- SOL has seen extra actions in the previous few days.

- ETH nonetheless holds the lead in different key metrics.

The competitors between Solana [SOL] and Ethereum [ETH] is intensifying, notably in transaction charges, as Solana sees a outstanding surge.

Latest knowledge reveals that Solana’s charges have surpassed Ethereum’s every day totals, reflecting rising exercise on the community.

Nevertheless, regardless of this spike in Solana’s charges and whole worth locked (TVL) development, Ethereum stays the dominant blockchain by way of general market worth and locked property.

Solana’s price surge outpaces Ethereum

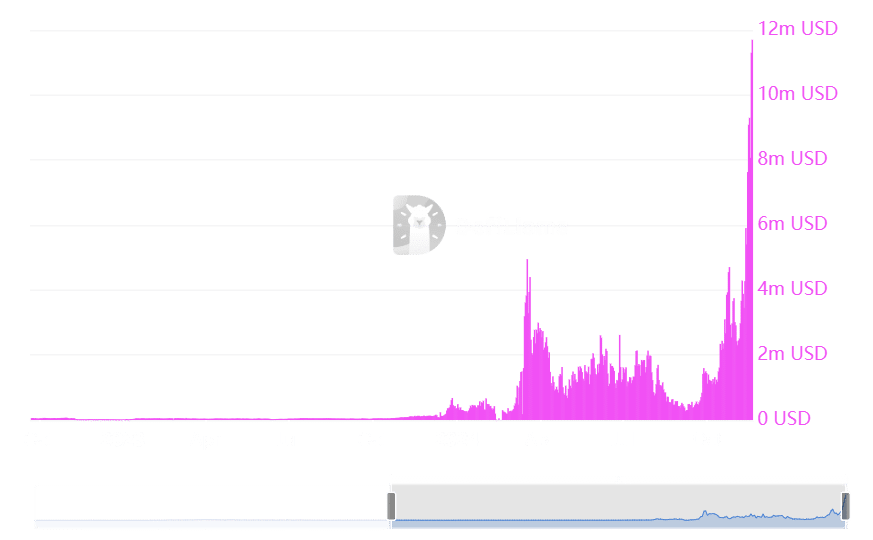

Solana has skilled vital development in transaction charges over the previous week. DefiLlama’s newest evaluation ranks Solana and its decentralized purposes (DApps) above Ethereum in every day price exercise.

Raydium, a significant DApp on the Solana community, reported almost $12 million in charges, making it the second-highest fee-generating platform through the interval.

Solana itself generated roughly $11.3 million in charges, whereas Jito, one other Solana DApp, added nearly $11 million to the community’s whole.

Ethereum, against this, recorded about $6 million in every day charges, putting it behind Solana within the rankings. Ethereum’s price pattern has proven little fluctuation over the previous week, with a constant sample of stability.

Solana, then again, has seen a number of price spikes, culminating in a brand new all-time excessive of $11.7 million on nineteenth November. This record-breaking exercise highlights Solana’s rising momentum in community utilization and adoption.

Ethereum retains management in TVL

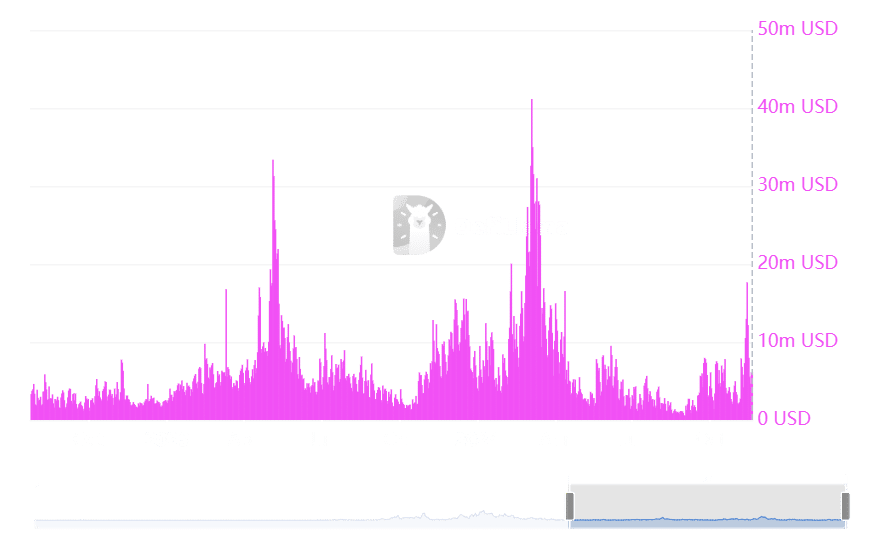

Whereas Solana has gained floor in transaction charges, Ethereum continues to steer in Whole Worth Locked, a key metric in decentralized finance (DeFi).

Solana’s TVL has climbed considerably in latest days, reaching $8.4 billion. This represents a powerful restoration for Solana, bringing it nearer to the highs it achieved in 2022.

Nevertheless, Ethereum stays the clear chief in TVL, with a staggering $60 billion locked in its ecosystem. This determine accounts for greater than half of the whole DeFi market’s $110.5 billion TVL.

Worth actions replicate broader developments

Solana is buying and selling at roughly $244, displaying a 1% enhance. The $200 help stage has confirmed to be a powerful basis for its latest upward pattern.

Real looking or not, right here’s SOL market cap in BTC’s phrases

Ethereum, then again, is buying and selling at simply above $3,000 with a 2% decline. Regardless of this, the cryptocurrency has held regular inside this value vary, and new help seems to be forming at round $2,900.