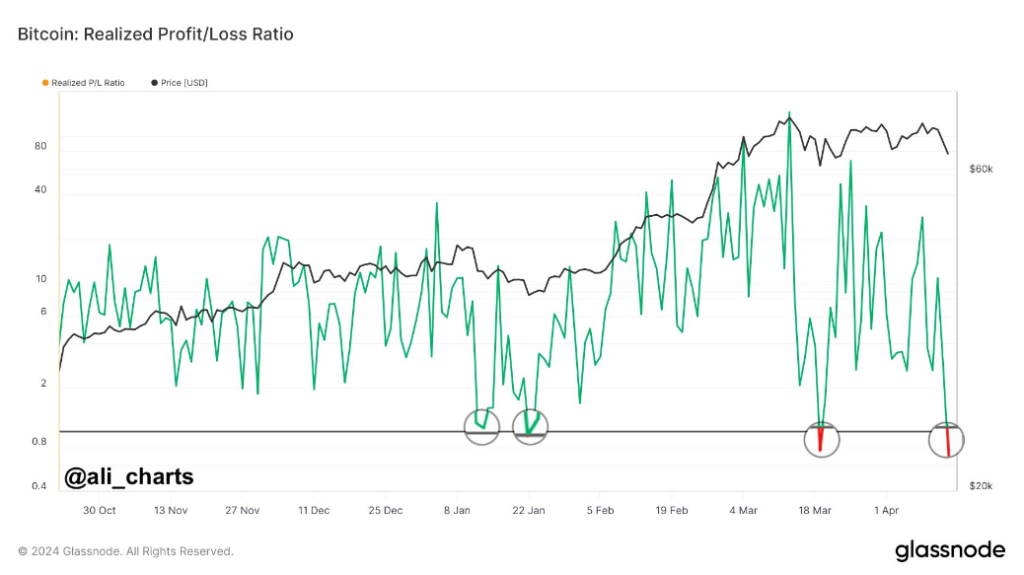

Buyers are bracing themselves for a rollercoaster journey as Bitcoin, the flagship digital asset, navigates by means of uneven waters. Current knowledge from Glassnode has revealed a noteworthy improvement: the Realized Revenue/Loss Ratio for Bitcoin has dipped under one.

This important metric, which compares the promote worth of Bitcoin with the value at which it was purchased, signifies that buyers are at present realizing extra losses than income. Traditionally, such a dip has typically heralded a possible bottoming out of Bitcoin’s worth, serving as a significant sign for market watchers.

Sense Of Optimism Regardless of Bitcoin Value Decline

The previous 24 hours have witnessed important volatility in Bitcoin’s worth trajectory. A sharp decline early within the day noticed Bitcoin’s worth plummet to roughly $64,000, worrying many buyers.

Nevertheless, a exceptional restoration ensued, with the value steadily climbing and peaking at round $66,000. This sturdy rebound has instilled a way of optimism, with a prevailing bullish sentiment taking maintain because the day progressed.

Whole crypto market cap at present at $2.261 trillion. Chart: TradingView

Institutional curiosity in Bitcoin continues to develop, with current developments signaling potential shifts in capital inflows. The approval of a spot Bitcoin ETF by Hong Kong regulators has opened the floodgates for elevated institutional engagement, notably from Asia.

This transfer may inject recent capital into Bitcoin markets, probably fueling additional worth momentum. Moreover, regional dynamics play a big function in shaping investor sentiment and conduct. Various funding developments throughout completely different areas spotlight the various responses to prevailing market circumstances.

Whereas some areas might exhibit cautious sentiment amidst volatility and geopolitical uncertainties, others might embrace Bitcoin as a hedge in opposition to inflation and forex devaluation.

Essential Assist Ranges

Bitcoin analyst Willy Woo has pinpointed a important assist stage at $59,000. Breaching this threshold may signify a transition right into a bearish market sentiment. Conversely, there’s anticipation amongst buyers for potential brief liquidations that might drive the value upwards, probably reaching between $70,000 and $75,000, supplied that present assist ranges maintain regular.

These anticipated occasions hinge on market liquidity and investor reactions to the quickly evolving worth actions. As Bitcoin continues its consolidation section close to all-time highs, buyers stay cautiously optimistic about its future prospects.

The upcoming halving event provides one other layer of complexity to the already intricate market dynamics, with expectations of heightened volatility within the days forward.

Analysts counsel that this era of lateral motion serves as a vital stage for the redistribution of property amongst buyers, probably laying the groundwork for a extra sustainable restoration in the long term.

The cryptocurrency market, notably Bitcoin, is navigating by means of a interval of heightened uncertainty and volatility. The current dip within the Realized Revenue/Loss Ratio alerts a possible turning level in Bitcoin’s worth trajectory, whereas institutional curiosity and regional dynamics proceed to form market sentiment.

Featured picture from Pexels, chart from TradingView