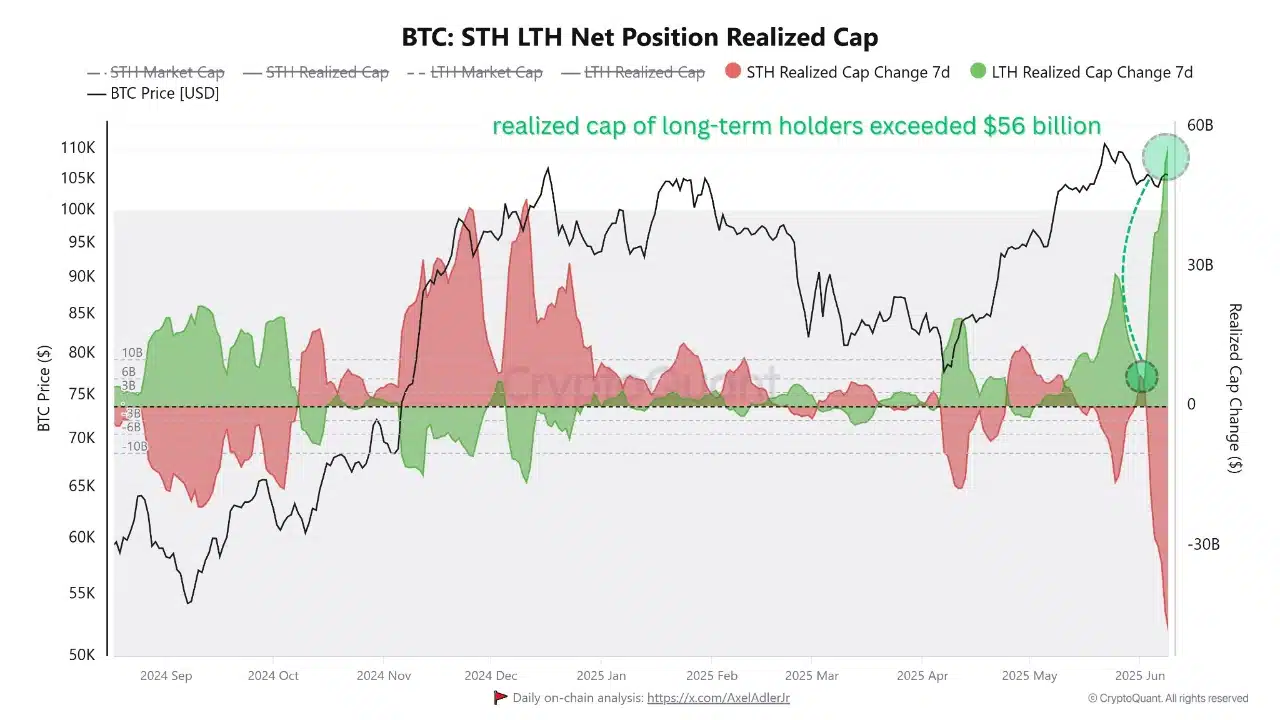

The Realized Cap for long-term holders has now exceeded $56 billion, underscoring a wave of conviction amongst buyers. In truth, coins aged over 155 days are more and more being moved to wallets with low exercise – An indication of unwillingness to promote into energy.

Traditionally, these pockets behaviors align with the early phases of long-term uptrends. Particularly as seasoned members lock away provide.

The growth on this realized cap metric additional confirmed that sensible cash has been positioning with confidence.

What this additionally means is that the prevailing development is proof of the robust foundational assist beneath BTC’s value motion.

Is rising Coin Days Destroyed a crimson flag or routine rotation?

Coin Days Destroyed (CDD) for alternate inflows elevated by 3.83% to 291.4k, indicating that some older cash not too long ago moved in direction of exchanges.

Whereas this may increasingly seem bearish, the size of motion has been modest and didn’t fairly sign widespread promoting. Quite the opposite, it may replicate routine rebalancing or revenue realization by a small cohort of holders.

Additionally, in distinction to this slight uptick in CDD, broader metrics such because the LTH realized cap and taker purchase stress have remained firmly bullish. On the time of writing, the general narrative nonetheless favored accumulation over distribution, regardless of this non permanent churn in older holdings.

Will low volatility set off Bitcoin’s subsequent huge transfer?

Bitcoin’s 30-day volatility dropped to 21.68% – Its lowest stage in practically a month. Such tight value consolidation typically precedes explosive strikes in both course.

Nonetheless, when coupled with robust long-term holder accumulation and constructive short-term UTXO dynamics, this volatility contraction may favor an upside breakout.

Because it stands, market members look like ready for a catalyst, with suppressed volatility offering the springboard for a attainable surge.

Subsequently, BTC’s calm value habits shouldn’t be misinterpreted as weak spot, however moderately a precursor to potential market growth.

Can a crowded brief commerce ignite a squeeze for BTC?

On Binance, 60.51% of merchants have been holding brief positions, with the lengthy/brief ratio plunging to 0.65 at press time. Such an awesome brief bias creates a extremely contrarian sign.

If spot market patrons proceed to use upward stress, brief positions may start unwinding, triggering a squeeze. On this atmosphere, even a average rally may liquidate a good portion of over-leveraged brief positions.

Regardless of minor indicators of spent coin motion, Bitcoin’s on-chain information has continued to flash indicators of confidence.

A surge in taker purchase quantity, rising LTH conviction, and a traditionally low volatility band all appeared to level to favorable circumstances for an upward breakout. Particularly with shorts closely crowded.

If patrons retain management, BTC could also be on the verge of its subsequent leg larger.