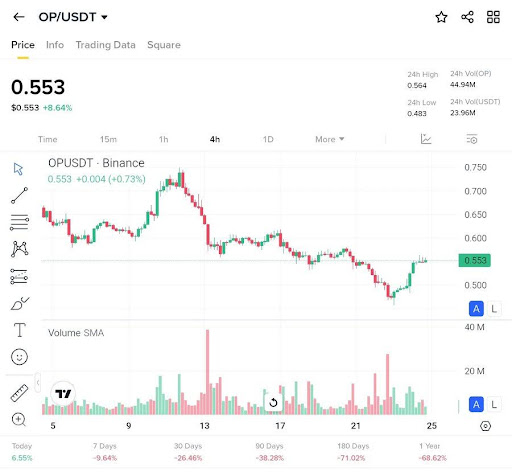

Crypto Man MAB, in his newest analysis on X, identified that Optimism (OP) is now priced at $0.553, exhibiting a light enhance of +0.004 (+0.73%) throughout the final 4 hours. Whereas the short-term motion is barely optimistic, he emphasised that the general development has been bearish because the asset peaked close to $0.75, marking a transparent section of correction within the market.

Pattern And Quantity Evaluation OF Optimism (PO)

Delving into the development, Crypto Man MAB noticed that the asset’s short-term development is leaning bearish. Over the previous 24 hours, the worth of OP has declined from a excessive of $0.564 to a low of $0.483, forming a downward trajectory. He famous that the longer-term outlook reinforces this sentiment, because the asset has dropped by a steep 71.02% over the past 180 days, clearly signaling sustained downward stress.

Turning consideration to quantity conduct, Crypto Man MAB emphasised the importance of latest spikes in OP’s buying and selling quantity, significantly throughout the sharp value decline. He defined that this enhance in quantity typically signifies heightened market participation, most probably pushed by panic promoting or stop-loss triggers. The quantity surge throughout this dip means that the bears are nonetheless energetic and in management.

In his analysis, Crypto Man MAB additional talked about that the Quantity SMA displays periodic surges, with the latest peak aligning with the downward motion in value. This alignment between rising quantity and falling value typically displays a robust bearish sentiment, reinforcing the downward stress seen on the chart.

Help, Resistance, And Indicators

Inspecting OP’s assist and resistance ranges, the analyst factors out that the present value is buying and selling close to $0.483. This zone might act as a possible assist if promoting stress begins to sluggish, providing an opportunity for a short lived stabilization or bounce. Nonetheless, a sustained break under this degree would possibly sign additional draw back within the close to time period.

On the flip aspect, the closest resistance lies round $0.564, which represents the 24-hour excessive. If the worth makes an attempt a restoration, this degree will possible function the primary barrier to beat. A profitable transfer above it might sign bettering sentiment, although additional affirmation can be wanted to shift the short-term bias away from bearish.

Trying on the chart patterns, latest candlesticks present a mixture of bullish and bearish exercise, however the crimson candles have been extra dominant. This sample reinforces the continued downward momentum, indicating that sellers nonetheless have management. Till there’s a seen shift in momentum, the general tone stays cautious regardless of pockets of potential assist.